Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Aug 29, 2019

Updated: Aug 29, 2019

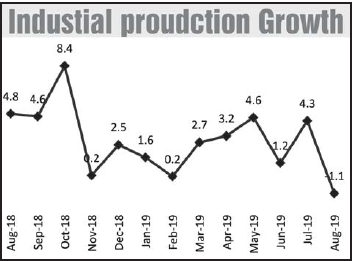

In line with the contraction in the core sector (-0.5% in Aug'19), and signaling a deep slowdown in the economy, the industrial output growth contracted for the first time in the past 2 years (26 months). In the month of August'19, the index of industrial production (IIP) growth contracted for the first time since Jul'17 by 1.1% as against a growth by 4.8% in August'18 and 4.3% in the previous month. CARE Ratings' had expected the industrial output to grow at 1.5% in Aug'19.

During Apr-Aug'19, the industrial output expanded by 2.4%, 2.9% lower than the 5.3% growth in the comparable period last year.

The growth during the month has been dragged down by contraction in manufacturing and electricity along with contraction in the production of capital goods reflective of weak investment climate and infrastructure goods and consumer durables owing to weak demand conditions.

There has been broad based reduction in the industrial output across sectors during the month. Barring mining, manufacturing and electricity sector witnessed contraction in the IIP during the month.

The production in the mining sector was slowest in the past 8 months. It grew at a lacklustre 0.1% growth rate as against the contraction by 0.7% in Aug'18. However, growth is much lower than the 4.9% registered a month ago.

Industrial output in the manufacturing sector contracted by 1.2%, first time in the past 6 months. High base (5.2% in Aug'18) and subdued industrial activities during the month have weighted on the growth in the sector.

Used-Based classification

Within the used based classification, capital goods, infrastructure goods and consumer durables witnessed contraction which is a cause of concern. Consumer durables growth contracted for successive 3rd month by 9.1%, much lower than the 5.5% growth registered in Aug'18. High base effect along with weak consumer demand has led to lower production in this segment. * Capital goods continued to witness contraction for consistent 8 months. The contraction by 21% in Aug'19 has been at historical low level. Subdued investment climate and slowdown in electronics and vehicles demand have weighed on this segment. * Infrastructure goods growth contracted by 4.5% as against 8% growth in Aug'18 and 2.1% growth in the previous month indicative of subdued construction activities. * Primary goods output growth was modest at 1.1% lower than the 2.5% growth in Aug'18. * Intermediate goods output growth fell to a 4 month low to 7%, though was higher than the 2.9% growth in the corresponding month last year. It was however lower than the 13.9% growth in July'19. * Consumer non-durables growth at 4.1% was at 5 month low. In Aug'18, this segment witnessed growth at 6.5%.

According to CARE Ratings industrial output is expected to see pick up in the coming months with the likelihood of improvement in the demand conditions (owing to festive season) and uptick in rural spending (aided by good harvest). The favourable base in the upcoming months (barring Oct'19) will also lend partial support the overall growth. For the remainder of the fiscal year i.e., Sept'19-March'20 we are expecting the industrial output growth to average around 5-6% on the premise of which the growth for fiscal year 2019-20 will be around 4-4.5%.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives