Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Aug 29, 2019

Updated: Aug 29, 2019

With behemoths like the US and China clashing over tariffs, global trade itself has been negatively affected, including equities, bonds, currencies, company profits, services and investments. India too has been willy-nilly caught up in the maelstrom with the US withdrawing thepreferential trade treatment and imposing tariffs on over $5 billion of imports from India. While there is a silver lining in that India sees a growing role in the global value chain, any perceived benefit to the country from the US-China spat is yet to happen as production relocation from China has been mainly to other Asian economies. According to CARE Ratings, if the country is to grow its export potential,the mantra should be diversification, high-quality and ease of doing business.

Trade tensions and disruptions have come to occupy centre-stage as the biggest impediment to the global economy. It has aggravated the weakness in global demand and economic growth and its impact spans the global economic, business and political space.

Although the tariffs hike by the US and China against each other since mid-2018 have come to be synonymous with the current trade wars, the trade tensions made an appearance before that when the US in early 2018 imposed higher tariffs and restrictions on its trading partners on a range of products imported into the country.

Even though the trade dispute between the US and China has been the focus point, given the size of their economies (together accounting for 40% of global GDP), it is not limited to these two economies. It also includes the conflicts between the US and a number of its trading partners, viz., the European Union, Mexico, India and Canada, among others. Japan and South Korea too have been involved in a trade dispute which has led to both nations imposing restrictions on trade. Given the nature of international trade, the effect of these disputes is being felt globally. It is seen to be changing the global trade dynamics with shifts in trade partners, supply chains, changes in trade policies of nations and increased government intervention (to support affected sectors).

According to an analysis by Care Ratings, the ongoing US-initiated trade tensions and associated uncertainty has been weighing down global growth. It has been affecting the commodities and financial markets (equities, bonds, currencies), as well as output and profitability of firms. It has also been hurting confidence and has deterred investment decisions of businesses. Even if the trade conflicts and the tariff hikes have been significant contributors to the global trade weakness, the slowdown in global demand, global economic and political uncertainty (Brexit) too has had a bearing on the slowdown in global trade.

The Care study examines the change in growth in world trade in the backdrop of the trade wars, the regions and countries that have been most impacted, how countries are dealing with the trade disruptions, the impact of trade wars on India and if the country stands to benefit from the changing dynamics in global trade.

Since early 2018, the US has hiked tariffs and imposed import restrictions on a number of merchandise goods. The hikes in tariffs by the US have been followed by retaliatory tariffs from its trading partners.

The tariffs imposed by the US and China on each other are mainly on manufactured items, which include intermediate manufacturing products, capital goods and consumer goods. Some agricultural goods and energy products too have seen a hike in tariffs. The tariffs between US and China have been increased for over 50% of the bilateral trade between the two countries.

World trade, which includes merchandise trade and trade in commercial services, grew at a slower pace in 2018 and there are indications that the weakness has been carried forward to 2019.

Global trade (valued at $ 25 trillion) grew by 9.4% in 2018, which was 0.5% lower than the growth in the preceding year (9.9%). The value of world merchandise trade and services trade of key economies in the first half of 2019 was lower than a year ago (H1 2018).

World Merchandise Trade: Merchandise trade dominates world trade with a share of around 80%. While in 2018 there was an increase in world goods trade in value terms (aided by commodity prices), there has been a decline in the volume of goods traded. World merchandise trade growth in volume terms in 2018 at 3% was 1.6% lower than year ago. Despite the decline in volume of trade, in value terms world merchandise trade rose by 10% to $19.7 trn in 2018, supported by higher energy prices.

In the first half of 2019, the growth in world goods trade in both volume and value terms has been lower. The growth in volume of world goods trade at 0.6% was significantly lower than the average growth of 4% in the same period of the last 2 years. In value terms, growth contracted by almost 3% during the period and was in sharp contrast to the average 11% growth in the first half of 2017 and 2018.

World trade in commercial services: Trade in commercial services includes IT and communication, travel, transport, logistics, management and consultation services, to name a few, and is around 20% of global trade.

Commercial services trade grew by 7.5% to $5.6 trn in 2018, 0.4% higher than the growth in 2017. There has been an observable decline in trade in commercial services of some of the leading exporters and importers in recent quarters. China, France, Germany, Japan, Italy and the United Kingdom, who are among the top 10 countries in trade of commercial services, have seen a contraction in their growth rates in the first half of 2019. In the case of the US, which leads in trade in services, the growth rate in the first half of 2019 is half the growth rate in the same period of last year.

Although the tariffs have been imposed only on goods it has implications on trade in services too, given the integration of the production and trade of goods with services. The disruptions in the production and trade in goods impact the various services associated with the goods, such as distribution, logistics, transport marketing and sales, financial and business services, among others. The disruption in the value chains also impacts a wide variety of associated services. Even service sectors that are not related to the goods on which tariffs are raised, such as tourism and education, get impacted. Investments in the sectors also suffer.

The decline in growth in merchandise trade has been broad-based across economies. Exports and imports have weakened globally, although the decline has been sharper in certain regions and countries. The decline in merchandise trade growth, both in value and volume terms, is pronounced in the case of Asia and Europe. Both these regions account for a little more than 70% of global trade. Although subdued, North America has seen the highest growth in volume of goods traded in H1-2019 (at 1.6%) among the key regions. The contraction in growth in value of goods traded too has been the lowest for the region.

In value terms, all the key regions have seen a contraction in their exports during H1-2019, while in the case of imports, barring North America, all other regions have seen a contraction. In volume terms, all key regions have recorded a significant decline in exports during H1-2019 compared with the corresponding period in the previous 2 years. In the case of imports, both Asia and South and Central America have recorded a contraction while other key regions have seen positive but limited growth.

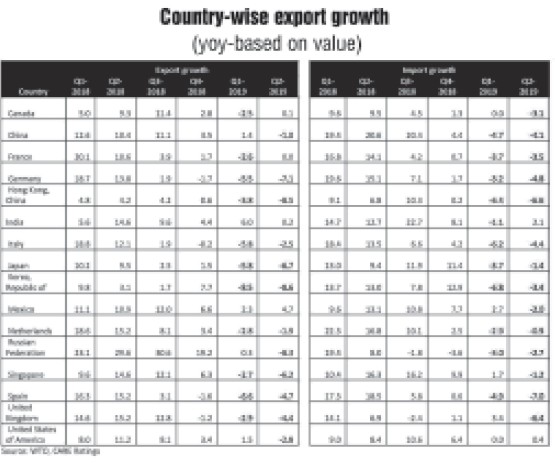

The analysis of the value of merchandise trade of the top 15 exporting and importing countries and India (ranks 19th for exports and 10th for imports), which account for over 60% of global merchandise trade, shows that:

In case of exports

In case of imports

How are countries dealing with the trade disruptions?:Countries have been resorting to various measures to limit the damage to their economies arising from the trade conflicts. Nations have been entering into bilateral as well as multilateral trade agreements. They have also been scouting for new and alternative export markets, trying to boost domestic consumption, providing tax and tariff incentives to attract foreign firms, and lowering the cost of funds, to name a few.

Some economy specific measures are:

India’s rank in world trade (goods and services) has improved from 16th position to 11th in the last 10 years. However, the country’s share in global trade continues to be low and was around 2.4% (2018). India’s share in world merchandise exports is 1.7%, and 2.6% in the case of imports.

India became a part of the ongoing trade wars when in June2019, the US withdrew the preferential trade treatment (under the generalized system of preference which did not charge duties on various imports) for India and imposed tariffs on over $5 billion of imports from India. This led to the imposition of retaliatory tariffs by India.

The country’s trade in 2019 presents a mixed picture. Imports have contracted and exports have increased marginally.

India’s exports are influenced predominantly by global demand. The weakness in global demand is being reflected on India’s exports. India’s export growth in the first 8 months of 2019 (Jan-Aug) at 1.4% ($219 billion) was significantly lower than the 11.8% growth in the same period a year ago. Despite the sharp decline, India’s cumulative export performance so far in 2019 stands out as the country witnessed positive growth while a majority of economies saw their growth in exports contract or stagnate. This could be viewed as India’s growing role in the global value chain.

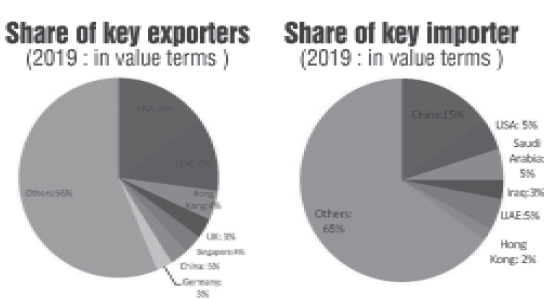

The US is India’s single largest export market, while China is the largest market for the country’s imports. Items such as engineering goods, automobiles (including auto components), gems &jewellery, chemical and petroleum products dominate India’s exports and these items, which are higher up in the value chain, are dependent on external demand. India features among the top 10 exporters of agricultural products.

Does India stand to benefit from the changing dynamics in global trade?: Although the tariffs imposed by China and the US on each other are perceived to present an opportunity for India to increase its share in world exports, there has not been a perceptible shift in production from China to India yet. The relocation, if any, has been limited so far. The decline in exports growth in the first 8 months of 2019 attests to that. The production relocation from China has been mainly to other Asian economies; viz., Vietnam, Philippines, Taiwan and Thailand.

Even as the recent corporate tax rate cuts (to 25.17% from 30% excluding surcharges) does makes India’s tax structure competitive, other debilitating shortfalls on the infrastructure front (energy shortages, lack of adequate transport and export infrastructure), laws and regulations, high costs of logistics and transactions, delays and costs due to procedural and documentation bottlenecks, among other factors, have been limiting the country’s export competiveness and growth.

It is perceived that trade agreements between trading partners can boost exports. In the case of India, regional trade agreements (RTA) and free trade agreements (FTA) are viewed as being more favourable to the partner-countries. The country has over a dozen trade agreements in place and an equal number is reportedly under negotiation.

Concluding, the CARE Ratings report maintains that given that India is playing an increasing role in the global value chain, the country can emerge as a viable option for companies seeking to shift production. The government has announced a series of measures to incentivise and facilitate exports, which is expected to benefit exporters. However, if the country is to grow its export potential, diversification across destinations, goods and services along with improvement in quality and ability to cater to the evolving global requirements while addressing the structural, administrative and procedural constraints become essential. India also needs to forge strong and beneficial FTAs to deepen intraregional trade with partner-countries.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives