Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Aug 29, 2019

Updated: Aug 29, 2019

Axis Bank is one of the first new-generation private sector banks to have begun operations in 1994. Promoted jointly by the Specified Undertaking of Unit Trust of India (SUUTI) (then known as Unit Trust of India), Life Insurance Corporation of India (LIC), General Insurance Corporation of India (GIC), National Insurance Company Ltd., The New India Assurance Company, The Oriental Insurance Company and United India Insurance Company, the bank has a large footprint of 4,050 domestic branches (including extension counters) with 11,801 ATMs and 4,917 cash recyclers spread across the country as on 31st March, 2019.

The overseas operations of the bank are spread over nine international offices, with branches in Singapore, Hong Kong, Dubai (at the DIFC), Colombo and Shanghai, representative offices in Dhaka, Dubai and Abu Dhabi, and an overseas subsidiary in London. The international offices focus on corporate lending, trade finance, syndication, investment banking and liability businesses.

With a balance sheet size of Rs. 8,00,997 crore as on 31st March 2019, the bank has achieved consistent growth and has a 5-year CAGR (2013-14 to 2018-19) of 16% in total assets, 14% in total deposits and 17% in total advances.

The bank was growing steadily, but during the 2015-16 and 2017-18 period, it met with a disastrous management programme, leading to a sharp rise in non-performing assets which pushed down its profits. The outcome: a change in the top management.

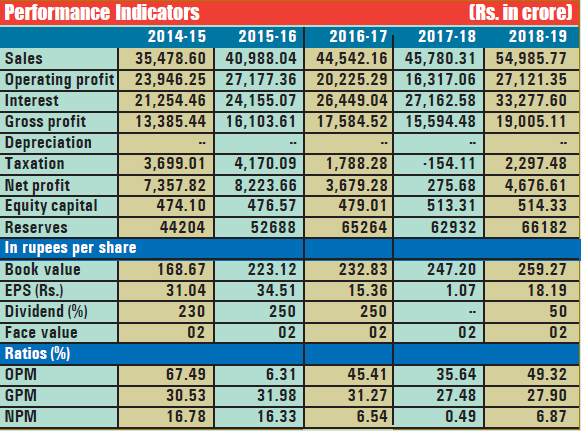

The financial performance of the bank during the last five years aptly reflects this. Though the business steadily advanced from Rs. 35,478.60 crore in fiscal 2015 to Rs. 54,984.77 crore in fiscal 2019, the profit at the net level, after shooting up from Rs. 7,357.82 crore in fiscal 2015 to Rs. 8,223.66 crore the next year, declined to Rs. 3,679.28 crore in fiscal 2017 and then slumped to Rs. 275.68 crore in fiscal 2018. However, under the new top management, the situation started reverting and the bank recovered substantial ground in fiscal 2019 with a net profit of Rs. 4676.61 crore. After paying a handsome dividend of 250 per cent in fiscal 2016 and fiscal 2017, it was forced to skip the dividend altogether for 2017-18. However, it re-entered the dividend list last year (fiscal 2019) with an equity distribution of 50 per cent.

Darpin Shah and Aakash Dattani, research analysts at HDFC Securities Institutional Research, point out that the appointment of a transformational leader at the helm, along with a near-complete top management rejig, has made the bank stand out versus its peers. This is supported by a change in credit/ risk practices. (1) Improving margins, (2) reduction in LLPs and (3) improving operating efficiency will facilitate the achievement of the guided RoEs (~18%) by FY21E. “While numerous strategic changes and the quarter’s performance lend credibility to this target, we have conservatively factored in RoEs of 15.5% over FY19-21E. Axis remains our preferred bet amongst private banks,” they note.

The bank reversed contingent provisions of ~Rs. 600 crore made in 3Q to ensure consistency with the new accounting policy. In line with the new policy, it made further provisions of ~Rs. 160 crore against standard exposures to stressed sectors. Consequent to the change in the accounting policy, provisions were higher for FY19 by ~Rs. 3,780 crore.

Kajal Gandhi, Vishal Namolia and Harsh Shah, research analysts at ICICI Direct Research, feel that “the long-term focus continues to remain on offering loans with higher riskweighted return. The remaining Rs. 7,000 crore of exposure to stressed names still standard to keep credit cost higher in FY20E. Accordingly, we cut our PAT and advances growth estimates by ~19% and 2.3% respectively for FY20E. However, we remain positive on the management’s effort to build a sustainable franchise. We value subsidiaries at Rs. 35 per share, post 20% holding discount. Factoring capital raising and subsequent dilution in return ratios, we cut down our target multiple from 2.9x earlier to 2.4x. Accordingly, we revise our target price to Rs. 850 and maintain our BUY rating.”

Nitin Aggarwal and Alpesh Mehta, research analysts at Motilal Oswal Research, pointed out in July that fresh slippages increased to Rs. 4,800 crore, while upgrade/recoveries (Rs. 2,180 crore) and write-offs (Rs. 3,000 crore) facilitated a 1% QoQ decline in GNPA. Calculated PCR improved 30 bps QoQ to 62.5% (78% including TWO). The bank downgraded Rs. 22.4 bn of stressed assets into the BB-and-below pool, resulting in a flattish trend in BB-and-below assets at Rs. 7,500 crore.

According to Pritesh Bumb and Prabal Gandhi, research analysts at Prabhudas Lilladher, though there was slower loan growth there was also strong deposit growth. The bank delivered strong deposit growth of 20% with TDS growth of 33% YoY, with slower CASA growth of 6% (on average basis 10% YoY), while loan growth of 13% YoY was slower but led by retail which grew by 22% helping improve mix by 220 bps QoQ to 52% as corporate/ SME continued on a cautionary path. Better deposit growth and loan growth has relieved C-D ratio to 90-92% from close to 100% a few quarters back. The bank expects loan growth to be higher than the industry growth.

Referring to asset quality, Mr. Bumb and Mr. Gandhi point out that the bank disclosed that it has ~Rs12,000 crore of exposure to eight stress groups which have been in recent discussions, of which Rs. 7,100 crore is standard and not in the BB-and-below watchlist. “This stress is in the form of term loans (large part), corporate bonds and NFB exposure. Additional stress along with BB-andbelow (including NFB) forms 3.0% of exposure, which adds risks and derails the story of lowering towards normalized asset quality and credit cost trends, and should not augur well with RoE improvements if stress book risks move to NPAs.”

Mr. Aggarwal and Mr. Mehta maintain that the bank has delivered a modest quarter in a challenging economic environment. “We cut our FY20/21 earnings estimates by 7%/6% to factor in the slight increase in our credit cost. Post a strong performance in the last couple of quarters, Q1 earnings and outlook reflect the deterioration in the underlying lending environment, which can further risk our estimates. Core operating profitability is getting good, helping to mitigate some credit cost pressures. Improvement in the RoA / RoE matrix will be a key to sustain the stock’s performance. Buy with a target price of Rs 825 (2.5x FY21E ABV).”

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives