Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Dec 29, 2020

Updated: Dec 29, 2020

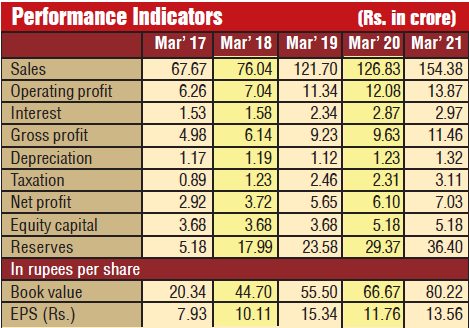

Inorganic growth is its route of choice for fast growth, in keeping with which ANG Lifesciences India has in quick succession acquired a penicillin unit, two formulation units and a huge API unit. Consequently, sales during the last five years have zoomed from Rs 67.67 crore in fiscal 2017 to Rs 154.38 crore in fiscal 2021, with PAT jumping from Rs 2.92 crore to Rs 7.03 crore. Its other fincancial parameters are also healthy – reserves at the end of March 2021 were Rs 36.40 crore, almost six times its equity capital of Rs 5.18 crore. The upbeat company is now looking at revenues of Rs 800 crore in fiscal 2022-23.

Himachal Pradesh-based ANG Lifesciences India, a leading pharmaceutical company, is growing at a fast pace through the inorganic route. Incorporated in 2006, the company -went public in 2017. After getting listed on the SME platform of the BSE, it migrated to the main board of the BSE in November 2021 with the help of a 1:1 bonus issue that increased its equity capital to more than Rs 10 crore. A number of acquisitions increased the stature of the company – it went from being a very small outfit with a sales turnover of Rs 67 crore in fiscal 2017 to over Rs 150 crore, with the profit at net level spurting from Rs 2.92 crore to Rs 7.03 crore during the last five years. The company has resorted to the acquisition route in line with its long-term strategic objective to emerge as a complete healthcare solutions provider. It aims to be an entity with a broad-based basket of pharmaceutical formulations for a differentiated and comprehensive profile in the pharmaceutical space.

To begin with, the company acquired the penicillin formulation unit of Star Biotech Pvt Ltd and is planning to commission the dedicated penicillin plant by the end of the current fiscal year. According to the management, the plant will generate additional revenue of Rs 250 crore per year.

The company then acquired two formulation units of Ind-Swift Ltd at Rs 60 crore in August 2021. The two-unit plant is running as Unit 5 and Unit 6.

In November 2021, the company decided to acquire a 51% stake in Baddi Agro Pvt Ltd, which was formerly known as Surya Pharmaceuticals Ltd. The purpose of this acquisition is to take up the manufacture of menthol API derivatives and other products at the manufacturing plant, which has a capacity is 10,000 mt, or 20% of global overall capacity.

Again, in November 2021, the company decided to acquire 100% equity shares of sister concern ANG Healthcare India Pvt Ltd, which will now become a subsidiary of ANG. This acquisition will help the company in brand building and direct marketing so as to stay close to the customer.

This acquisition spree has raised the stature of ANG Lifesciences, which has now graduated from being a smallscale company to a mid-size entity. Sales turnover during the last five years has zoomed from Rs 67.67 crore in fiscal 2017 to Rs 154.38 crore in fiscal 2021, with the profit at net level jumping more than two and a half times from Rs 2.92 crore to Rs 7.03 crore during this period. The company’s financial position has also improved considerably, with standing reserves at the end of March 2021 at Rs 36.40 crore – almost six times its equity capital of Rs 5.18 crore. In the fiscal 2021, the company has entered the dividend list with an interim equity distribution of 10 per cent.

With these acquisitions, the company has entered on an exponential growth curve. In the first half of the current fiscal (April to September 2021), the company has generated an EBIDTA of Rs 49 crore with an EPS (earning per share) of Rs 32.50 per share of the face value of Rs 10. The management is confident of achieving revenues of Rs 400 crore this fiscal. After a year, revenues are expected to double that of the current fiscal, i.e., Rs 800 crore, with a corresponding improvement in the bottomline.

Prospects ahead are all the more promising as the management is keen on further acquisitions of stressed assets at an attractively low investment in order to fuel its growth strategy.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives