Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

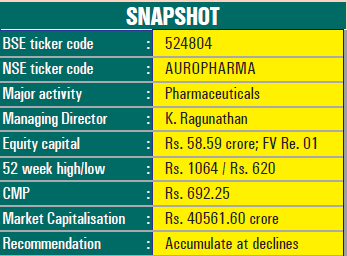

Hyderabad-headquartered Aurobindo Pharma, a leading pharmaceutical company, has emerged as a multinational entity with almost 90% of its revenues being earned from overseas countries. The company, which has ruled the roost for over three and a half decades, is engaged in the manufacture of generic formulations and active pharmaceutical ingredients (APIs). Prospects for the company are highly promising. Consider:

This fast-growing Indian MNC is spreading its footprint across the globe. By now, it has set up 26 manufacturing facilities for its APIs and generic formulations with approvals from various regulatory authorities, including the US FDA, the UK MHRA, Japan’s PMDA, South Africa’s MCC, Brazil’s Anvisa and Canada Health. The company has also entered Poland and the Czech Republic with its acquisition of Apotex’s commercial operations. Meanwhile, it has strengthened its presence in the US with the acquisition of the dermatology and oral solids business from Sandoz.

Today, the US accounts for half the revenues of the company, with other countries contributing 40%. Going ahead, its US business is expected to stage a marked improvement on account of a sturdy pipeline of new products and expected traction in the lucrative injectables space driven by the commissioning of a new facility at Vizag. The company plans to launch around 50 products in the US in the current year and expects to sustain the launch momentum into fiscal 2022 as well. The new launches will include injectables, which are a ‘wonder’ development with 50 assets under review and 80 approved products. The new greenfield plant at Vizag will also take care of rising demand from the European (France and Italy) and emerging markets.

In its programme to launch new products, the company’s focus on injectables to drive growth augurs well. It has a strong product portfolio in injectables, and the company is setting up a new facility aimed at the US market with a focus on high-value and low-volume products. The new facility will also enable the company to benefit from local tenders. Collectively, the company is targeting revenues of around $ 650-700 million over the next three years from injectables, from around $ 380 million as of now.

Apart from injectables, the complex generics space is fast gaining traction, that too at a time when the complex generics market is slated to be around $ 20 billion over the next 3 years, up from $ 16 billion at present. Currently, the company has a small presence in complex generics but it is looking to enhance its presence gradually in the segment. Collectively, a strong overall new product pipeline, focus on injectables and a gradual improvement in the complex generics space is expected to take US sales to 13% CAGR over fiscal years 2021 to 2023. Overall, Aurobindo expects to incur a capex of $ 200-220 million during the next two years.

The company has acquired a 51 per cent stake in generic veterinary pharma firm Cronus Pharma Specialities India for a cash payment of Rs 420 crore. The deal will give Aurobindo a foothold in the $ 48 billion global animal health market. Cronus Pharma has manufacturing facilities in India as well as in the US. Cronus has over 67 products in the pipeline, of which 22 have been filed and six have been approved by the US FDA. Cronus also generates income as a contract research organization.

Earlier, Aurobindo had acquired the commercial operations and supporting infrastructure assets of Canadian pharmaceutical firm Apotex International in five European countries for 74 million euros.

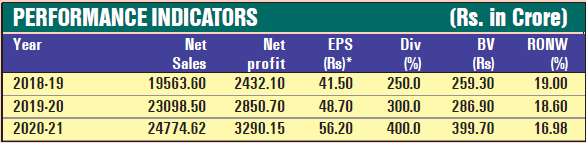

Aurobindo has made rapid strides on the financial front. During the last five years, its sales turnover has expanded from Rs 8,781 crore in fiscal 2017 to Rs 15,824 crore in fiscal 2021, with the profit at net level shooting up from Rs 1,707 crore to Rs 3,113 crore during this period. The share price is quoted around Rs 679. By 2025, the turnover is likely to exceed Rs 25,000 crore with a corresponding improvement in earnings, while the share price is likely to cross Rs 1,000.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives