Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

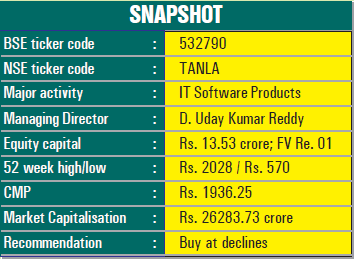

Hyderabad-headquartered Tanla Platforms (formerly known as Tanla Solutions) is a leading cloud communications company providing value-added services in the cloud communications space. Promoted by Dasari Uday Kumar Reddy, who is Chairman and CEO of the company, Tanla was originally started as a bulk SMS provider in Hyderabad, mainly catering to SMEs. The company subsequently evolved into a cloud communications provider with services and products with aggregators and telcos across the globe. Tanla has entered into various partnerships with leading companies to enter newer areas, and this has upgraded the stature and size of the company. This mid-cap technology company has offices in ten locations, including Singapore, London, Colombo, the US and Dubai. It operates with a team of more than 500. It is doing very well and its prospects ahead are all the more promising. Consider:

The company has grown in stature through the acquisition route. It has expanded its bouquet of services by acquiring Karix, the market leader in the smart messaging space, and Gramooga, a marketing automation company, a couple of years ago. It also recently launched Trubloq, a blockchain-based solution to filter spam messages. Tribloq processes almost 62 percentage of India’s SMS traffic.

The company has been driving partnerships. Tanla has entered into a partnership with Vodafone Idea, wherein it will be the exclusive provider of solutions to secure, encrypt and enhance performance for the entire international messaging traffic on the VI network. According to Uday Reddy, the partnership with VI, powered by the Wisely platform, is a massive step towards a leadership position in the global digital interactions space. “The Wisely platform is a win-win proposition for all stakeholders – consumers, global enterprises, suppliers and regulators — as we are commited to innovate with the entire ecosystem in mind,” Mr Reddy says.

A major development for the company was the launch of Wisely – a blockchain-enabled communications platform as a service (CPaaS) offering built on Microsoft Azure. A unique marketplace for enterprises and suppliers, Wisely offers a global edge-to-edge network that delivers privacy, security and trusted communication experiences. Microsoft is the development partner which designed and built this platform. Wisely is expected to be a game changer for enterprises, mobile carriers, OTT players, marketers and industry regulators. With the launch of Wisely, Tanla continues to be an undisputed market leader in the domain of commercial communication by enabling trusted customer experiences.

Visualising that future prospects for Tanla are highly promising, marquee investors like Infosys and Azim Premji of Wipro have acquired stakes in the company. Azim Premji’s two funds – Pioneer Investment Fund (13.50 lakh shares) and Prazim Trading Investment Company (6.62 lakh shares) have bought a total 20.58 lakh shares of Tanla. These investments have given a big push to Tanla shares with widespread buying. Tanla attracted not only Infosys and Wipro but also several domestic and foreign institutional investors, including SEBI, Life Insurance Company. Small-cap World Fund Inc also picked up stakes in Tanla in June, 2021.

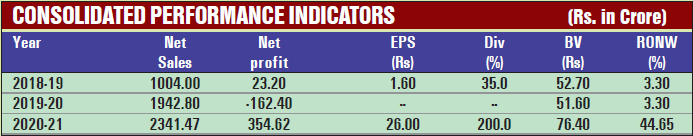

Needless to say analysts have turned distinctly bullish on Tanla as the company is going from strength to strength on the financial front. During the last five years, the company’s revenues have expanded from Rs 489 crore in fiscal 2017 to Rs 1,060 crore in fiscal 2020, before falling modestly to Rs 892 crore in fiscal 2021 on account of the Covid-19 pandemic. The spurt in earnings has been fantastic, with profit at the net level skyrocketing from a loss of Rs 63 lakh in fiscal 2017 to Rs 159 crore in fiscal 2021. The company’s financial position is very comfortable, with reserves at the end of March 2021 standing at Rs 653 crore – almost 50 times its equity capital of Rs 13.60 crore. Discerning investors are rushing to include these shares in their portfolios.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives