Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

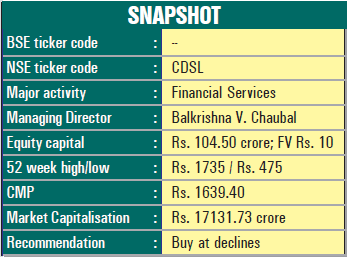

The company was promoted by BSE in 1999 with a view to providing convenient services at an affordable cost to all market participants. Subsequently, BSE divested its stake In CDSL to some leading banks. The company facilitates holding of securities and securities transactions in electronic form. It is one of two depositories — the other being NSDL promoted by NSE — but CDSL is the only depository company listed on a recognized stock exchange. Prospects for the company are immense. Consider:

There are only two depositories in the country. As a result, CDSL enjoys the fruits of a duopoly. As dematerialization of stocks is compulsory, the company’s business is continuously on the rise. Little wonder that even during the pandemic period, there was a heavy rush for dematerialization of stocks. Even among the two companies, CDSL is the undisputed leader with a 52 per cent marketshare.

CDSL facilitates holding and transacting in securities in electronic form, and facilities settlement of trades on stock exchanges in the case of securities, including equities, debentures, bonds, exchange traded funds (ETPS), units of mutual funds, units of alternate investment funds (AIFS), certificates of deposits (CDS), commercial papers (CPS), government securities (G-Secs) and treasury bills (T-Bills). Now, according to MCA guidelines, unlisted companies have to dematerialize shares before any transfer or corporate action. There are around 80,000 companies in the unlisted space, out of which almost 10,000 companies have already been admitted for dematerialization till now. According to an estimate by the CDSL management, the total opportunity for the company from the unlisted segment can be around Rs 30 crore over the next five years, assuming at least a 40 per cent marketshare. Besides the demat of unlisted public companies, there are two other new growth engines, viz., insurance and e-warehouse receipts which will also drive additional revenue of the company.

The company has robust financials with a healthy balance sheet. It is a cash-rich company with net cash being 25 per cent of its market cap, a healthy dividend payout and high return ratios. During the last five years, its sales have more than doubled from Rs 121.52 crore in fiscal 2017 to Rs 270.58 crore in fiscal 2021 with the profit at net level inching up from Rs 67.64 crore to Rs 160.06 crore. The company’s financial position is very strong with reserves at the end of March 2021 standing at Rs 576 crore against the equity capital of Rs 104.50 crore.

As the company can boast of an asset-light business model and minimum capex requirement, the balance sheet of the company is robust. The cash collection cycle is pretty healthy as the depository participants (DPs) have to make transaction-related payments before the 25th of every month and annual charges are collected from DPs in advance. It has also a very healthy dividend pay-out ratio of 40 per cent. The company is doing business at an excellent EBDTA margin of around 50 per cent.

Growth prospects for the Indian capital market are immense. In fact, the country’s market cap-to-GDP is way below the global average. Gradually, the money is shifting from physical assets (real estate, gold, etc.) to financial assets. All these factors indicate that there will be a significant growth in the Indian capital market in the near future. As capital market activity and depository business growth are directly co-related, this augurs well for the sustained growth of CDSL.

Today, as there are only two depository companies, CDSL enjoys the benefits of a duopoly. As the government is thinking of opening up the field to others, there may be more players in the coming days. But this will not affect the prospects for CDSL as it will not be easy for newcomers to penetrate the space dominated by CDSL and NSDL. This is just the beginning for CDSL and its long-term outlook is extraordinary. Investors with a long-term perspective can certainly invest in this scrip to reap a rich harvest in the long run.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives