Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Aug 15, 2022

Updated: Aug 15, 2022

The Indian steel industry witnessed a dream run in FY22, especially in H2 of the fiscal year and the first two months of FY23. Two major flows of steel demand emanating from consumption expenditure and investment display the confidence that the trend is likely to be sustained. In FY22, private final consumption expenditure accounting for 56.9 per cent of GDP dropped from 57.3 per cent in the previous year. The brighter signal was observed in a higher share of Gross Fixed Capital Formation (GFCF as a % of GDP), which increased from 26.6 per cent of GDP (at market prices) in FY21 to 28.6 per cent in FY22. Thanks to the focus on higher budgetary support for public investment (Rs 7.5 lakh crore), construction activities in roads, water pipelines, urban infrastructure and real estate increased.

Meanwhile, the global steel market witnessed subdued growth. The spread of the pandemic in China as well as in Hong Kong, a global business centre, resulting in locational lockdowns dampened steel demand and the lower level of steel production led to slower demand for both iron ore and coking coal.

After a Covid pandemic-hit lull in performance and growth in the last two years, the Indian steel industry is coming into its own all over again, thanks to the Centre’s policies and budgetary support for public infrastructure as well as a pick-up in the realty sector.

This, even as domestic inflation remains high and major global economies are subdued due to macro factors like high crude prices and the Russia-Ukraine war. In fact, the IMF has projected a lower GDP growth for major economies – the saving grace for India being its strong sectoral fundamentals.

Another positive sign for the domestic steel sector is the good performance of the manufacturing sector – a major consumer of steel – which has logged healthy double-digit growth in the first quarter of the current fiscal year. And with the government pushing for an import-substituting ‘Atmanirbhar Bharat’, the upward graph of the domestic steel industry – and its crude output target of 500 million tonnes by 2047 — is majorly linked with the growth of the country’s MSME sector.

The inflationary expectation in India was realized as WPI at 14.6 per cent in March’22 rose to 15.88 per cent in May’22. The corresponding growth in CPI or headline inflation, the benchmark for the RBI ruling on repo rate determination, also went up from 6.95 per cent in March’22 to 7.01 per cent in June’22. It remains a challenge to bring down inflation by another 1-1.5 per cent by March’23 without hurting the growth perspective.

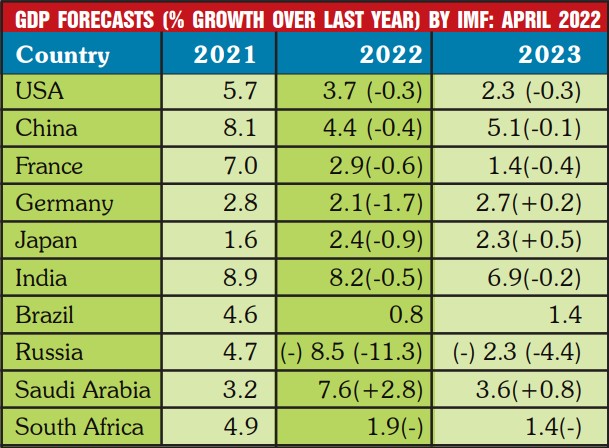

The global economy is also facing innumerable challenges. The high cost of crude oil (despite a perceptible reduction in the recent rate), coupled with subdued or declining industrial growth, has taken a few countries to the brink of stagnation. A few major economic parameters like industrial growth, current account deficit as % of GDP, inflation rate, current rate of interest and quarterly GDP growth rate for major economies can be compared as under Table-1. The latest IMF projection of global GDP growth, including that of major economies, is shown under Table-2.

Note: Figure in brackets in the first column indicates Q1 GDP growth rate in 2022 over that in the previous quarter. A few interesting observations on the table can be made. First, Looking at only the GDP figure, one may not get a comprehensive and appropriate view of the downward risks facing the country. Consumer prices in the US at 9.1 per cent is much higher and may spoil the bonhomie of a comfortable GDP growth. Germany with an inflation rate of 7.6 per cent is also on the higher side, but its current account balance is strongly positive and provides adequate resilience to the economy. The current interest rate at 2.9 per cent in the US has resulted in a large outflow of FPIs from India, thereby leading to a fall in the exchange rate and share market indices in India.

The figures in brackets in the second column refer to a decline in forecasts from earlier estimates. It is seen that forecasts for 2022 for almost all major countries in April’22 are lower than what was projected in January’22. India’s GDP projection for 2022 has already been reduced to 7.5 per cent by Asian Development Bank — however, India’s growth still remains one of the highest in the world.

India needs to be watchful on the 7.0 per cent retail inflation and the unemployment rate of 7.8 per cent. The current account deficit of 1.5 per cent of GDP is manageable. The deficit in aggregate demand is a cause of worry — however, the strong fundamentals of the Indian economy reflected in some of the high frequency indicators provide confidence. Some of these indicators are:

The Indian steel industry in the post-pandemic scenario returned to a high-growth path, driven more by investment than consumption expenditures as shown above. The following table summarises the industry’s journey in the recent past.

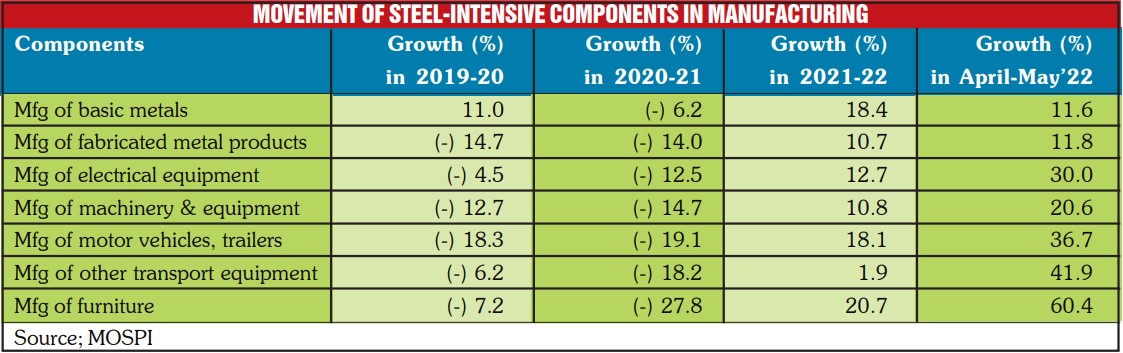

Growth of manufacturing has an overbearing influence on steel consumption. It is interesting to take a closer look at this relationship. Manufacturing, with more than 77 per cent weightage in Industrial Production, is steel-intensive as nearly 31 per cent of manufacturing directly contributes to steel consumption and another 25 per cent of manufacturing indirectly influences the use of steel. The following table summarises the trend of growth of the critical components in manufacturing that has a direct impact on steel consumption.

The share of manufacturing in Gross Value Addition (GVA) of the economy is a critical indicator of industrial growth and therefore of growth of the steel industry in any economy. Major steel-producing countries with a high per capita steel consumption like China, South Korea and Turkey have the share of manufacturing at nearly 25-35 per cent in GDP/GVA. The following table indicates the trend of manufacturing’s share in the Indian economy.

The near-stagnant share of manufacturing in GVA at around 17-18 per cent stands much lower compared to the level achieved by some other prominent countries during their journey as developing nations. When the Manufacturing Competitiveness Council was set up around 3 decades earlier, the target was to pull up the manufacturing share to 25 per cent of GDP by 2022, which could not be realised.

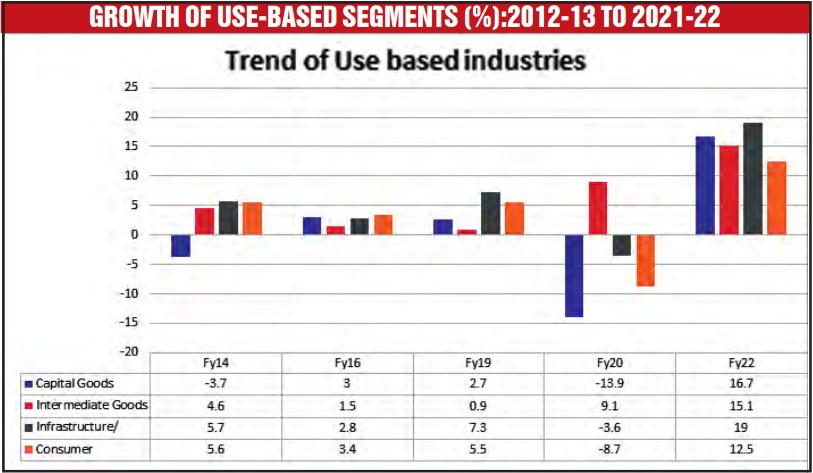

The low share of manufacturing is the primary reason why India is suffering from a not-respectable industrial growth in the last few years. The growth of steel consumption is closely linked with the growth of steel-intensive industrial segments, namely capital goods, intermediate goods, infrastructure/construction and consumer durables.

The role of steel in each sub-segment of these industrial groups is enormous. Steel availability at competitive prices holds the key for development and growth of these sectors. In addition, a large number of MSMEs are functional in these segments and these units contribute immensely in terms of job opportunities and income generation.

The major thrust of ‘Atmanirbhar Bharat’ is on developing a strong manufacturing base in India, which would provide capacity augmentation by these units by replacing the need for regular imports and prevent outflow of foreign exchange. The government is trying to develop an enabling business environment to encourage and incentivise the MSME sector in enhancing its output to cater to domestic as well as export demand. Small and medium-scale manufacturers would be able to participate in the global value chain by restricting imports and becoming export-oriented units in the medium term.

The growth and development of the Indian steel industry is intractably connected with developing a strong manufacturing base in the country. The high capex earmarked for different infrastructure sectors by the government provides ample opportunities for the indigenous manufacturing sector and equipment suppliers to grow and manufacture engineering items and equipment that get imported each year at a high cost. Innumerable defence items are imported by India and it is gratifying to note that the government is encouraging indigenous manufacturers to come forward and make available these items by banning imports of similar goods.

A strong and growing MSME sector is one of the most critical elements for the growth and development of the Indian steel industry in its journey towards attaining the target of 500 million tonnes of crude steel by 2047.

Golden days are ahead for the Indian steel industry, which was mired in a rut in the last couple of years. The demand recession has ended and there has been a sizeable improvement in offtake of the metal. Not only at home, Indian steel has started attracting demand from abroad on account of the prolonged Russia-Ukraine conflict and supply constraints from China. Though New Delhi has poured cold water on exports by imposing an export duty of 15 per cent and raising the export duty on iron ore to 50 per cent, there are reports that a rethinking is going on in the steel ministry on these duties.

Of course, the government has played a very meaningful role in pulling the steel sector from the mire in which it was stuck for quite some time. First, it waived the import duty on raw materials such as coking coal and ferro-nickel used by the steel industry. At the same time, the government announced ambitious growth plans for infrastructure like roads, railways, bridges and airports. The infrastructure sector consumes around 9 per cent of the country’s steel output and this is expected to increase to 11 per cent by fiscal 2025-26. Notes Chaudhary Birendra Singh, former steel minister, “Due to rising investment in infrastructure, the demand for steel products will increase in the years ahead. Almost 70 per cent of the country’s infrastructure, estimated at Rs 6 lakh crore, is yet to come up. A significant growth potential for the steel sector exists.”

The estimated steel consumption in constructing airports is likely to grow to more than 20 per cent over the next few years. The railways, oil & gas and energy sectors are also set to increase their steel consumption. The automotive industry is forecast to reach $260-300 billion by 2026. The industry accounts for around 10 per cent of the demand for steel in India. The capital goods sector accounts for 11 per cent of the total steel consumption and the figure is expected to increase to 14-15 per cent by 2025-26.

On the global front, prospects for the Indian steel industry have improved considerably. As of October 2021, India was the world’s second-largest producer of crude steel with an output of 9.8 million tonnes. Easy availability of lowcost manpower and the presence of abundant iron ore reserves make India competitive in the global set-up. In fact, the country is home to the fifth highest reserves of iron ore in the world.

To achieve a steel capacity build-up of 300 million tonnes per annum by 2030, India would need to invest $156.08 billion by 2030-31. “The industry is witnessing consolidation of players, which has led to investments by entities from other sectors. The ongoing consolidation also presents an opportunity to global players to enter the Indian market,”

In 2019, the government introduced the steel scrap recycling policy with an aim to reduce imports. Under the policy, raw materials such as plastic, copper, aluminum, steel and rubber will be recycled from scrapped vehicles

“This will bring down the cost component and help the industry become more cost-competitive. This proposed policy seeks to phase out unfit vehicles to reduce vehicular pollution, meet climate commitments, improve road safety and fuel efficiency, formalise the vehicle-scrapping industry and recover low-cost materials for the automotive, steel and electronics industries. Primarily, this new policy aims to boost new vehicle sales, which will stimulate the economy,” the report added.

With the rising export demand, the Indian steel industry could sell almost 135 lakh mt in the first 135 days of 2022. However, the imposition of excise duty brought down exports substantially. According to the steel industry, such a government step at a juncture when Indian steel is in very good demand abroad will be detrimental for the growth of the domestic industry which is planning ambitious expansion programmes. Not only will India lose a golden export opportunity, the regressive step may also impact overall economic activity in the country.

Some economists feel that at a time when the rupee’s value has hit a new all-time low and the country needs a lot of foreign exchange, the government should reconsider its export duty decision. Echoing this feeling, the Centre is reportedly considering reducing or removing the export duty in the near future.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives