Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Aug 15, 2022

Updated: Aug 15, 2022

This fortnight I have selected as Fortune Scrip a comparatively new company which will make its shareholders as proud as the TCS-Infosys-Wipro trio made this investor in the 1980s and 1990s. It is Happiest Minds Technologies, the superb creation of 79-year-young IT veteran Ashok Soota, who famously developed the IT business of Wipro and set up multi-bagger IT company Mind Tree.

The company leverages a spectrum of disruptive technologies such as Big Data Analysis, Cloud, Security, Artificial Intelligence and Cognitive Computing, Internet of Things, SDN-NEV, RPA and Block Chain. Its capabilities span product engineering, digital business solutions, infrastructure management and security services

If the current-generation technology trio of TCS, Infosys and Wipro have put up an excellent show and cheered their investors time and again, Happiest Minds Technologies is undoubtedly the most promising player among next-gen tech companies. The Bengaluru-based company is engaged in next-gen IT solutions and services, enabling organisations to capture the business benefits of emerging technologies. It applies agile methodologies to enable digital transformation for enterprises, a seamless customer experience, enhancing of business efficiency and actionable insights.

The company delivers these services across many industry sectors such as retail, edutech, R&D, engineering, manufacturing, automotive, travel, transportation and hospitality. It offers a wide range of embedded design services that are intended to turn an idea into a complete product. This includes system architecture, hardware design, software design, mechanical design, prototyping, valuation, regulatory certification and pilot production.

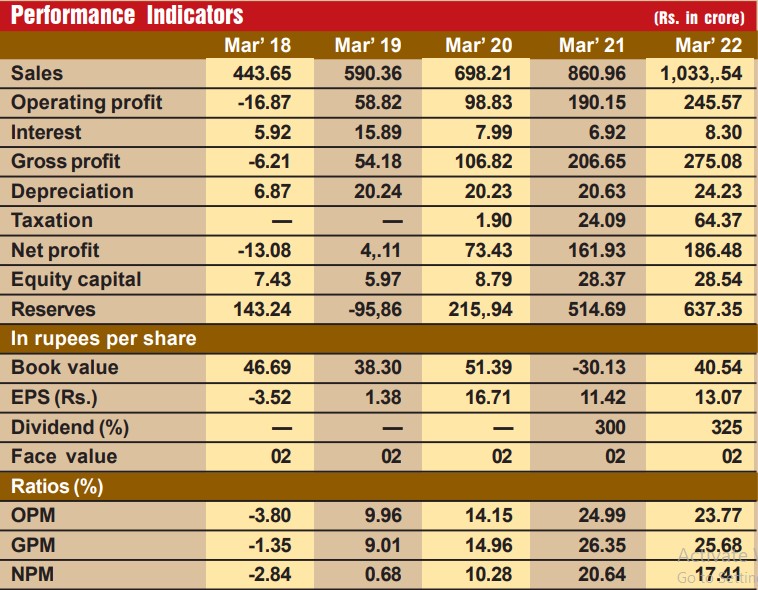

Little wonder then that with such an extraordinarily modern profile, Happiest Minds is making rapid strides on the financial front. During the last 12 years, its sales turnover has skyrocketed from just Rs 8 crore in fiscal 2012 to Rs 444 crore in fiscal 2018 and further to Rs 1,111 crore in fiscal 2022, In the same period, operating profit, which was negative (loss) at Rs 29 crore, turned the corner in fiscal 2017 with a profit of Rs 1 crore and then shot up to a huge profit of Rs 268 crore in fiscal 2022. At the net level, the company was in the red in fiscal 2012 and remained so till 2018 when its loss was Rs 13 crore. However, from fiscal 2019, it turned the corner with a net profit of Rs 4 crore, which skyrocketed to Rs 204 crore in fiscal 2022.

Happiest Mind’s operations are highly profitable. During the last five years, while the company’s compounded sales growth works out to 19 per cent, its compounded profit growth comes to 112 per cent. Thanks to this high profitability, the company has been able to strengthen its financial position, with reserves at the end of March 2022 standing at Rs 641 crore – over 22 times its equity capital of Rs 29 crore.

What is more, the company has given staggering returns of 285 per cent in the first 12 months after it entered the capital market with an IPO of Rs 166 per piece. On a widespread buying spree, the stock shot up to a high of Rs 1,568 per share of a face value of Rs 2. The stock has not only outperformed the IT sector but also the BSE Sensex by over 250 per cent over a 9-year period, and was even moving above its 200-day average while lower than its 5-day, 20-day, 50-day and 100- day moving averages. It has also been witnessing higher investor participation.

This has been a really extraordinary debut. But we have not selected Happiest Minds as the Fortune Scrip for its past laurels. We strongly feel its future prospects are highly promising. Consider:

All these acquisitions and partnerships will enable Happiest Minds to further strengthen its offerings and leadership in the digital transformation space as well as help create greater digital capital for customers and facilitate more customer logos of strategic consequences, and in the final analysis raise its stature as a next-generation IT player. Interestingly, the company expects to continue its acquisition drive going ahead.

Prospects for the company are highly promising and it will move on lines of TCSWipro-Infosys going ahead. Remarkable expertise and undoubted leadership in disruptive technologies acquisition of three/four valuable companies, the company’s long-standing relationships with global ISVs and technology firms for developing various include Microsoft, Amazon Web Service, Netsuite and Salesforce – all these will go a long way in sustaining the pace of growth of the company. Stocks of the company which were issued under its IPO at Rs. 165/166 skyrocketed to Rs. 1568. However, due to the global tumbling of stocks in the wake of geo-political tension between Russia and Ukraine, fast rising inflation at home as well as in the US and UK, the stock price nosedived to Rs. 785. However, thanks to the re-entry of FPIs in the Indian stock market, the share price recovered modest ground to Rs. 970. Discernible investors should start buying at the current price in small lots and go on accumulate at every decline.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives