Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Aug 31, 2022

Updated: Aug 31, 2022

A pioneer and veteran of the domestic food processing industry, FIL’s vast range of packed and canned food caters to the most demanding palates in India and overseas. Its recent acquisition of the popular ‘Kusum’ spices brand has added to its market dominance. Chairman Bhupendra Dalal is upbeat about growth prospects in light of growing rural demand and postCovid revival of various sectors, especially tourism. According to him, the company’s business focus now is on improving its RoCE and EBITDA as well as on asset-light expansion. Giving a fillip to FIL’s growth prospects is its PLI selection, under which it stands to receive incentives of around Rs 148 crore over the next few years.

Based in Mumbai, Foods & Inns (FIL), a BSE-listed company, is recognised as India’s second largest processor and exporter of processed fruit and vegetable products. The company has been a pioneer of the domestic food processing industry for over 50 years and continues to spearhead the development of new food products using cutting-edge technology, with a clear focus on building sustainably integrated value chains.

The company’s seven integrated manufacturing facilities are located at Chittoor, Valsad, Sinnar and Gonde (Nashik). Its principal divisions are aseptic, canning, spray drying, frozen fruits and IQF (individually quick frozen) vegetables and snacks. Its product range includes tropical fruit purees and concentrates of mango, guava and papaya, in addition to tomato paste, natural fruit and vegetable powder. With a 99.99% holding, FIL recently became a partner in ‘Kusum’ Spices. Established in 1972, the ‘Kusum’ brand is quite popular. This acquisition in the latter part of 2019 has widened FIL’s offerings in the food segment. According to APEDA, the Indian spice market is currently estimated at Rs 40,000 crore. This augurs well for taking the ‘Kusum’ brand to its next level of growth. Kusum Spices contributed Rs 14.26 crore to FIL revenues in FY21 and Rs 15.88 crore in FY22, and has taken a big leap by contributing Rs 6.16 crore in Q1 of the current FY23 vis-à-vis Rs 3.81 crore in the corresponding period of the previous year.

The company has shifted its spice manufacturing facility from rented premises in Mumbai to its own campus in Gonde (Nashik). Explaining the advantage, Mr. Dalal, Chairman, says, “The state-of-the-art facility will help us to grow our export business worldwide.” In a commentary after the release of June quarter results, Mr. Dalal says, “We expect an increased demand in processed fruits and vegetables like guava, tomato, chilli, etc. Such incremental demand in other categories should help us in better absorption of our fixed overheads.” He adds, “The increasing outreach of electricity in India’s villages, the return of mobility, the government’s push for incremental fruit content in drinks to reduce GST, and the increased demand from HORECA as well as the tourism sectors have led to a strong sector revival. The recent announcements by Coca Cola and its bottling partners on investing around $ 1 billion to expand their production capacity by up to 40% are also a big positive indicator.”

Expressing his views on the overall business outlook, Mr Dalal says, “The company is working towards improving its RoCE and EBITDA on a sustainable basis by increasing the share of value-added and branded products across our food offerings. Likewise, we are increasing operating leverage by producing allied products during the non-peak season, converting waste into value-additive products. More importantly, we have started concentrating on a higher EBITDA margin business in addition to focusing on the asset- light model of expansion.” Mr Dalal is very bullish on growth sustainability in the domestic market. According to him, “the demand for packed food and snacks is growing substantially post-Covid, resulting in increased demand in our spray-dried product category. Anticipating this, we have our new brownfield expansion scheduled to be commercially operational by September 2022, which will double our existing capacity for spray-dried products.”

Revealing a change in the company’s product-mix strategy, Mr Dalal says, “This year, we have diversified our product portfolio further to reduce our dependency on mango and this will be a conscious strategic path we will follow, moving ahead. Fruit-based drinks, especially guava-based, are seeing a substantial increase in demand. Tomato paste consumption in India has now started depending majorly on domestic production, unlike earlier times when we used to substantially import from China. This has thrown open business opportunities for our company.”

Envisaging a rise in demand for its various products, FIL has also started associating with other plants (contract manufacturing) to enhance its production capacities, especially in processing of fruits and vegetables.

FIL has been selected under the production-linked incentive scheme of the government under the fruits and vegetables processing industry category. The company stands to receive incentives of around Rs 148 crore on a best-case basis between FY23 and FY27, based on future growth in investment and sales as per the committed capex, wherein FIL has to grow sales at a minimum CAGR of 10% over the period to become eligible to receive incentives which are payable upto a CAGR of 15% on eligible sales. Commenting on this, Mr Dalal explains, “We are also expected to get incentives of 50% of our branding and marketing expenses incurred abroad over the period FY22 to FY26.” If things go as planned, the PLI scheme has the potential to change the complete landscape and become a growth engine for the company.

The company has partnered with IDH of Netherlands to drive sustainable mango farming in India by addressing environmental issues such as climate impact, pesticide management, crop traceability, etc., as well as increasing the income of small-holding farmers. The government’s focus on chemical-free natural farming, and various programmes under the PPP mode with private agritech players, etc., will benefit FIL.

In an important move to achieve ESG goals, the company has filed its GHG (green house gas) inventories and carbon emission data via the Carbon Disclosure Project (CDP). With a sense of satisfaction and a glint in his eyes, Mr Dalal says, “This brings us on a global platform with other players who are collectively trying to reduce global emissions. We have been rated ‘B’ under the CDP platform, which is a great achievement for the company in our industry globally.”

FIL has installed tetra recart machinery at its greenfield facility at Vankal (Gujarat), where currently test runs are going on, and the unit is likely to be commercially operative by October this year. With a lot of enthusiasm, Mr Dalal notes, “We will also be associating with prominent brands to fulfill their packaging requirements in the recart form. The tetra recart facility will run under an exclusive arrangement in India for the first couple of years of its operations, with the company having the first right of refusal for future expansion.”

As an initiative towards SVA (Sustainability and value addition), the company has entered into a joint venture last year with a food technology company to convert its fruit waste into pectin, oils and butter. Explaining the rationale behind this, Mr Dalal says, “The idea is to upscale waste from mango processing to address its disposal and convert it into pectin, which has a huge potential in India given that 95% of India’s pectin requirement is being met through imports. The JV company is named Beyond Mango Pvt Ltd. Managing waste is a huge pollution control challenge apart from its large disposal cost. This initiative removes the challenges with an immediate and opposite effect.”

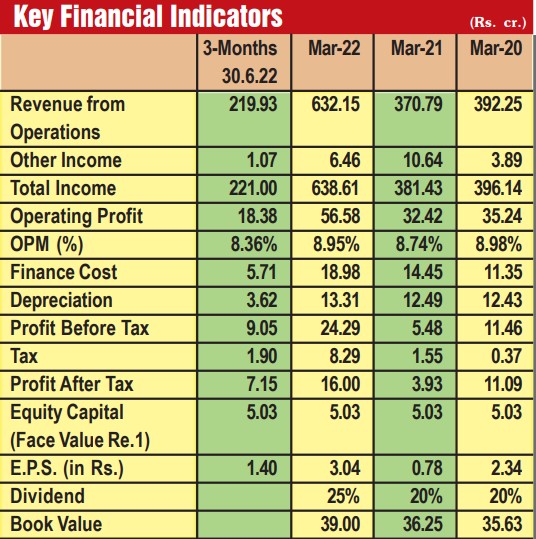

On a consolidated basis, during FY22, FIL clocked operational revenues of Rs 632 crore, EBITDA of Rs 56.57 crore and net profit of Rs 16 crore. On a small equity capital of Rs 5.03 crore, the EPS works out to Rs 3.04 on a face value of Re 1 per share. In the first quarter of the current fiscal, revenues have gone up sharply from Rs 146 crore to Rs 220 crore (51% growth) on a y-o-y basis, whereas an improved EBITDA stood at Rs 18.38 crore against Rs 15.67 crore in the corresponding period in the previous year. The net profit remained at Rs 7.15 crore vis-à-vis Rs 6.12 crore.

In total sales tonnage, against 46,220 mt in the full FY22, the company has achieved 34,548 mt in the first quarter itself (PY 17,653 mt), which exhibits its strength. However, amongst geographies, export sales have come down by 22% and domestic sales have grown by a whopping 144%.

The 50-year-old FIL has well-positioned its product portfolio with recognised brands in its fold. Its business prospects are also looking quite promising. The company’s selection under the PLI scheme is a bright spot and could prove to be a game changer because it provides an excellent opportunity to take FIL into a new orbit to accelerate its pace of growth. However, the key to its success is execution with a further improvement in the EBITDA margin. Unless this is achieved, it will not be able to retire the existing borrowing of Rs 214 crore (Mar 2022), plus new borrowings which the company’s board has cleared recently. The finance cost for FY22 had been nearly Rs 19 crore.

Against its March 2022 consolidated book value of Rs 39, the stock is currently being quoted at around Rs 70. The company has exhibited notable growth in its revenues during the first quarter of the current fiscal. Likewise, the net profit margin has also gone up to 3.25% simultaneously vis-à-vis 2.53% in the full previous year. However, despite having strong business verticals and bright growth prospects supported by its sound track record of the last five decades, the improvement in sustainable profitability remains a real challenge. Nevertheless, evaluating the scrip from different perspectives, it appears that the stock has the potential to offer reasonably good returns, keeping in mind a medium-term horizon.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives