Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Aug 31, 2022

Updated: Aug 31, 2022

This fortnight we have picked a unique and fast-growing speciality chemicals company, Balaji Amines, as the Fortune Scrip. Balaji is the largest manufacturer of methyl amines in the country. It also manufactures ethyl amines, derivatives of specaility chemicals and pharma excipients. Besides, it has manufacturing facilities for derivatives which are downstream products for varous pharma/pesticides industries, apart from user-specific requirements.

Promoted by the KPR group of industries in 1988, BAL is also one of the leading manufacturers of aliphatic amines in India. In 1989, it commenced the manufacture of methyl amines and subsequently added facilities for ethyl amines and other derivatives of methyl and ethyl amines.

At present, the company’s customers include blue chip companies like IDI, Hoechst, Rallis, Ion Exchange, Chemnor Drugs and TTK Phama. The company has three plants, at Tuljapur and Chincholi in Maharashtra and at Medak in Telangana. It also owns a five-star hotel in Solapur and a CFL (lamps) facility at Medak. As such, BAL operates in three segments — speciality chemicals and amines, hospitality and CFL (lamps). A new facility to manufacture speciality chemicals is under construction at Chincholi. Besides, the company has set up a modern R&D centre at Hyderabad.

BAL is continuously on the move with rising demand for its products. It embarked upon an expansion programme for value-added products like choline chloride, DMAE-HCL and other intermediates at a cost of Rs 50 million. Later, it started power generation with a 1.5 MW windmill unit at Satara in Maharashtra. This was followed by a 2.5 MW co-generation power plant at Tamalwadi in Solapur. Subsequently, BAL was awarded 90 acres of land at MIDC, Chincholi by the Maharashtra government for a mega project to take up the manufacture of morpholine and acetonitrile. The company also set up a new plant under its subsidiary, Balaji Speciality Chemicals.

Besides good demand for its products at home, the company started attracting overseas demand. Leading global customers are happy with the company’s products as it is one of the few companies in India that can match the stringent international quality standards. In fact, BAL has been awarded an ISO 9001-2015 certification apart from appreciation and continuous orders from global majors for its product range. The company is now striving to leverage the ‘China+1’ policy of global MNCs in order to take advantage of the new international trend.

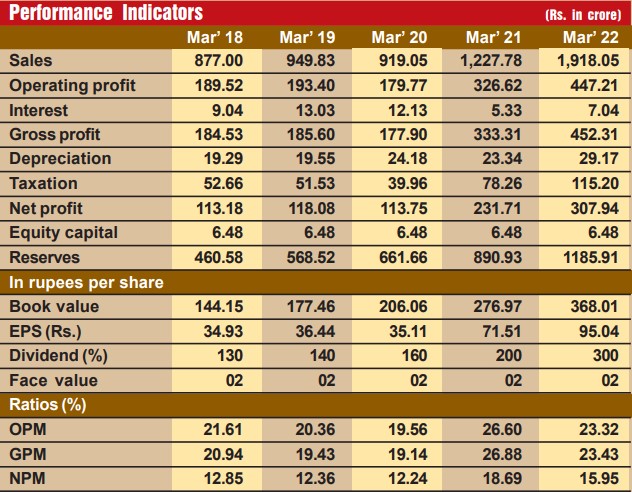

Needless to say, BAL is going from strength to strength on the financial front. During the last 12 years, sales turnover has expanded almost seven times from Rs 347 crore in fiscal 2011 to Rs 2,319 crore in fiscal 2022, with operating profit spurting by over 11 times from Rs 63 crore to Rs 699 crore. During the same perod, the profit at net level has zoomed over 13 times from Rs 27 crore to Rs 368 crore. During the last five years, the company’s consolidated sales have grown at a rate of 28 per cent and consolidated profit at 36 per cent!

The company’s financial position is very strong, with reserves at the end of March 2022 standing at Rs 1,186 crore – over 183 times its equity capital of Rs. 6.48 crore, and that after issuing bonus shares in the ratio of 1:1 in fiscal 2006.

However, we have not picked up Balaji for its past laurels. We strongly feel that future prospects for the company are all the more promising. Consider:

— Savyasachi

January 31, 2026 - Second Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives