Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Dec 15, 2022

Updated: Dec 15, 2022

Some readers have complained that we always select a high-priced stock as the Fortune Scrip. Why don’t you select a low-priced stock for this very informative column sometimes, they ask. Keeping in mind the wishes of these readers, I have selected a small cap, low-priced stock as the Fortune Scrip for this fortnight.

Manali Petrochemicals, the Chennai-headquartered petrochemical company belonging to the Muthiah group of SPI. The company manufactures propylene glycol and polyols. Annually, it produces 27,000 tonnes of propylene oxide (PO), 14,000 tonnes of propylene glycol and 15,000 tonnes of polyether polyol and polyol systems. These innovative products find applications in a variety of industries such as appliances, automotives, bedding, food and fragrances, furniture, footwear, paints and coatings, and pharmaceuticals.

The company is the only domestic manufacturer of propylene glycol (PG) and the largest manufacturer of propylene oxide (PO) – which is the input material for propylene glycol. It is focused on sustaining its leadership position in the market.

Manali has two manufacturing facilities — one plant originally built by SPIC with technology from Atochem for the manufacture of PG and PO, and the second, that of Arco, for the manufacture of polyol acquired through Technip France. The company places a lot of emphasis on innovation. According to the management, innovation and customer focus are the two guiding principles of research and development efforts at Manali.

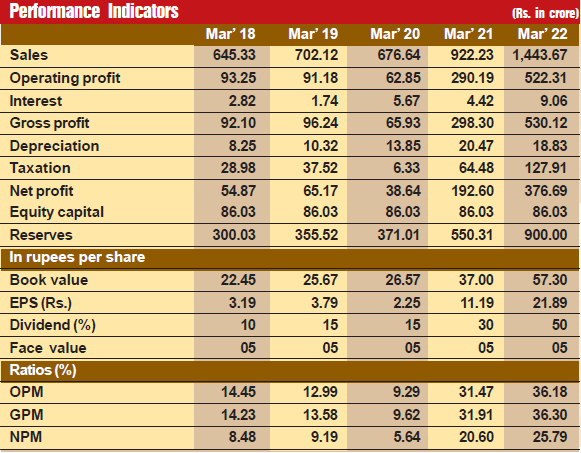

The company is steadily progressing on the financial front. During the last 12 years, its sales turnover on a consolidated basis has expanded from Rs 445 crore in fiscal 2011 to Rs 1,445 crore in fiscal 2022, with the operating profit spurting more than 13 times from Rs 38 crore to Rs 522 crore and the profit at net level surging over 15 times – from Rs 25 crore to Rs 377 crore during this period respectively. The company’s financial position is very strong, with reserves at the end of March 2022 standing at Rs 900 crore — over 10 times its equity capital of Rs 86 crore. The company is almost debt-free, its borrowing is only Rs 16 crore and the interest burden is a nominal Rs 9 crore (for 2022); i.e., a fractional 0.6 per cent of its sales turnover.

However, I have not selected Manali for its past performance. The company’s prospects going ahead are all the more promising. Consider:

These challenges at the most can slow down the pace of growth of Manali but cannot harm it in any other way. Interestingly, the company has set up a propylene oxide manufacturing facility which is the key intermediate raw material for manufacturing PG. Again, Manali has set up its base from commodity PO to speciality PO.

A plus point in favour of Manali is the fact that it has managed to amass FCFE (free cash flow to equity) of Rs 700 crore in the last seven years. This is not bad for a small cap company with market capitalization of Rs 1,600 crore. Again, the company’s move towards specialities allows it to tweak the product mix and manufacturing lines as per the customer’s demand. This is something that international players would find hard to accomplish since they look for dumping a commodity mix in large volumes. What is more, the increasing use of PG in pharmaceuticals, food industries and paint will majorly benefit Manali rather than importers. This is because these industries look for reliable supplies for their speciality use case. Without the local knowledge of industries, global companies like DuPont find it had to compete in local speciality use cases. The company also has a competitive edge on the freight cost front.

And the entry into the field of speciality chemicals would enable Manali to graduate from the small cap to the mid-cap category in the near future.

Shares are available around Rs 80-85 and there is tremendous growth potential for long-term investors.

December 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives