Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Feb 28, 2022

Updated: Feb 28, 2022

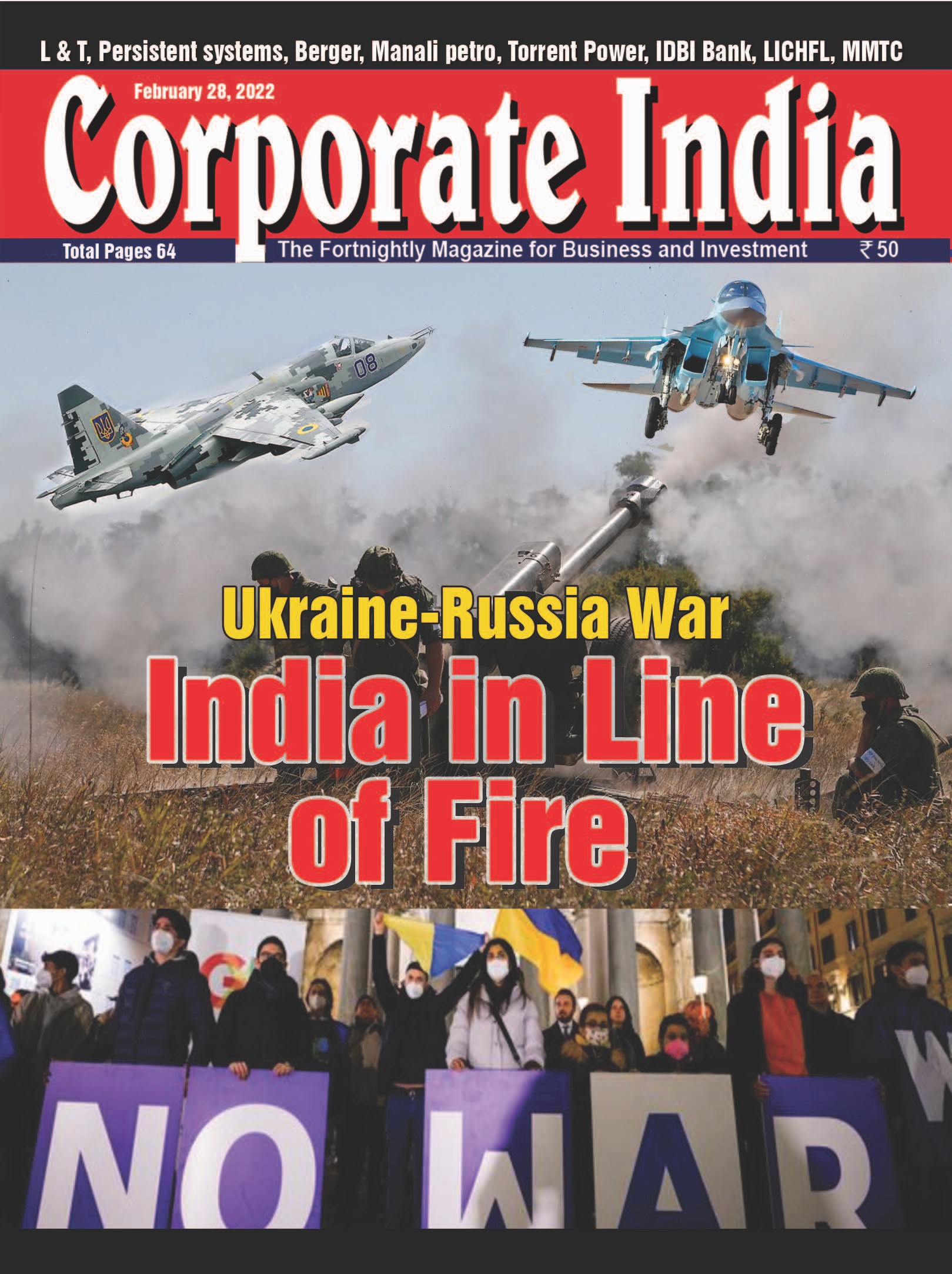

With Russian overlord Vladimir Putin finally ‘making good’ on his threat to invade neighbouring Ukraine, both global politics and economics have been bowled a ‘googly’. While India is – understandably, given its long-time ties with Russia – moving gingerly in its political response to the Putin’s naked opportunism, there are risks as well as opportunities on the economic front for the country.

While the Sensex and the Nifty took a bad hit in the immediate aftermath of the Russian invasion, a longer-term worry is about rising crude prices and the impact on Indian’s import bill and domestic retail inflation. On the flip side, given the threat of Western sanctions against a Russian ally like China, India could benefit from the situation with increased exports to the European Union. And as far as Indian retail investors are concerned, the experts are unanimous in advising them to wait for a market correction and not offload stocks in panic mode.

With Russian President Vladimir Putin finally following up on his warlike sounds with Ukraine last week, the world has been stunned. The Ukrainian Foreign Minister has termed the Russian incursion a “full-scale invasion”, while US President Joe Biden has called Putin’s move an “unprovoked and unjustified attack by Russian military forces.” Though the US and its allies have not yet entered to the fray to bail out Ukraine, but hope their sanctions will have the desired effect, major global indices went into free fall in the immediate aftermath of the Russian invasion while a ‘safe asset’ like gold registered its highest price rise since early 2021 and Brent crude breached the $ 100 mark. On a global level, the ‘invasion virus’ set in motion by Putin comes just as the world was slowly recovering from the ‘Wuhan virus’ and raises the spectre of yet another period of global economic instability.

Though India is not involved in any way in the conflict, it has started feeling the pinch as the world is now a global village and the Ukraine-Russia imbroglio will have a significant adverse impact, albeit indirectly. As explained by Mr. Deepak Jasani, Head of Retail Research, HDFC Securities ”Geopolitical events involving large nations and at crucial geography could impact the movement of goods, disrupt supply chains, resulting in anticipatory hoarding which could lead to commodity price rise. This could impact the inflation rates and hence the currency rates of nations. Such events may also impact the risk appetite of global investors resulting in selling pressure in assets. Countries and their economies are interconnected in terms of their dependence on each other for trade, services, investments, etc. Hence a big geopolitical event in one part of the world will have a sentimental impact initially on markets in other countries while the actual impact will be known only later.”

Elaborating on the subject Mr. Neeraj Chadawar, Head, Quantitative Equity Research, Axis Securities says ”Macroeconomic factors across the world drive trade, finance, currency. These factors also drive the fund flow which moves from developed markets to emerging markets or say Asia-Pacific markets. Macroeconomics are the key factors having a bearing on the equity markets. Along with that, macroeconomics also has a bearing on all the major asset classes including equity, debt. gold, currency. Geopolitical tensions have a direct, indirect impact on macroeconomic factors as they can disrupt supply chains, trade channels, movement of goods and services.”

Stock market which are volatile are always the first one to get hit says Chadawar, ”A geopolitical event always comes up with a short-term reaction in the market because the news flow headline across-the-board leads to market volatility, the gauging factor which decides the sentiment of the market. Since equity is always considered as a volatile and highly risky asset class as compared to debt, gold and currency. So the reaction to geopolitical tensions in the equity market is always higher compared to other asset classes.” added. He went on to explain how the recent developments in Ukraine has caused volatility across the world to spike. In domestic markets, India VIX rose to 32 mark and that is a short-term negative factor which leads to short-term underperformance of riskier assets like equity.

As the Russian army marched into Ukraine a week ago, the Indian stock market suffered a severe jolt with the two leading indices – the Sensex, based on prices of 30 pivotal stocks quoted on the BSE, and the Nifty, based on 50 leading stocks quoted on the NSE — tanking almost 3.5 per cent in early trade hours after the event. What is more, Indian markets were the worst hit among Asian equity markets.

Subsequently, the market stopped declining and tended to recover. However, market sentiment has remained somewhat nervous with the uncertainties generated by the war weighing heavily on the minds of investors. And observers are busy trying to analyse the indirect effects of the war on the Indian economy.

For example, the war has given a boost to crude oil prices which are now hovering at an around 7-year high, with Brent oil prices crossing the historical $100-a-barrel mark for the first time since 2014. Notably, Russia is a key supplier of energy globally, and Europe relies on Russia for about a quarter of its oil supplies and a third of its gas.

Even before the incident, in her post-budget comments, Indian Finance Minister Nirmala Sitharaman had remarked that Russia-Ukraine tensions and a surge in crude oil prices posed a risk to the financial stability of the country and the government was closely monitoring the situation. “Even in the FSDC (Financial Stability and Development Council) meeting, when we were looking at the challenges posed to financial stability, crude was one of the things. The international worrisome situation, where we actually voiced that we want diplomatic solutions for the situation developing in Ukraine — all these are headwinds,” she had noted. According to JPMorgan Chase & Co, oil prices are likely to average $110 a barrel in the second quarter amid the Russia-Ukraine conflict. The bank has further said that the crude market is likely to see sustained higher prices in the next quarter before retreating to an average of $ 90 at the end of the year.

Data from the US Energy Information Administration shows that China is the largest single customer for Russia’s oil exports. While Asia and Oceania as a whole accounted for 42% of Russia’s total crude oil and condensate exports, China emerged as the largest importer of Russia’s crude oil and condensate at 31% in 2020.

“There will be oil coming to the market but the current geopolitical risks and also the potential worry about supplies, leading to buying to fill storages, will keep prices at high levels for now,” Kang Wu, head of Global Macro, Demand and Asia Analytics at S&P Global Platts, said recently.

India accounts for a negligible (less than 1%) share of Russia’s crude oil exports, which is partly because most Indian refineries cannot process the heavy crudes that Russia exports and also because of high transportation costs from Russia. However India will face the brunt of higher crude oil prices and its import bill shoot up immensely. Brokerage firm ICICI Securities in its note has argued that the impact of a Russian invasion of Ukraine and its aftermath will be two-fold. “Higher crude oil prices will keep CPI inflation higher for longer, obliging the RBI to raise rates more than the two hikes we expected in August-December 2022, unless the government sharply cuts excise duties on petrol and diesel to contain fuel inflation.”

On the flip side, on the trade front, given that the European Union is the biggest market for India’s exports, supply disruptions to the EU are likely to generate greater demand for steel, engineering goods, etc., of which India is an alternative supplier.

“The factors that caused India’s exports to outperform the world in CY21 will continue to hold in CY22, allowing exports to remain robust. India buys very little oil and gas from Russia, so the near-term disruptions to the Indian economy will be minimal (apart from the higher oil import bill),” the ICICI Securities note adds.

The West had so far blunted the possibility of a Russian invasion with the threat of sanctions. ICICI Securities has further said that countries defying sanctions could face reprisals from the Western banking system, which could prove disruptive to China’s ability to participate unhindered in the global trading system. “This would offer a potentially positive opportunity for India as an alternative supplier of manufactured exports, although the primary initial benefits would flow to ASEAN, Taiwan, Korea, and Japan,” the brokerage has said.

The Indian stock market has taken a beating over the last few weeks owing to a potential tightening of policy measures, now topped off by the Russia-Ukraine crisis. Oil manufacturing companies (OMCs) have not hiked fuel prices since November last year when the government provided some respite to consumers by reducing excise duty on diesel by Rs 10 and on petrol by Rs 5. But analysts feel a rise in fuel prices may be due. And in the current scenario, it could force global central banks, including the Reserve Bank of India, to take a relook at their policy stance.

According to a financial expert, in the past it has been seen that at the end of a war-like event, the market typically tends to bounce back. “Unless you are a trader and you know you have to sell, I think it is crazy for investors to react in this kind of market and sell anything indiscriminately. There is no point in selling out of fear,” he added.

Other experts point out that the Russia-Ukraine conflict will have a noticeably adverse impact on Indian households Narendra Modi - Prime Minister, India February 28, 2022 Corporate India 33 as well as on policy makers. Ukraine and Russia together account for almost 90 per cent of India's sunflower oil imports. According to one expert, higher oil prices and rising inflation will also put pressure on the Indian currency. In case the US FED increases interest rates, the rate differential between the US and India is expected to narrow. This can lead to capital outflows from India, leading to further depreciation of the Indian currency. The rupee has already weakened as much as 1 per cent to 75.325 against the dollar versus Wednesday's (February 23, the day prior to Russia's invasion of Ukraine) close of 74.555. For the next week or so, all eyes are on the evolving geopolitical situation, with all other economic factors taking a backseat.

Significantly, Russia is a leading producer of commodities and Ukraine is a major producer of wheat. Prices of all these commodities have risen as traders remain concerned about the possibilities of disruption to shipments. A leading banker has noted that grain prices could also go up. Russia is the world's top wheat exporter while Ukraine is the fourth largest exporter of wheat. In fact, the two nations account for nearly a quarter of all global exports of wheat. However, the impact on India is not expected to be very high as the country does not need to import wheat.

The rise in oil prices will also have an impact on the current account deficit - the difference between the value of goods and services imported and exported. As oil imports work out to around 25 per cent of total imports, this will have a very adverse impact on India's fiscal deficit. According to the Confederation of All India Traders (CAIT), the Russia-Ukraine conflict is expected to hit the Indian economy and trade to a significant extent. The conflict is likely to brake efforts by domestic trade to recover from the Covid-19 pandemic.

The expected rise in crude oil will be a crucial and critical factor, which will force other prices upward, whereas the expected rise in gold prices will also lead to a hike in the prices of commodities. A hike in crude oil will lead to further inflation in petrol and diesel prices, which will lead to overall inflation as manufacturing and transportation costs of goods will increase.

The crisis will impact Asian economies, but the impact will be polarized across the region, according to Nomura analysts. The negative impact on Asia, they believe, will be predominantly because most of these economies are net oil importers, with food and energy accounting for nearly half of their consumption expenditure.

Although the ongoing geopolitical tensions can hurt Asia through multiple channels, such as tighter global financial conditions, elevated uncertainty and the risk of weaker global demand, higher commodity prices, especially oil, are the most important transmission channel.

"A sustained rise in oil and food prices would have adverse impacts on Asia's economies, manifested through higher inflation, weaker current account and fiscal balances, and a squeeze on economic growth. In such a scenario, India, Thailand and the Philippines are the biggest losers, while Indonesia would be a relative beneficiary," write analysts at Nomura.

As regards India, every 10 per cent rise in the crude oil price, according to Nomura, will shave off around 0.2 percentage points (pp) from GDP growth and widen the current account deficit by 0.3 per cent. This, Nomura believes, could add to growth uncertainties as the country navigates an uneven recovery and counters near-term tailwinds like higher public capex, services normalisation and easy financial conditions.

Inflation projections, too, rise in tandem with flaring oil prices and typically a 10 per cent rise in crude oil fans a 0.3-0.4 pp rise in headline inflation. According to Dr Soumya Kanti Ghosh, group chief economic adviser, State Bank of India, there appears to be an upside risk of 90-100 bps to the RBI's inflation projection of 4.5 per cent for FY23 if oil prices average $90 a barrel, and a 100-130 bps upside risk if oil prices average $100 a barrel.

As Russian forces swooped in on Ukraine a week ago, within just an hour of the development Indian investors in stocks lost $ 177 billion on a selling avalanche touched off by the Russian invasion of its neighbour. In fact, stock indices all over the globe crashed with India being the hardest hit. The Sensex, the most popular index in India, nosedived by 3.5 per cent, followed by the Hang Seng (Hong Kong) by 3.11 per cent, Australia by 3.02 per cent, the Nikkei (Japan) by 2.33 per cent, Taiwan by 2.08 per cent and Shanghai (China) by 0.89 per cent.

The news of a full-blown war, which the Ukrainian Foreign Minister termed “a full-scale invasion”, hit equity markets that were already reeling for reasons like relentless FII selling, expectation of a fall in interest rates, high fuel prices and a rising inflationary price spiral.

As for the Indian stock market, nervousness gripped market sentiment as the Russian army entered Ukraine and the Sensex tumbled down by 2,700 points to end the day at 54,529, while the Nifty lost 816 points to close the day at 16,248. This is the fourth lowest daily fall witnessed by the Indian bourses. Almost all the sectoral indices ended in deep red with pockets such as financial, IT and gas being the biggest drags on headline indices.

Of course, Russian stocks were the worst hit with the rouble sinking to a record low. The dollar-denominated RTS index plunged 50 per cent to a new low of 614.19 for the day. MOEX – another Russian index — wiped off 46 per cent of its value to trade at 1,690.13.

The MSCI-Asia Pacific index slid as much as 2.8 per cent to the lowest level since November 2020 after the Russian incursion. Benchmarks in Australia, Hong Kong and Singapore also fell by 3 per cent each. The S&P 500 entered a correction on the eve of the invasion as it fell 1.8 per cent to 4,225.5. The index is now nearly 12 per cent down from its January 3 record high.

It’s rightly said that ‘it’s darkest before the dawn’. We use this philosophy in many walks of life. As fund managers and stock pickers, we have observed similar trends in the equity market over the years and we have seen time and time again that the market rewards patience and prudent capital allocators even in times of despair.

We know from cyclical market behaviour that history doesn’t necessarily repeat itself but it most certainly ‘rhymes’. This note will highlight a trend in equity market crashes either leading up to a major, unavaoidable (‘black swan’) event like the global financial crisis (GFC) in 2007-08, the recent Covid-19 pandemic-led decimation, or the effect of wars through the world’s history. You will see that after a precipitous fall, especially due to war-like scenarios, headline indices together with top-tier market-leading companies with strong fundamentals are quick to recover and generate outsized returns for investors. These scenarios sometimes create much-needed corrections in structural bull markets and present a great opportunity to long-term investors to allocate additional capital in equities.

We would also like to draw attention to one behavioural aspect of investors. We have well-documented evidence to suggest that the highest equity inflows happen at times when the bull market is peaking and may be running into headwinds, while substantial outflows take place when equities are either sideways or in correction mode. We strive to build awareness around avoiding such ‘herding’ behaviour and urge investors to follow an approach contrary to what is described above.

We believe the India story is very much alive and kicking. It is led by government policies and increased capex spends across sectors, and supported by private sector capex, and we are seeing positive signs of the results.

As history tells us, the BFSI sector outperforms during interest rate hike regimes and we have positioned our portfolio to be overweight here. In addition to this, we have taken a targeted exposure to autos which have seen a prolonged down cycle over the last 3-5 years. Given the thrust by the government on housing in the recent past and the renewed push to the infrastructure sector, we are positive on home builders and the construction space as well. Rising crude prices and worries of inflation will lead to volatile sessions until the dust settles. However, we only see further investment opportunities in such conditions and make use of the same.

In closing, we recommend that investors ignore the ‘noise’ and stay put with their current investments. We as a fund house plan to deploy cash strategically and use the current dip to buy high-quality stocks in a staggered manner. We recommend that our clients do the same, as it is said that in times of war, ‘do not let a good opportunity go a-begging’!

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives