Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Jan 15, 2022

Updated: Jan 15, 2022

BSE and NSE-listed Ease My Trip, India’s leading online travel platform, has announced a bonus issue in the liberal ratio of 1:1. The company’s board, which met recently, has approved its free scrips out of reserves created out of profits. The board has taken this decision in order to allow its shareholders to increase their equity holding and gain greater exposure to its future growth.

Of course, this issue of bonus shares is subject to shareholders’ approval through a postal ballot. The record date will be announced in due course.

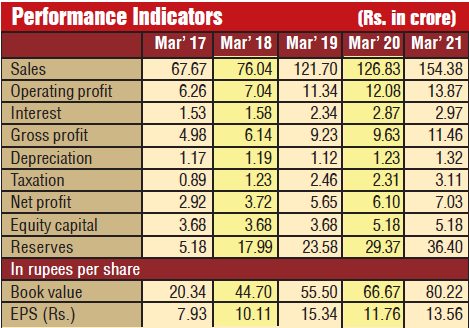

Commenting on the issuance of bonus shares, Nishant Pitti, CEO and co-founder of EaseMyTrip, says, “Despite the challenges faced due to the pandemic, the company has consistently produced profitable results due to a sustainable and result-oriented business model.” He adds, “Through the issuance of bonus shares, we want to reward our existing shareholders, allowing them to increase their equity in the group and gain greater exposure to our future growth.”

Looking at the new avenues for growth from the non-air segment and continued focus on financial and operational efficiency, the company will continue to generate value for its stakeholders, Mr Pitti maintains.

According to the company, the plan for the bonus share comes on the heels of strong results registering a four-fold jump in profit in the second quarter of fiscal 2022. It has also declared interim dividends twice since its listing in March 2021.

The company recently announced the acquisition of companies like Spree Hospitality, Traviate and Yolobus to strengthen its presence in the non-air segment.

The company has also expanded its international footprint to six countries -- the Philippines, Singapore, Thailand, the UAE, the UK, and the US.

The company is getting more and more popular by the day as it is a trendsetter for ecommerce platforms. It has been profitable right from the first day of inception while other travel firms have been running in losses and burning investors’ money. It may be noted that it was completely bootstrapped till the IPO, unlike other platforms which have been invested in by multiple investors in the past.

EaseMyTrip is known for getting direct business from consumers via credit/debit/net banking, which accounts for almost 93% of its total revenues.

The promoters, who have tremendous confidence in its future prospects, hold a 75% stake in the company, unlike other platforms where promoters hold less than 5% and consider an IPO an easy exit for themselves and their investors.

EaseMyTrip has acquired 1.5 crore flight/hotel booking users with ATV as high as Rs 10,000.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives