Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Editorial

It is a no-brainer that the forthcoming Union budget for fiscal 2021-22, to be presented by Finance Minister Nirmala Sitharaman in the Parliament on February 1, will be heavily influenced by the Covid-19 pandemic which has dealt a body blow to the country’s economy, apart from causing thousands of fatalities and millions of infections among the populace. While the economy was already under stress over the last couple of years, post the pandemic the pace of growth has slowed considerably, the fiscal deficit is on the rise, the finances of the country are under strain and the debt burden is mounting. Adding to these woes, the coronavirus has hit the country at a time of serious border confrontation with China, border disputes with Nepal and the ever-present tensions with Pakistan, all of which have forced an increase in India’s defence expenditure.

Meanwhile, the ‘aam aadmi’ continues to suffer as thousands of small and medium enterprises have closed down, unemployment is on the rise and millions of jobless people are finding it difficult to make ends meet

Little wonder then that the task before Ms Sitharaman is an unenviable one. Business activity in the country has been adversely affected by the pandemic and the budget will have to provide liberal stimulus packages to boost this sector. Vaccination again Covid-19 will demand a lot of funds while resources will be equally needed for rapid infrastructural development and revival of the economy.

However, Ms Sitharaman will have to include a special focus on the country’s public health infrastructure. The pandemic has exposed the country’s poor public health infrastructure and shown how far we are behind Western countries in this respect. According to the National Health Profile, the country is still struggling to reach a figure of one bed per 1,000 population as against the WHO recommendation of a minimum of five beds per 1,000 population. Worse, highly populous states like Uttar Pradesh, Bihar, Madhya Pradesh and Maharashtra have even fewer government hospital beds than the national average. Overall, India has only 0.8 doctors per 1,000 population when WHO recommends at least one doctor for the same number of people. Even China and Sri Lanka fare better at 1.97 and 1.0 per 1,000 population respectively.

The corona crisis has shown the extent to which ordinary citizens have had to bear the brunt of private hospitals’ exorbitant charges, as evidenced by the fact that the country’s out of pocket (OOP) debt cycle expenditure is more than 60 per cent of the country’s total health expenditure, while Mexico, China and Brazil have an OOP expenditure of around 40 per cent each.

India’s public health expenditure has been oscillating at a low 1.2 to 1.6 per cent of the GDP for the last 10 years, as compared to countries such as China (3.2 per cent), the US (8.6 per cent), and Germany (9.4 per cent). According to a World Bank report, “If we take the matrix of per capita health expenditure in India, it is $ 69 (Rs 5,039), whereas private spending per person is nearly $ 183 (Rs 13,359).” Of course, the Modi government has taken some positive and progressive initiatives like ‘Health For All’ under the National Health Policy (2017) and Ayushman Bharat. However, these initiatives have lost their impact in the prevailing pandemic-affected economic situation, when the GDP is expected to nosedive to its lowest level in the seven decades since Independence.

In these circumstances, the forthcoming budget will have to pay utmost importance to developing a robust public health infrastructure even as other areas of the economy cry for attention. After all, when the chips are down, human life is more important than the pace of economic growth. Ms Sitharaman will have to bite the bullet and come up with a meaningful, innovative and effective public health policy in the interests of our long-suffering people.

Cover story

Mr. Amit Mehta entered the world of investments purely by chance after Dena Bank offered him his late father’s job. While working there, Mr. Mehta honed his investment skills to such an extent that he subsequently quit his job and became a full-time stock broker.

Corporate Grapevine 123 15

The Hinduja brothers have reportedly decided to working on an amicable settlement. I have initiated talks over the group’s fortunes. On the disastrous table, while Janak Dwarkadas is representing SP Hinduja and his daughter Vinoo, the other three Hinduja brothers have hired Harish Salve as their mediator.

Corporate Report

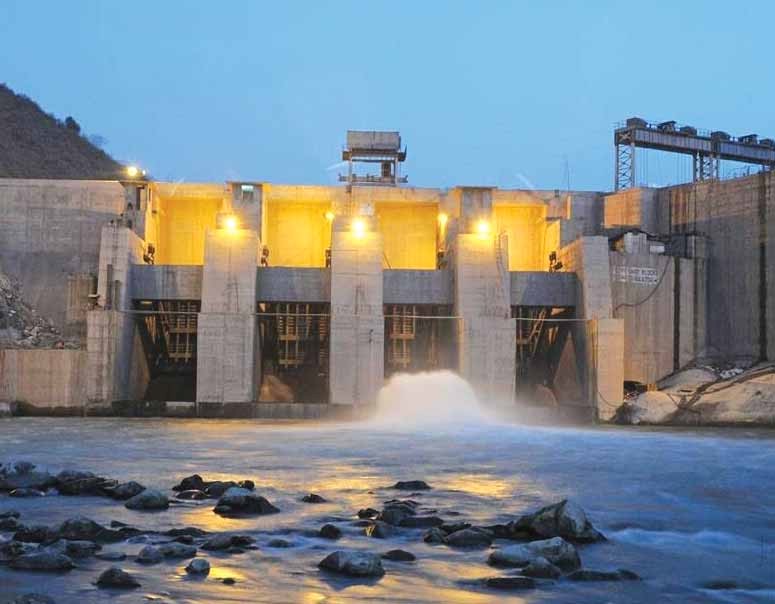

Sticking to its hydro-mech expertise Om Infra’s fortunes are sure to change for the better as the company has decided to focus on its core strength of hydro-mechanical works for hydro projects

Expert Opinion

The Indian equities are no longer cheap and markets are only a short distance away from being the most expensive they have ever been.

Management 123 15

Necessity is the mother of invention as well as change, and the Covid-19 pandemic has changed our lives in ways we cannot yet fathom. Working online has required maintaining trouble-free gadgets, jottings, use of videos and slides for presentations etc. However, these all are not a total substitute for the office.

Special Report

Looking at various economic issues holistically, Bibek Debroy, chairman of the Economic Advisory Council of the Prime Minister, has said that a budget is not just about revenue and expenditure but also about policy content and intent.

Economy 123 15

Wholesale inflation has narrowed to a 4-month low of 1.2% in December 2020 compared with 1.6% in the previous month and 2.76% in the corresponding month last year. CARE Ratings had estimated wholesale inflation at 1.6% for the month. The moderation in wholesale inflation can be primarily ascribed to perceptible deflation in the primary articles segment and sustained deflation in the fuel segment.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives