Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Jun 15, 2022

Updated: Jun 15, 2022

Even as markets worldwide are reflecting the deleterious effect of the ongoing UkraineRussia war on global supply chains, the resulting inflationary pressures have spurred central banks to raise interest rates, administering another blow to corporate profits. As far as India is concerned, the worst affected sector is Information Technology, which is facing a double whammy of thousands of layoffs and a startlingly high attrition rate of skilled staff. Observers note that the industry had got used to the idea of being mediocre at a time when there was an overseas shortage of techies.

But today, overseas clients prefer companies which are proficient in newer technologies. All these headwinds have inevitably led to IT stocks, including blue chips, taking a steep nosedive. Be that as it may, the present scenario is ripe for discerning investors to pick fundamentally sound IT stocks at attractive prices.

Stock markets have tumbled down across the world and the slump is all the more pronounced in Information Technology stocks. In tandem with global markets, the Indian stock market has registered a hefty plunge, with IT stocks suffering the most. Reflecting this mood, the Sensex, the most popular stock market index based on 30 pivotal stocks quoted on the BSE, has nosedived from its 52-week high of 62,245.43 to 52,541.39, and the Nifty 50, the darling of analysts based on 50 leading stocks quoted on the National Stock Exchange (NSE), has tumbled from a 52-week high of 18,604.45 to 15,692.15. And even as all sectors have been facing the brunt of the crash, the downward drift is all the more pronounced in IT stocks. The BSE IT index has slumped from a 52-week high of 38,713.30 to 28,244.01 by now and the Nifty IT index has tumbled from 39,448 to 27,812 – very close to its 52-week low of 27,423.

In India, during the current melt-down in the stock market, IT stocks have been among the worst-hit. Maintain J P Morgan analysts: “Soaring inflation, supply chain issues and the hit from the Ukraine war will bring an end to the growth boom the Indian IT services industry enjoyed during the pandemic.” While downgrading the sector to “under weight”, they add that the $ 194-billion sector, whose software services helped businesses adopt to pandemic-era practices of online shopping and remote working, is facing a demand slowdown and there are more downside risks to current earnings assumptions. The leading brokerage house expects the slowdown to worsen in 2023, partly due to a potential decline in orders from the key market of the US, where economic growth has started to weaken. The downward drift of the IT industry has forced companies to resort to job cuts. Says an industry expert, “The IT job market in India is seemingly crashing. There are reports that IT firms in India are in the middle of one of the largest job cuts ever seen in this industry. Nearly 2 lakh jobs are at stake, while big ticket companies are looking to both hand over pink slips to incumbent employees and hire fewer talent.”

The number of layoffs this year is likely to be twice that of last year – the main reasons being an inability to adapt to new technologies, inadequate growth, rise in costs and subsequent fall in profits, and the use of automation tools which reduce the number of employees needed. According to market reports, seven of the biggest IT companies are in the process of laying off more than 66,000 engineers

Individually speaking, Cognizant seems to be the worsthit as the company is planning on laying off as many as 6,000 staff – representing a whopping 2.3 per cent of its total workforce. The company is reportedly struggling with adapting to new technologies and digital services, and is laying off employees in lower-end jobs which are becoming redundant because of automation.

Another company, Tech Mahindra – the fifth largest Indian IT firm on the basis of revenue — has reportedly let go more than 1,000 employees. Explains a company spokesman, “We have a process of weeding out bottom performers every year and this year is no different.”

Another company, Snapdeal — a struggling e-commerce player – is reportedly planning to axe a huge 30 per cent of its workforce on account of poor growth, reduced revenues and incurring losses. What is more, even Infosys, the second largest Indian IT company, is planning to lay off as many as 1,000 employees in the coming months.

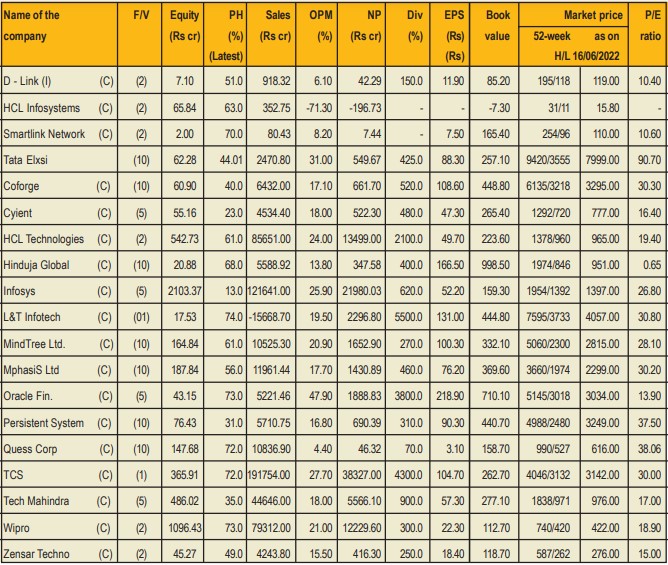

Little wonder then that investors led by Foreign Portfolio Investors (FPIs) have been selling IT stocks, which has eroded the substantial wealth invested in IT stocks. The stock price of TCS, the numero uno IT company in the country, has tumbled from its 52-week high of Rs 4,046 to Rs 3,132, Infosys has nosedived from Rs 1,954 to Rs 1,397, Wipro from Rs 740 to Rs 422, HCL Technologies from Rs 1,378 to Rs 965, Tata Elxsi from Rs 9,420 to Rs 7,999, L&T Infotech from Rs 7,597 to Rs 4,057, Mindtree from Rs 5,060 to Rs 2,815, Persistent Systems from Rs 4,988 to Rs 3,249, Tech Mahindra from Rs 1,838 to Rs 976, Zensar Technologies from Rs 537 to Rs 276. Coforge, which was in demand around Rs 6,135, is today friendless at around Rs 3,295.

There are several factors which are responsible for the debacle of the IT sector. The global meltdown in general and the steep slide in Nasdaq also vitiated market sentiment in India as FPIs emerged keen sellers.

The tech-heavy Nasdaq 100 index slumped last fortnight by more than 26 per cent year-to-date after the US Federal Reserve raised interest rates, while the world’s largest technology companies shed over $ 1 trillion in value in just three trading sessions. The sentiment remained depressed as the Fed once again raised interest rates this month.

Tech and growth stocks have been hit hard by the prospect of higher rates as the Fed and other major central banks around the world, including the Reserve Bank of India, look to cap soaring inflation by tightening monetary policy.

The sudden downward drift in high-growth tech stocks – widely seen as overvalued at the market peak in late 2021 – has led some commentators to voice concerns about a tech-driven crash similar to that of the dotcom bubble bursting in 1999/2000.

Global markets have not been able to digest the economic uncertainties created by the Ukraine-Russia war, which has led to economic uncertainty in Europe and across the globe as companies have ceased doing business in Russia and Ukraine and shortages have emerged with supply chains being disrupted. As a result, many companies have been deprived of their raw materials, while exporting companies which have not been able to dispatch their products are facing huge unsold stocks in overcrowded godowns.

Galloping inflation has administered another blow as prices of raw materials have climbed to levels which will adversely affect profit margins. Prices of several commodities have reached sky-high levels. And as if this is not enough, in order to certain the inflationary price spiral, central banks including the Reserve Bank of India, started tightening their monetary policies and raising interest rates. This has administered a further hit to the profit margins of companies. Little wonder then that the last quarterly performance of the topmost Indian IT companies – TCS and Infosys — turned out to be disappointing. Correspondingly, it is feared that the performance of all IT companies going ahead will be far from encouraging.

Leading Indian IT companies depend a lot on North American companies for their business, as the latter account for over 70 per cent of revenues of the Indian IT sector. Due to economic uncertainties and an inflationary price spiral, the growth rate of North American companies has slowed down significantly, which in turn has forced them to cut their spending on IT, thus affecting the performance of Indian IT companies.

The rapid growth of the Indian IT industry has led to the employees having unrealistic expectations. On one side, the Indian IT sector is facing a severe talent crunch. No doubt, there are a lot of engineers in India today and the tribe is increasing every year. But very few of them are experts in software engineering. According to surveys conducted by human resource consultants, more than half of this workforce is simply not trainable. The fact of the matter remains that getting good tech resources in India is as difficult as getting them in Silicon Valley. This is because the jobs are far greater in number as compared to the number of skilled employees. Realising this, skilled employees are now in search of higher salaries and better working conditions. As experienced employees get set to leave a company, the management is forced to offer higher salaries and perquisites or appoint freshers – the latter inevitably slows the pace of growth of the company.

“The focus of Indian IT services companies has to shift from competing on price to competing on value to customers,” maintains Mr. Narayana Murthy, the founder of Infosys,. “Companies will have to bring in innovation to increase the business value leverage. The price can be higher if the business value to the customer is higher. This will also move companies away from the tendency to commoditise market and compete only on cost, he said.”

Pointing out that the major challenge is to revamp education system to enhance curiosity critical thinking and proaction problem solving among youngsters,” he adds. “The New Education Policy has made many useful recommendations. Nasscom has a seminal role in exhorting the higher educational institutions to implement these recommendations with alacrity.”

According to him, Nasscom can also prepare a recommendatory methodology for private companies to prepare talent for successfully executing government projects in India on time, within budget and with the requisite quality. It can produce a manual to help government in India to plan a digitisation project, to prepare a proper bid; to select the right vendor, to detail the requirement definition and to manage time, cost, productivity, quality, security, privacy and disaster recovery in developing,maintaining and operating large application projects of digitisation. Nasscom can create a group to share innovative ideas in this effort. Infosys always believed that sharing ideas will only make the ideas better. The success of an idea is determined primarily by how well and how quickly one can execute the idea so individual companies need not worry about competitors, he said.

A keen observer of the Indian IT sector says bluntly, “The Indian IT industry has got used to the idea of being mediocre. This is because the industry flourished during a time of labour shortage. American MNCs were offshoring jobs because of the huge cost advantage. They did not care much about quality. As a result, Indian IT companies got used to the idea of hiring substandard employees whom they could later train. But now technologies have changed and the tech industry has become highly competitive. Today, clients would like to offshore work to associates who are capable of understanding and implementing newer technologies independently. Indian IT companies have limited resources of this calibre. Thus, there is a shortage of skilled employees and with the latter always in search of better jobs, the attrition rate has shot up much beyond the norm of 10-15 per cent all these years.”

After former US President Donald Trump adopted a protectionist stance and resorted to restructuring rules for Indian employees to enter the US, some other countries like Australia and Singapore also started banning IT professionals from outside. This trend, if extended, will spell a grim future for Indian techies and Indian IT companies.

American clients also face time zone issues with their offshore teams. The time overlap is not insignificant as clients do not get enough time to interact with workers. Indian offshoring firms are mitigating this problem by introducing night shifts. However, it does not seem like the workers are very happy about the prospects of burning the midnight oil with almost no possibility of securing an overseas assignment.

To sum up, Indian IT companies do not sell any innovative products. Instead, they simply sell commoditised services where a price war is imminent. Also, with protectionist policies on the rise, company savings are also declining, leaving a question mark on the future of 4 million employees and the country’s multi-billion dollar IT industry.

Experts believe that the downward drift in Nasdaq, the inflationary price spiral and declining industrial growth have certainly played their part in hammering IT stocks in the Indian market, but another major reason for the slump is the unbelievably high share prices. In recent times, the IT sector had seen a lot of momentum which had pushed up price-to-earnings (PE) to unbelievably high levels, and what we are now seeing is a massive correction.

IT companies are dumbfounded and investors in IT stocks are jittery. The questions being asked are: What is lying in the future? How long will the stock bloodbath continue? Is this another dotcom bubble that's ready to burst? With experts in the US predicting a disastrous recession, what is the future of IT companies in India?

Says market expert Neelkanth Mishra, Co-head of Asia Pacific Strategy and India strategist for Credit Suisse "Meta and Instagram are not the same as TCS, and Alphabet is surely different from Infosys. Are we looking at a long- drawn consolidation/correction in the Indian IT sector, or is this a knee-jerk reaction playing out and perhaps restricting itself to new age tech companies?"

He adds, "I do not think it is about the sell-off in Nasdaq which is affecting Indian IT stocks. There may be some minor links but this is more related to the fact that this sector has seen a lot of momentum which pushed up P/E levels unsustainably, we are now seeing a correction."

The US, which houses the premier and pace-setting stock market, fears that the inflationary price spiral may lead to a recession which can hit technology stocks very hard. According to an expert on the US economy, how people spend their money is shifting as the economy slows and inflation pushes prices higher everywhere, including in gas stations, grocery stores and luxury retail shops. The housing market, for example, is already feeling the pinch. Other industries have long been considered recession-proof and may enjoying a bump as people start going out again after hunkering down during the pandemic.

Take the example of Brigette Engler, an artist based in New York city. As gas and food prices climb, she says she is driving to her second home upstate less often. Cutting back on eating out, she says, "Even twenty dollars seems extravagant at this point for lunch."

Meanwhile, US investors in stocks now prefer to disinvest their stocks to raise funds rather than buy new stock

Says an observer of the US economy, "Inflation is at a 40- year high and stock prices are sinking. The Federal Reserve is making borrowing more costly. And the economy actually shrank in the first quarter of the current calendar year."

US consumer prices rose 8.6 per cent a month ago from a year earlier - Russia's invasion of Ukraine has exacerbated global food and energy prices. Extreme lockdowns in China over Covid-19 have worsened supply shortages. Fed Chief Jerome Powell has vowed to do whatever it might take to curb inflation, including raising interest rates so high as to weaken the economy. If that happens, the Fed could potentially trigger a recession perhaps in the second half of next year, fear economists.

Eventually, a slowdown would feed on itself with layoffs mounting as economic growth slows, leading consultants to increasingly cut back out of concern that they too might lose their jobs. The clearest sign that a recession might be nearing, economists say, would be a steady rise in job losses and a surge in unemployment. As a rule of thumb, an increase in the unemployment rate of three-tenths of a percentage point on average over the previous three months has meant that a recession will eventually flow. If this happens, stock markets in general and tech stocks in particular will fall further.

In India, some economists believe the economy is heading for stagflation. However, the Union Finance Ministry is of the opinion that India faces near-term challenges which need to be managed carefully without sacrificing hard-earned macro-economic stability. But the country faces a low risk of stagflation owing to its prudent stabilisation policies.

The FinMin report prepared by the Department of Economic Affairs says the world is looking at a distinct possibility of widespread stagflation but it adds that the risk is low for India. Both retail and wholesale price inflation is high but there are prospects of robust growth. But economists believe that if countries led by the US become victims of recession/ stagflation, India cannot remain untouched by it.

In any case, the situation is uncertain and stock markets in general and IT stocks in particular are likely to remain depressed during the short term as well as in the medium term. The sudden downturn for high- growth tech stocks - widely seen as overvalued at the market peak in late 2021 - has led some commentators to voice concerns about a tech-driven crash similar to that of the dotcom bubble bursting in 1991-2000. However, experts - in US as well as in India -- strongly believe that the trend will undergo a dramatic change in the long term.

Says UBS CEO Ralph Hamers, "Clearly there is a question of what should the exact market value of some of these models, but the underlying business models are true business models - not only now but also for the future in terms of delivering services, advice and what have you digitally."

He adds, "It is a trend that is supported by demographies and acclaimed by client behavioural change. So, whether it is in consumer series or in financial services or whatever, I do think that the technology business models, the ones that are digital, still are the right ones going forward because they are real business models. It is not like 20 years ago (in the dotcom bubble). We had some models that were just models on paper and not real. The last 20 years, we have been able to show that there are real changes happening in retail businesses, in financial businesses etc."

Maintains Axel Lehmann, Chairman of Credit Suisse, "Investors should retain a long-term perspective despite the temporary shake-out of tech stocks, as many companies within the sector are still solid and sound. The valuation levels have come down basically in all stock markets, but the profits are still there of companies. While there are similarities to the dotcom bubble, the underlying trends are now more supportive."

According to David Rubenstein, a billionaire investor, "The markets have been over-reacting despite the Fed's efforts to manage expectations. In the dotcom bubble case, you had internet companies with no revenues, obviously no earnings, that had nothing but a business in some cases, and those companies should not have gone public, let alone maybe been getting any capital. Now, you have a company like Netflix which has 250 million subscribers. It may not be worth what it was worth in the market a few months ago, but it is certainly worth more in my view than what it is currently trading for." Adds Mr. Rubenstein, "When markets overreact - as they have been today - there is an opportunity for investors to go in and buy at the bottom."

Points out the Union Ministry of Finance of the Indian government, "Finally, as the heat wave gradually gives in to the expected timely arrival of the southwest monsoon, sending newer crops to the mandi, food prices and consequently headline retail inflation are expected to decline. Early evidence of that was seen in May, with retail inflation easing from 7.8 per cent in April to 7 per cent in May and food inflation dropping from 8.3 per cent in April to 8 per cent in May

Agreeing with these arguments, observers of the economic scenario, including stock markets, insist that the prospects are bound to improve in the long term and investors with a longterm perspective should not worry about the current meltdown.

Says a septuagerian stock broker, "Commentators attributed the crash of IT stocks to overvaluation. But now, prices of all IT stocks have tumbled from their sky-high levels to highly attractive low prices. Now that the bullish fervour or speculative buying has come to an end and prices have descended from skyhigh levels to the earth, it is the time to enter the market and pounce upon your favourite stocks.

In fact, the time has come when discerning investors should accumulate select IT stocks - which have made 'roadpatis' real crorepatis -- at every decline, with the likelihood that if the current meltdown continues for some more time, stock prices may decline further. There is little doubt that once the current bearish phase comes to an end, the IT sector will re-enter the bullish path and prices which have gone down to unreasonably low levels will start moving up again.

We specially recommend the following IT stocks which discerning investors should include in their portoflios by buying at the current attractive levels. Of course, one should buy in small lots as there can be an opportunity to buy another lot at a still lower price in the next 3 to 6 months.

FACE VALUE 05

CMP 1446.00

52 WEEK HIGH /LOW 1954/1367

FACE VALUE 02

CMP 840.40

52 WEEK HIGH /LOW 1581/785

FACE VALUE 10

CMP 3224.75

52 WEEK HIGH /LOW 4987/2542

FACE VALUE 01

CMP 4016.85

52 WEEK HIGH /LOW 7596/3733

FACE VALUE 02

CMP 963.90

52 WEEK HIGH /LOW 1377/944

FACE VALUE 05

CMP 981.20

52 WEEK HIGH /LOW 1838/944

FACE VALUE 01

CMP 3232.00

52 WEEK HIGH /LOW 4046/3023

FACE VALUE 02

CMP 412.55

52 WEEK HIGH /LOW 740/402

FACE VALUE 10

CMP 7475.00

52 WEEK HIGH /LOW 9420/3607

FACE VALUE 10

CMP 427.80

52 WEEK HIGH /LOW 579/163

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives