Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Jun 15, 2022

Updated: Jun 15, 2022

For this fortnight, we have selected Astral Ltd, an Ahmedabad-based company which is a remarkable growth story in the plastic industry, catering to the needs of millions of households while adding extra mileage to the country’s developing real estate fraternity with the hallmark of unbeaten quality. An undisputed leader in the CPVC pipes segment, Astral has diversified into adhesives and emerged as the fastest growing plastics company in the country through the organic and, more so, the inorganic route. During its journey spread over a quarter-century, the company has acquired Resinova Chemie Ltd of Kanpur (India) and Seal IT Services, based in the UK. These acquisitions have enabled the company to expand its adhesives business, apart from its pole position in plumbing and drainage systems in the CPVC, PVC and DWC categories. While the pipes division contributes around 79 per cent of the company’s revenues, the adhesives division contributes the balance 21 per cent.

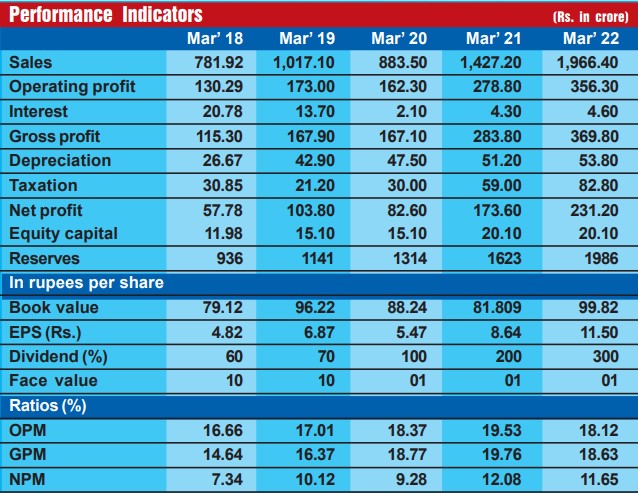

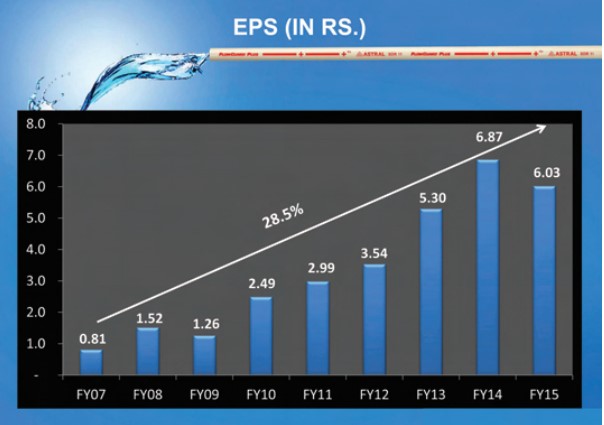

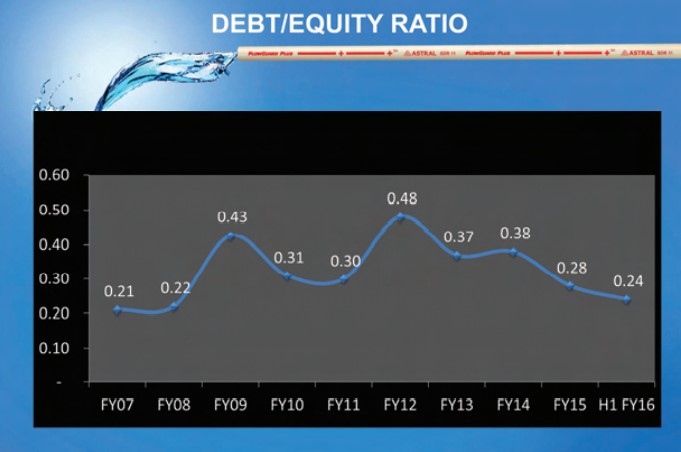

As demand for products of both divisions is on the rise, the company has started growing at a fast clip. During the last 12 years, its sales turnover has expanded from Rs 402 crore in fiscal 2011 to Rs 4,304 crore, with operating profit shooting up from Rs 55 crore to Rs 638 crore and the profit at net level surging from Rs 33 crore to Rs 484 crore during this 12-year period. With this speed, Astral has emerged as the fastest growing company in the pipes and fittings segment. The compounded sales growth during the last 10 years has been at 23 per cent while the compounded profit growth works out to 29 per cent during the same period. The company’s financial position is very strong, with reserves at the end of March 2022 standing at Rs 2,316 crore – more than 115 times its equity capital of Rs 20 crore. The company is a virtually debt-free entity and its borrowings, which were around Rs 229 crore in fiscal 2017 have been reduced to just Rs 84 crore in fiscal 2022. Thus, within the next 2 to 3 years, Astral will be a totally debt-free company.

No doubt, the company has made rapid strides during its first quarter-century with a huge spurt in revenues and earnings and a robust balance sheet. But we have not picked this company as the Fortune Scrip for its past laurels. We strongly believe that future prospects for the company are all the more promising. Consider:

Of late, the government has announced several new policies which can become excellent growth drivers for the piping industry. For example, the policy of ‘Housing for All’ by 2022, announced by the Prime Minister, has given a big boost to the construction of affordable houses. At the same time, the development of 100 Smart Cities and Swachh Bharat Abhiyan will give a boost to the demand for pipes.

At present, the PVC pipe industry consists of the organised sector which accounts for around 60 per cent, and the unorganised sector which meets the balance 40 per cent. The implementation of GST will support the organised pipe industry, while builders have started to prefer quality pipes, signifying a shift from the unorganised to the organised sector. At the same time, replacement of G1 (metal) pipes with CPVC pipes continues in the country, and can provide significant growth opportunities to CPVC pipes in the coming years. Astral, being the largest manufacturer of CPVC pipes in India, is well placed to capture the significant opportunities from this high-growth industry.

The Union Commerce and Industry Ministry recently imposed anti-dumping duty of 90 per cent on imported CPVC pipes from China and Korea. This step has saved domestic manufacturers like Astral from unhealthy competition and made it possible for our companies to raise their selling prices. As this measure has hit China and Korea, they have in turn increased the prices of CPVC resin which Indian companies have to import to the extent of 40 per cent of their requirements. Astral has a double advantage here, as it imports its resin component requirements from Sakisui (Japan) and will not face Chinese price pressure. At the same time, those who used to import CPVC pipes from China and Korea have turned to domestic companies like Astral. Besides, the demand for the latest products has increased rapidly. At the same time, the company finds itself in a position to raise its prices, which are easily accepted in the market.

We see bright prospects for the company going ahead, mainly on account of a large addressable market, a strong balance sheet, remarkable operational efficiency and favourable government policies. Although, during the current bearish environment, the share price has tumbled from the 52- week high of Rs 2,525 to Rs 1,635 — near the 52-week low of Rs 1602 — the stock is fundamentally very strong and discerning investors would do well to accumulate these shares in the current market crash. Investors in this scrip will reap rich rewards going ahead.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives