Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Jun 30, 2022

Updated: Jun 30, 2022

Based in Bengaluru, NSE-BSE listed Centum Electronics is one of the largest electronics system design and manufacturing (ESDM) companies in India.

CEL has world-class design and manufacturing facilities across North America, Europe and India, and offers the entire spectrum of design services and manufacturing of systems and subsystems for mission- critical products in the defence, space, aerospace, industrial, transportation and medical sectors

During FY22, on a consolidated basis, the company reported operational revenue of Rs 780 crore (PY Rs 817 crore). Mainly due to an exceptional item of Rs 60.4 crore, at the net level it reported a loss of Rs 53.5 crore, resulting in a negative EPS of Rs 24 on its equity capital of Rs 12.9 crore. The EBITDA margin remained lower at 9.51% against 10.95% in the previous year.

Broadly, the company has divided its operations into three segments, wherein the first one is engineering R&D (ER&D) services, which has contributed 37% to its revenue and includes conceptualising and designing of electronic hardware, embedded software, FDGA, analog, radio frequency products, etc.

Likewise, electronic manufacturing services (EMS), which contributed 26%, include manufacturing services solutions focused on high-complexity products in the high-technology segment. The thirdegment, build-to-specification, contributed 37% and includes turnkey solutions to take a project from conception to mass production quickly and efficiently.

Geographically, during FY22, Europe contributed 65%, Asia 25% and North America 10% to the company’s revenue, while industrywise, defence, space and aerospace remained at the top at 44%, followed by 30% from transport & automotive, 17% from industrial & energy, and the balance 9% from healthcare. CEL plays a key role to the global aerospace supply chain, delivering critical electronics for cockpit computers and air traffic management, and also works closely with OEMs to design next-generation flight controls and power solutions, among various other technologies.

In space technology also, CEL has made significant investments to ensure right-quality technology and bigger volumes. The company has delivered mission-critical electronics on the ambitious Chandrayaan and Mangalyaan projects, and also 300 to 500 components for almost every Indian space mission. This is one of CEL’s very big achievements

Though CEL started its defence vertical a bit later in 2010, today it is the largest industry vertical for the company. It has been successful in developing and manufacturing critical systems for major defence programmes that span land, air and naval systems with applications in missiles, electronic warfare, radar, military communications and fire controls, amongst many others. CEL is also contributing, for the past two decades, in the development and manufacture of modules, subsystems for missiles, radars and military electronic warfare communication applications for DRDO laboratories, ordnance factories and other domestic PSUs. Moreover, the company has become one of the select few Indian partners to international defence OEMs

In the healthcare segment, the company has engineered medical devices and equipment like digital radiography systems, automated pumps for drug injection, ultrasound equipment, patient monitoring devices, customised room controls for operation theatres, etc. Similarly, in automotive, the company supports customers in the disruptive technologies domain by turning big ideas into reliable and performing solutions.

CEL has developed proprietary technologies in two key product lines of its transportation vertical and works closely with leading global OEMs and rail operators on developing next-generation technologies for rolling stock signaling and passenger information system applications. These products have been deployed on board trains in North America, Europe, Asia and Australia.

All these indicate that the three supporting verticals viz., transportation, industrial and medical, all hold promise with sustainable growth potential. The prospects for engineering R&D services that the company is into are equally good. The services outsourcing for this domain is expected to globally cross $ 650 bn by 2025. The Indian ER&D sector, which employs about 7 lakh people in the country, could rise to one million by 2025, provided the growth momentum sustains.

CEL holds a strong domain expertise and has created a niche for itself wherein there is an entry barrier for new players. The company is sitting on a comfortable order book of Rs 1,090 crore (as at March 31, 2022), reflecting a clear revenue visibility of over a year. Further, the sparkling new developments taking place, especially in the aerospace, space and defence sectors, will prove to be major growth drivers for the company. Importantly, the company, under the leadership of Apparao Mallavarapu, Chairman & Managing Director, and his key team, possesses all the necessary capabilities to meet the growth challenges

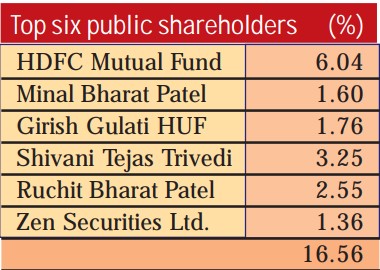

The promoter group holds a 58.8% equity stake and the balance 41.20% is spread among 8,776 public shareholders, of which the top six members (refer table) hold 16.56%. The long-term and short-term borrowings stood at Rs 81.6 crore and Rs 191 crore respectively. The debt-equity ratio has improved marginally from 1.43% to 1.34% at year end. The consolidated book value for a Rs 10 paid-up share is at Rs 158.30.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives