Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: May 31, 2022

Updated: May 31, 2022

After a detailed study of the past, present and future of Tata Power, we have decided to pick it as the Fortune Scrip for this fortnight. But we were shocked when a part of the equity research community sidelined Tata Power. While HDFC Securities downgraded the rating of Tata Power from ‘reduce’ to ‘sell’ and brought down the target price from Rs 271 to Rs 232, another research analyst placed the target price of the company at Rs 200. Yet another analyst has further brought down the price to Rs 150, while one analyst went to the extent of insisting that the Tata Power would nosedive to Rs 100.

Stunned by these analyses, we once again studied the company and, having been doubly convinced, have gathered our courage in both hands and decided to select Tata Power as the Fortune Scrip for this fortnight. We strongly believe that the company will emerge as a solid multi-bagger scrip in times to come as its future prospects are electrifying.

The company, belonging to the illustrious Tata group, is the largest integrated power company, present across the entire value chain of conventional as well as renewable energy, power services and next generation solutions, including solar rooftop and EV charging stations. The century-old company – formerly known as Tata Electric — has pioneered technology adoption in the utility sector with many firsts to its credit, including setting up one of India’s first hydro-electric power stations in 1915. Together with its subsidiaries and joint entities, the company has 12,772 MW of power generation capacity of which around 30 per cent comes from clean and green energy sources. From energy-saving power services to making India EV-ready with multi-city EV charging stations and being India’s number one rooftop solar provider, the company has been continuously delivering green technology for the smart consumer.

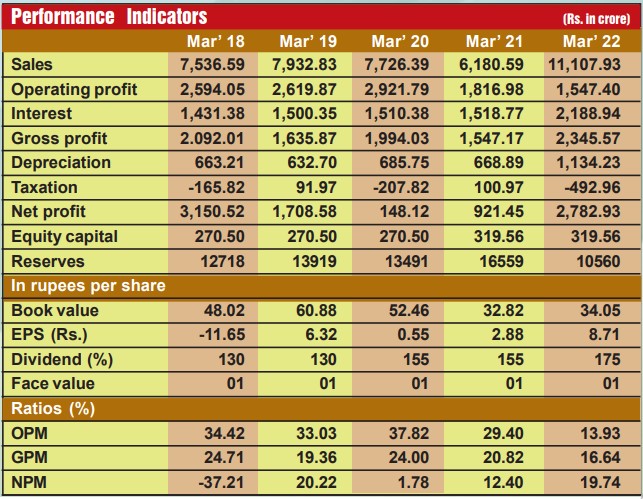

The company has been going from strength to strength on the financial front. During the last five years, its sales turnover has expanded from Rs 7,537 crore in fiscal 2018 to Rs 11,108 crore in fiscal 2022. However, due to the Covid-19 pandemic, the operating profit, which had gone up from Rs 2,594 crore in fiscal 2018 to Rs 2,922 crore in fiscal 2020, declined to Rs 1,817 crore in fiscal 2021 and further to Rs 1,547 crore in fiscal 2022, while the net profit dropped from Rs 3,151 crore in fiscal 2018 to Rs 921 crore in fiscal 2021, before recovering to Rs 2,783 crore in fiscal 2022.

The company’s financial position is getting stronger, with reserves moving up from Rs 12,718 crore in fiscal 2018 to Rs 16,559 crore in fiscal 2021 before declining to Rs 10,560 crore in fiscal 2022. Even these reserves are 33 times the company’s equity capital of Rs 319.56 crore.

However we have not picked this company as the Fortune Scrip because of its past laurels and existing activities. We have done so as the company is undergoing a massive transformation of far-reaching significance. Moving with the times, the company will gradually do away with conventional thermal energy generation and aims to scale up its renewable energy portfolio from the current level of 4 GW to 15 GW by 2025 and to 25 GW by 2030, thereby achieving 80 per cent clean generation capacity, up from the current 31 per cent. Consider:

Viewed in all these contexts, the company is all set to make rapid strides going ahead and is very much ready for re-rating. Needless to say, the company is emerging as a high-potential multibagger. All discerning investors must include this stock in their portfolio.

November 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives