Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Nov 15, 2022

Updated: Nov 15, 2022

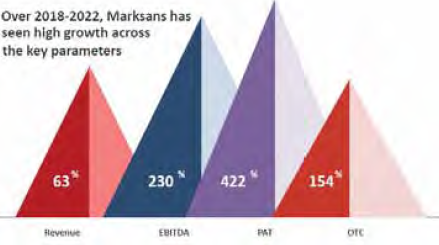

Marksans Pharma (MPL), engaged in manufacturing and marketing generic pharmaceutical formulations and with a strong global footprint, has continued its growth momentum in Q2. On a consolidated y-o-y basis, operating revenues at Rs 452.6 crore are higher by 25.5% from Rs 361.2 crore whereas EBITDA has impressively improved from Rs 60.1 crore to Rs 80.3 crore, exhibiting an increase of 110 bps from 16.6% to 17.7%. Net profit saw a 30% jump from Rs 46.3 crore to Rs 60.1 crore, translating into EPS of Rs 1.52 against Rs 1.11 on its one-rupee face value.

Again, on a cumulative basis, the company registered operating revenues of Rs 886.3 crore in the first half of the current fiscal vis-à-vis Rs 710.2 crore in the previous year. Though the net profit at Rs 120.3 crore showed an increase of 10.5%, the EBITDA margin went down from 19.4% to 17.3% (210 bps). For FY22, MPL earned a revenue of Rs 1491 crore, PAT of Rs 186.81 crore and paid 25% dividend. In its equity capital of Rs 40.42 crore, the promoter group holds a 48.60% stake.

Geographically, the UK and Europe remained in the forefront by contributing Rs 374.5 crore (42.3%) in the H1 revenue, followed by the US and North America combined at Rs 364.2 crore (41%), whereas Australia and New Zealand remained at Rs 96.5 crore (11%), keeping the rest of world at Rs 29.1 crore (5.8%). The company achieved total exports of Rs 710.2 crore out of its total operating revenue of Rs 886.3 crore in the first half, which translates to a whopping 80%, exhibiting the company’s core strength.

Commenting on the Q2/H1 results, Mark Saldanha, Managing Director of the company, said, “We saw high double-digit growth with a robust performance across all our regions, despite a tough operating environment, as we continued investing in our capabilities. Manufacturing and innovation are our strategic pillars, and we believe the acquisition of capacity from Tevapharm India will provide a further fillip to growth. We continue to navigate the challenging environment through our strong execution. Looking ahead, we continue to see growing demand in our OTC segment across regions and we are well positioned to take advantage of these opportunities.”

In a recent development, MPL has entered into a business transfer agreement with Tevapharm India to acquire its business relating to the manufacture of bulk pharmaceutical formulations located at Verna, Goa as a going concern on a slump sale basis. The transaction for cash consideration is likely to be finalized by April 1, 2023. Through this acquisition, the company eventually plans to double the existing Indian capacity from 8 billion units per annum currently. MPL has chartered to manufacture tablets, hard and soft gel capsules, ointments, gummies, etc., from the new capacity. It is a scalable capacity to manufacture oral solid dosage forms.

It is worth mentioning that Tevapharm India’s unit is located at Verna Industrial Estate, Goa. MPL already has its south Goabased manufacturing site spread over 47,597 square metres in the same area. This will benefit the company on the time, operational cost and other administrative convenience front.

Currently in India, MPL has only one manufacturing unit at Goa, whereas the two other units are at Southport (UK) and Farmingdale (US). The Goa unit has approvals from the EU, Health Canada and Japanese Health Authority.

Revealing MPL’s plans on the Tevapharm transaction, Mr Saldanha said, “I am excited to share that the acquisition has potential to significantly expand our manufacturing capacity and accelerate our core growth strategy. It will supplement our innovative product portfolio, as we plan to begin manufacturing of creams, ointments etc. in India.”

The company is ready with the pipeline of 32 products for the US and North American market, of which 20 are oral solids and 12 are ointments and creams. Within oral solids, 4 are softgel. Similarly for the UK and Europe, it has planned 34 new filings over the next three years, of which 7 are being planned in FY23. In addition, 16 products are already filed and awaiting . As regards the Australia and New Zealand market, the company is ready with 10 products in the pipeline and expects to launch them over the next two years.

The Tevapharm India acquisition is going to be a big leap for MPL towards backward integration into API manufacturing of its core molecules for captive consumption. The state-of-the-art four multi-locational manufacturing facilities (including Tevapharm) with four R&D centres in Goa, Navi Mumbai, the UK and the US, supported with a 1,400-plus manpower (including 50+ scientists), a strong portfolio of over 300 products, 76 products in the pipeline, 350-plus filed dossiers, approved ANDAs/MAs of 300, AND filed ANDAs/MAs in excess of 25 are positive indicators of MPL’s encouraging growth potential.

In order to expand its presence in the Gulf region, the company has acquired a 100% share capital of Dubai-based Access Healthcare for Medical Products LLC (AHMP) for Rs 275.41 million, having marketing authorization for various products duly approved by UAE regulatory authorities which are valid in UAE and neighbouring countries. AHMP has now become a subsidiary of MPL.

MPL has always been focusing on research and development and has successfully put forward many products at regular intervals. The company spent Rs 9.8 crore, i.e. 2.2% of the revenue, on R&D during the first six months of the current fiscal and has expressed its intent to take it to 4-5% over the next few years.

In July 2021 the company allotted 10,00,000 convertible warrants to Mr Saldanha (promoter group) and 4,93,24,324 to Orbimed Asia IV Mauritius FVCI, both at a price of Rs 74 per warrant on a preferential basis. The conversion into equity shares is to be completed within 18 months. Rs 931 million, being the 25%, is received and the balance 75% payment (Rs 2,793 million) will be received at the time of their exercising the right.

The company’s share buyback is currently ongoing. It has a mandate to buy back up to a maximum price of Rs 60 per equity share with an aggregate buyback consideration not exceeding Rs 60 crore through an open market purchase which translates into a buyback of upto a maximum of one crore shares. As per the latest BSE data, the company has bought back 62,59,584 shares so far.

Financially, the company is on a strong wicket. As of September 2022, it had outstanding working capital borrowings of Rs 39 crore whereas there are no long-term borrowings and importantly it is sitting on cash balance of Rs 335 crore during the same period. Though the acquisition value of Tevapharm India is not yet made public, it is presumed that the same will be paid out of this hefty cash balance and the remaining (if any) from the receipt from the warrant holders, i.e., ‘no fresh borrowings’. MPL has also announced a capex of Rs 200 crore over two years but it is not clear if it includes the Tevapharm India acquisition.

The one-rupee face value stock is currently being quoted at around Rs 53 with a yearly high-low of Rs 65 and Rs 38 respectively, translating into a market capitalization of Rs 2,182 crore. Evaluating the scrip from different perspectives, investors could consider buying in small lots from its current level and add further at every decline keeping a 12-18 months horizon.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives