Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Nov 15, 2022

Updated: Nov 15, 2022

Polycab India Limited (PIL), a leading electrical brand with over Rs 122 billion in revenues, is the largest manufacturer of wires and cables in India and at the same time one of the fastest growing players in the FMEG (Fast Moving Electrical Goods) space. This fortnight, we have selected this company as the Fortune Scrip as it has tremendous growth prospects going ahead.

Promoted by the Jaisinghani group almost four decades ago, the company is engaged in the manufactucture of power cables, control cables, instrumentation cables, solar cables, building wires, flexible cables, flexible/single multi-core cables and round cables, rubber cables and railway signaling cables, speciality cables and green wires in the engineering, procurement, construction (EPC) business.

The company caters to various public and private institutions across the relevant industries as well as small customers through its B2C business. It has a strong pan-India distribution network of over 4,100+ authorised dealers and distributors, which in turn cater to over 170,000 retail outlets. Business operations are managed through a corporate office, 4 regional offices and 16 local offices across the country. The company has 23 manufacturing facilities located across Gujarat, Maharashtra, Uttarakhand and the union territory of Daman. It puts strong emphasis on backward integration of its manufacturing process and R&D capabilities to adhere to various national and international quality certifications. Polycab went into the export business in the last few years, and has succeeded in entering as many as 66 countries.

In 2014, it entered the FMEG segment with the manufacture of switches and switchgears, fans, LED lights, water heaters, coolers and cloth irons, among others. Interestingly, this business has also picked up quite well.

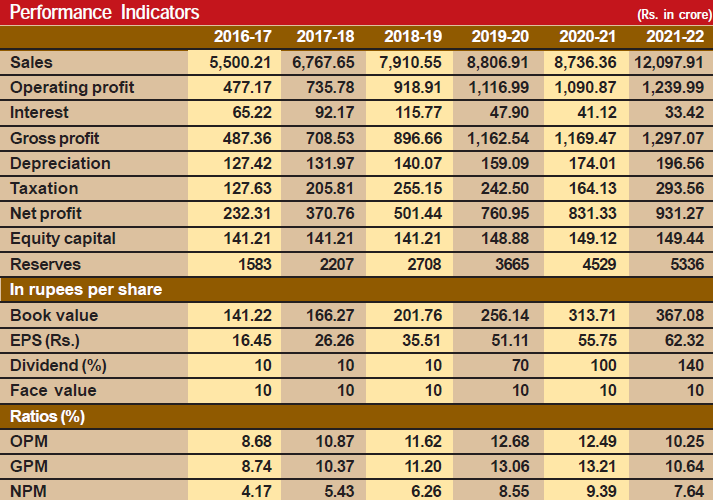

Needless to say, the company is going from strength to strength on the financial front. In 9 years, its sales turnover has more than trebled – from Rs 3,986 crore in fiscal 2014 to Rs 12,204 crore in fiscal 2022, with operating profit shooting up more than four times from Rs 299 crore to Rs 1,264 crore and the profit at net level spurting over 8 times from Rs 89 crore to Rs 766 crore during this period.

The company’s financial position is very strong, with reserves at the end of March 2022 standing at Rs 5,394 crore – over 36 times its equity capital of Rs 149 crore. The company has been continuously reducing its debt, which has come down from Rs 856 crore in fiscal 2017 to Rs 112 crore in fiscal 2022. Thus, it will be virtually a debt-free corporate entity very soon. The company has not only delivered an excellent 30.8 per cent CAGR over the last five years but its debtor days have also improved from 52.6 to 38.8 days. Though it has not made any bonus issue so far, it has been paying handsome dividends, and has been maintaining a healthy dividend payout of 17.9 per cent.

But we have not selected this company as the Fortune Scrip because of its past laurels. We are confident that the future prospects for Polycab are highly promising. Consider:

The company’s sub-brand ETIRA, which was launched in Q4 FY2022, has reported a 2X growth on a sequential basis. ETIRA caters to the economy segment and the company plans to penetrate the rural market with this brand.

Polycab is India’s largest player in the wires and cables (W&C) segment with a formidable brand presence. It is one of the fastest growing FMEG players, aiding its transformation from a B2B company to a B2C company. PIL is a market leader in the domestic wires & cables (W&C) segment with an over 12% marketshare (an 18% organized marketshare). In a forward extension to its W&C business, Polycab is also present in the EPC business, bidding for projects with ~40-60% cabling requirements.

In the wake of rapid strides made by the company so far and better prospects ahead, the share price of Polycab has more than trebled to Rs 2,700 during the last one year or so. We expect a further spurt in the coming years and will not be surprised if the price reaches even the Rs 5,000 level during the next five years if the same pace of growth is sustained going ahead.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives