Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Sep 30, 2022

Updated: Sep 30, 2022

The Indian speciality chemicals industry is passing through a golden period with not only domestic demand on the rise but overseas demand too steadily going up. The prime factor behind for this happy state of affairs is a sharp drop in supplies from China, the world’s largest manufacturer of speciality chemicals. The reasons for the drop in supplies from China are two-fold: that government’s stress on environmental protection has seen several factories shut down, while alongside the Indian government has started restricting imports from China. As a result, Indian customers who were depending on Chinese speciality chemicals have no other go but to turn to Indian manufacturers, thus pushing up the domestic demand for speciality chemicals. On the global front, with China being seen as the ‘villain of the piece’ for the worldwide spread of the coronavirus, a majority of multinationals have resorted to a ‘China+1’ policy to cut their dependence on that country. This has been a windfall for the Indian speciality chemicals industry, as Indian products are of international standards and come at competitive prices due to the low cost of production on account of cheap labour. Little wonder that Indian speciality chemicals manufacturers have started spreading their footprint overseas markets and are augmenting their production capacity.

Joining the bandwagon is Laxmi Organic Industries which focuses on two business segments – Acetyl Intermediates and Speciality Intermediates. Laxmi is a signatory to ‘Responsible Care’ – a voluntary commitment by the global chemical industry to achieve excellence in environmental health and safety. Since its inception over three decades ago, the company has maintained a constant focus on innovation, creativity and speed which have enabled it to meet new challenges and service new opportunities worldwide. Laxmi’s manufacturing facilities are located in a chemical park in Raigarh, Maharashtra – around 150 km south of Mumbai, where the company’s corporate office is situated. All its plants are state-ofthe-art and have the relevant ISO accreditations.

Starting with the manufacture of alcohol-based bulk chemicals, the company subsequently progressed up the value chain and started producing ethanol downstream while also pioneering the manufacturing of solvents in India. Due to its focus on quality and customer satisfaction, it became one of the preferred partners for pharmaceutical companies and ink manufacturers. In view of the rising demand for its products, the company has during the last decade expanded its capabilities. It also added diketine to its portfolio by acquiring the diketine division of Clariant Chemicals.

Laxmi, which initially started manufacturing acetaldehyde and acetic acid in 1992, took up the manufacturing of ethyl acetate in 1996. Its domestic marketshare is around 30 per cent. At the same time, it is the only manufacturer of diketine derivatives and has one of the largest portfolios of diketine products in the country, with a hefty 55 per cent marketshare in diketine derivatives. In 2019, the company acquired the assets, including plant and machinery design and operating paperwork, REACH registrations and patents of Miteni, a manufacturer of organic fluorospecialities and electrochemical fluorination, with a view to foraying into the fluorospeciality chemicals business. The company has also acquired the patents, 41 REACH registrations and formulations, production and maintenance data and R&D data through this acquisition.

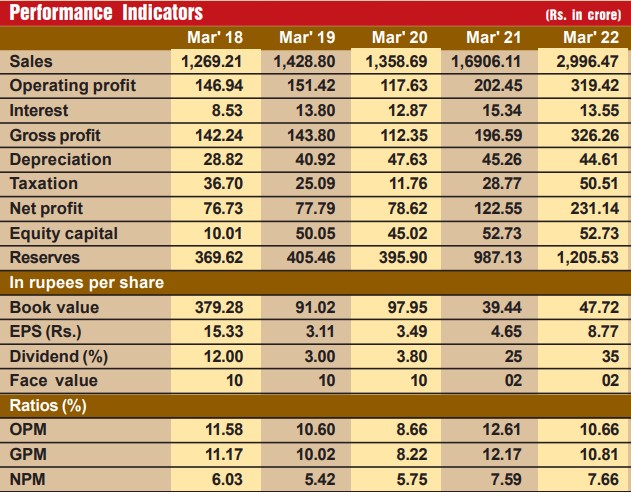

The company is going from strength to strength on the financial front. During the last eight years, its consolidated sales turnover has almost trebled from Rs 1,074 crore in fiscal 2015 to Rs 3,084 crore in fiscal 2022, with operating profit during this period spurting by over four times – from Rs 86 crore to Rs 371 crore — and the profit at net level shooting up over 10 times – from Rs 21 crore to Rs 219 crore. Laxmi’s financial position is very strong, with reserves at the end of March 2022 standing at Rs 1,248 crore – over 23 times its equity capital of Rs 53 crore. The company’s debt is on the decline, coming down from Rs 215 crore in fiscal 2018 to Rs 139 crore in fiscal 2022. If the borrowings continue to decline at this rate, the company can be a debt-free entity within the next five years.

However we have not selected Laxmi as the Fortune Scrip this fortnight on its past laurels. Future prospects for the company are all the more promising. Consider:

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives