Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Sep 30, 2022

Updated: Sep 30, 2022

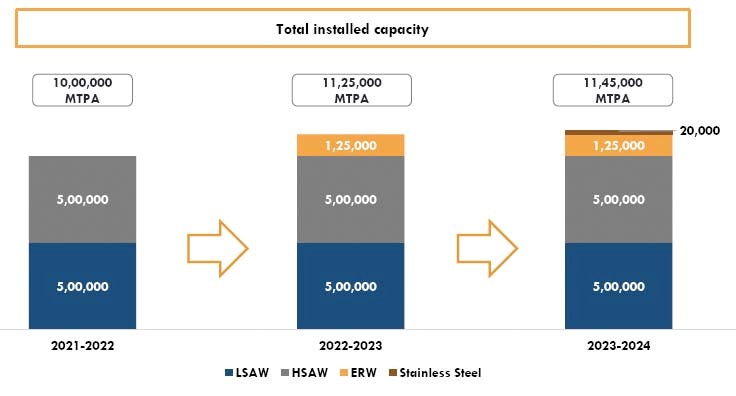

Man Industries (India), a BSE-NSE listed company, is the flagship company of the Man group and one of the largest players in LSAW pipes, spirally welded pipes and coating systems. Spread across a total of 150 acres, it has two manufacturing units with five production lines at Anjar (Gujarat) and Pithampur (Madhya Pradesh) with a combined capacity of one million mtpa. Since inception, the company has supplied 13,000+ km of pipes and enjoys the distinction of being the first Indian company to export 80-inch diameter, 18-metre long pipes with 24 mm thickness for a prestigious international project.

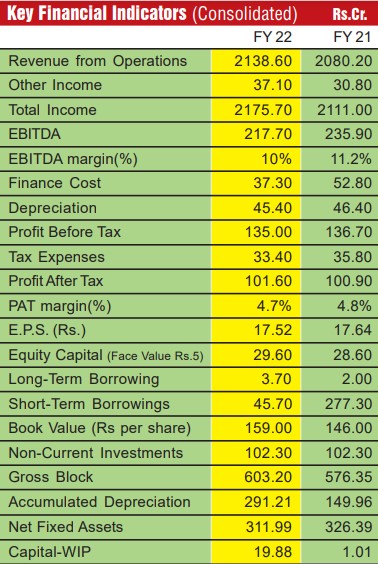

MIL reported an increase of 27.5% in its total income in the first quarter ended June 2022 at Rs 523 crore, vis-à-vis Rs 410.3 crore in the previous year during the same period. Despite this impressive revenue growth, its EBITDA, EBITDA margin and PAT registered a substantial reduction with Rs 34.6 crore against Rs 45 crore, 6.6% against 11% and Rs 9.8 crore against Rs. 19.3 crore respectively.

Commenting on this, Dr R. C. Mansukhani, Chairman, said, “The quarter has been impacted on account of higher commodity prices like polymers, crude, chemicals and the increase in cost of logistics. However, July onwards we have seen a downward trend in these commodity prices and we are hopeful that going forward our performance will improve.”

During FY22, the company achieved a consolidated total income of Rs 2,176 crore and net profit of Rs 101.6 crore against Rs 2,080 crore and Rs 100.9 crore in the previous financial year. The EBITDA margin got reduced to 10% vis-à-vis 11.2% in FY21, whereas the EPS remained at Rs 17.52 (PY Rs 17.64).

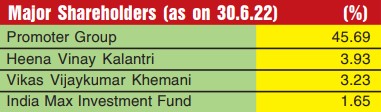

The company’s gross debtto-equity capital ratio is quite favourable at 0.06 as of Marchend, 2022. Its long-term borrowing is also negligible at Rs 3.66 crore, with working capital borrowing at Rs 45.69 crore. However, the bank balance of Rs 240 crore and the capital work-inprogress of Rs 20 crore indicate that the company is on a sound footing. The equity capital of Rs 29.60 crore and consolidated net worth Rs 942 crore translates into a book value of Rs 159 on a face value of Rs 5 per share. The promoter group holds a 45.69% equity stake. In August this year, MIL had an order book of Rs 1,000 crore to be executed over the next 5-6 months. The 90% orders are received from domestic clients. The bids book of more than Rs 17,000 crore are at various stages of evaluation for several oil, gas and water projects, both in the domestic and global markets. Interestingly, 80% bids are for exports and the rest are from domestic territory.In view of this, the company expects a good inflow of orders in the near future.

Expressing his optimism, Dr Mansukhani said, “This will help us perform even better in times to come. Our ERW steel pipes project implementation is on track and is developing well as per the revised schedule and is expected to be completed by Q4 FY23. Along with this, our plan to enter the stainless steel business has also been progressing well, as an order for major critical equipment has already been placed and work is going on in full swing.” Having realized the need to improve its EBIDTA margins, the company has decided to diversify into value-added products like connector and bends. It has started undertaking the required capex to further expand these product offerings so as to eventually become a product-based company from a project- based one.

In the management’s belief, the new product offerings like ERW pipes, steel bends and stainless steel pipes will improve the company’s EBITDA. Likewise, its technical collaboration for connectors will augur well in fetching better operating margins. MIL is aspiring to a revenue CAGR of 18%-20% on the back of better utilization of existing facilities and addition of new products. The company is also desirous to explore opportunities in the clean fuel transportation space. Explaining the rationale of strengthening MIL’s competitive position and improving margins, Dr Mansukhani said, “We are improving lead time, optimizing production, focusing on larger orders, adapting technology etc. by developing our internal capabilities.”

“In order to increase our operating

margins and competitive position, we are

improving lead time, optimizing

production, focusing on larger orders,

adapting technology etc. by developing

our internal capabilities.”

— Dr R. C. Mansukhani, Chairman

MIL has entered into a technical collaboration and knowhow agreement with Singapore-based OMS Oilfield Services Pte Ltd, through its wholly owned subsidiary, Man Offshore & Drilling Ltd, for manufacturing high-quality speciality connectors and crossovers. The manufacturing of stainless steel will be carried out by another wholly owned subsidiary, Man Stainless Steel Ltd. The project is likely to be completed by Q3/Q4 of the next financial year 2024. It is worth mentioning that market regulator SEBI vide its letter of 22.11.21 has informed the company about the appointment of a forensic auditor to investigate the accounts of the company for a period of seven years from FY 2015 till FY2021 with regard to certain transactions of the company. The scope of the audit indicates a possibility of fraud and diversion of funds. However, surprisingly, it is learnt that such sensitive matter came to the investors’ knowledge only in May 2022. On this matter, the management has clarified that all required details have been submitted and it is awaiting the final outcome of the audit. The management has also indicated that the outcome of the audit will not have a material impact on the financial statements of the company.

In another important development, the company, through its wholly owned subsidiary Marino Shelters Pvt Ltd, is developing a residential/IT/commercial real estate project at Nerul, Navi Mumbai. The company is carrying an investment amount of Rs 10,230 lakh in its consolidated accounts. However, the auditors have qualified that due to an ongoing dispute with the lender, there are indicators of potential impairment of the investments made by the company in its subsidiary. However, using the ‘DCF’ valuation method and also based on the valuation report, the management doesn’t feel the necessity of making any provision and the same are being considered good.

While clarifying further on the subject matter, the management has revealed that they have already entered into a settlement deed which has been agreed by the borrower and lender and the company has two month time for its execution, which gets over by October, 2022. The market value of the project is being estimated in the region of Rs. 160 crore against its investment book value of Rs. 102.30 crore. The company is also in the process of monetising its land parcel in Karnataka wherein it expects to realise around Rs. 40 crore.

After summarizing and evaluating various developments at MIL, one could conclude that though the company is late in implementing its value-added products and diversification projects, it certainly appears that the management has become extra cautious and is now determined to accelerate its pace of growth in light of the tremendous growth opportunities being offered by the boom in its user industries.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives