Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Apr 15, 2023

Updated: Apr 15, 2023

Hindustan Aeronautics (HAL) recently inaugurated the third production line of the TEJAS MK-1A fighter jet, which is expected to increase annual production capacity of the plane from the earlier 16 to 24. The new facility was inaugurated by Defence Secretary Giridhar Aramane.

It is important to recall that the Indian Air Force (IAF) had ordered 83 numbers of the TEJAS MK-1A in 2020, at a cost of over $5.2 billion, with delivery schedule from 2024 onwards. These were in addition to the earlier order of 40 TEJAS MK-1s. There are reports that the IAF might buy another 50 TEJAS MK-1As after the completion of the current order of 83 jets.

It is understood that HAL’s TEJAS has performed spectacularly well at the recently concluded Desert Flag-VIII exercise in the UAE on March 17, though its official confirmation is yet to be received. It is obviously a matter of great pride when we hear that an Indian-made fighter jet exceeds expectations and is appreciated by other leading world players in the field.

HAL has registered its highest-ever revenue from operations at around Rs 26,500 crore in the just concluded FY23 as against Rs 24,620 crore reported in FY22, registering a nearly 8% growth yoy. Of course, the figures for FY23 are provisional and unaudited.

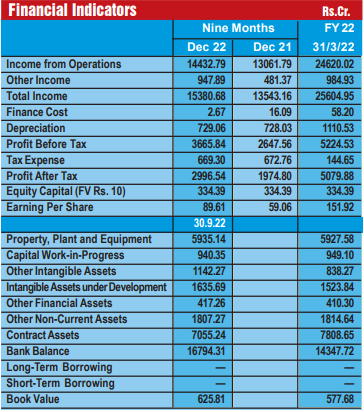

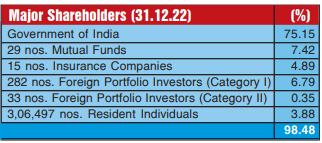

During the first three quarters (9 months) of FY23, on a consolidated basis HAL has reported a revenue of Rs 14,432.79 crore against Rs 13,061.79 crore during the same period in the previous year. The net profit has gone up at Rs 2,996.54 crore (PY Rs 1,974.80 crore) and for the full financial year 2022 it was Rs 5,079.88 crore. On a paid-up equity capital of Rs 334.39 crore, the EPS for the nine months comes to Rs 89.61 (PY Rs 59.06) and Rs 151.92 for the full FY22. The government holds a 75.15% equity stake and its consolidated book value per share as of March 2022 works out to Rs 577.68. Importantly, it’s a debt-free entity with a sizeable cash surplus, despite being in a capital intensive sector with a longer working capital cycle.

HAL’s cash flow has improved considerably during FY23, mainly on account of receipt of payment of around Rs 25,000 crore from various customers from the defence division. During the year, the company also received an income-tax refund of Rs 1,798 crore, including interest of Rs 542 crore, consequent to the favourable decision of the ITAT. With this, all the old outstanding litigation with the Income Tax department got over. Considering the improved performance and growth momentum, the company has paid an interim dividend of Rs 40 per share (400%) on the face value of Rs 10 for FY23.

Expressing his satisfaction and pleasure, CB Ananthakrishnan, Chairman & MD, said, “Despite the challenges of supply chain disruptions due to the geo-political situation, the company could achieve the targeted growth in the topline. This was possible with the increased thrust on indigenization and with the available inventory.”

Adding further, Mr Ananthakrishnan said that the order book of HAL stood at around Rs 82,000 crore at the end of March 2023 after liquidation of the supplies during FY23. During the year, fresh contracts of around Rs 26,000 crore were received which include manufacturing contracts for 70 HTT-40, 6 Do-228 aircraft and PSLV launch vehicles. In addition, on the ROH front, a fresh order to the tune of Rs 16,600 crore was received during the year.

Undoubtedly, the fortunes of this highly integrated defence giant have changed radically. However, it is also equally true that whatever has been known in the public domain about HAL so far, after the stock got listed on the bourses is just the tip of the iceberg. This jewel of the public sector has many big and valuable treasures in store, and possesses a huge intrinsic value. Moreover, under ‘Make in India’ and Atmanirbhar Bharat, the government’s policy direction is crystal clear, especially for the defence sector, and HAL is the single largest beneficiary having the potential to lead a 180-degree change in India’s defence sector landscape.

Another most important and critical factor is that the company has an unprecedented order book of Rs 82,000 crore as of March-end, 2023. Though one would find the majority of the orders from our own government, that doesn’t mean that because of its public sector status the government is emptying its coffers for the company. The fact is that HAL has marvelous capabilities evaluated from different parameters. A majority of its boxes are well ticked. The company is well-versed with new and advanced technological developments taking place around the world. It has sharpened its own R&D to the extent that in certain areas it is ahead compared to established global defence majors.

Broadly, HAL has established seven different verticals and simultaneously created a strong network of capable indigenous vendors for an uninterrupted and assured supply chain. Hence, when HAL is fully booked for the next couple of years, obviously these vendor organisations will also remain fully occupied. Many of these are from the MSME sector, and this helps in generating a lot more work down the line, unitedly contributing to employment generation, import substitution, and immense savings in cost and forex, eventually leading to supporting and strengthening the Indian economy.

It is worth highlighting that with the government’s clarity, focus, determination, motivation and policy support to the sector, HAL is now gearing up to widen and consolidate its product portfolio, including a plan to enter the commercial plane domain too. Again, it’s the government’s dream to become a self-reliant and reliable exporter of defence-aerospace equipment. HAL would be the natural and unanimous choice because it could certainly play a leadership role in this regard. Hence, though HAL is a PSU, if everything goes as planned and if it is allowed to perform, the company could be a game-changer going forward because the core domain which HAL is into has got a lot of entry barriers and needs a different kind of investment appetite, domain expertise, manufacturing capabilities with a large volume and, most importantly, access to cutting-edge technologies – all of which goe in HAL’s favour.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives