Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Apr 15, 2023

Updated: Apr 15, 2023

The unprecedented rush for speciality chemical stocks witnessed during fiscal 2021 and the early part of 2022 is suddenly over and almost all leading speciality chemical stocks have tumbled down from their unbelievable heights. The Russia-Ukraine war, widespread fears of the outbreak of recession in the US and European economies, and a spurt in prices of raw materials for speciality chemicals in their major producing centre of China on account of a sharp drop in production in the wake of government restrictions on grounds of environment protection have adversely affected demand for speciality chemicals and the profit margins of manufacturers of these chemicals. Little wonder that prices of leading Indian speciality chemical stocks fell back sharply by 40 to 50 per cent. Even the lower levels do not attract investors.

There is one stock – Vinati Organics — which plummeted from the 52-week high of Rs 2,373 to Rs 1,693 but knowledgeable investors bought the stock and the price recovered to modest ground of Rs 1,840.

After considering the prevailing situation and future prospects for the product being manufactured by Vinati Organics, we have decided to place the crown of Fortune Scrip on Vinati for this fortnight.

Mumbai-headquartered Vinati Organics is one of the fast-growing speciality chemicals and organic intermediates maker with a sustained market presence in as many as 35 countries. Today, it is the world’s largest manufacturer of IBB and ATBS. Since its inception in 1989, it has evolved from being a single-product manufacturer to an integrated business offering a wide range of products to some of the largest industrial and chemical companies across the US, Europe and Asia. The company blends innovation with chemistry to deliver value-added products to its varied clientele.

The company operates in niche segments and has an exceptional product basket with a significant marketshare in its products globally. It is the largest manufacturer of ATBS (acrylamido testiary butyl sulfonic acid) and IBB (iso butyl benzene) and enjoys a 65 per cent marketshare globally in each product. As a result, the company is able to generate a significantly higher margin profile.

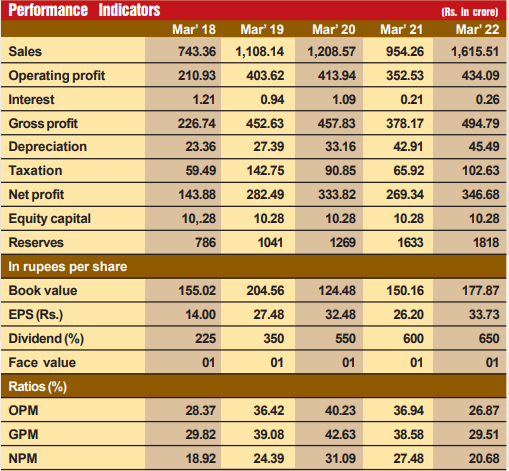

Thanks to the rising demand for its products, the company is making rapid strides on the financial front. During the last 10 years, its CAGR growth in revenue has been 10 per cent, CAGR growth in profit 20 per cent, and 49 times growth in shareholder wealth. Its financial position is very sound, with reserves at the end of March 2022 standing at Rs 1,818 crore against its tiny capital of Rs 10 crore, with its debt/equity ratio at zero per cent.

However, we have not picked Vinati as the Fortune Scrip for its past laurels. In fact, of late, market sentiment has been vitiated on account of geopolitical and global economic issues. But it is on the recovery path and its prospects going ahead are highly promising. Consider:

Remarkable synergies due to backward and forward integration, strong cash flows, a healthy balance sheet and attractive ROE and ROCE levels (about 24 per cent for a 5-year average) instill tremendous confidence among investors about the company. In the recent downturn of speciality chemical stocks, the stock price of Vinati Organics has come down from Rs 2,373 to a highly attractive level of Rs 1,830. Accumulate at the current level as well as at every decline if any. Discerning long-term investors will reap a rich harvest.

April 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives