Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Apr 15, 2023

Updated: Apr 15, 2023

Vide its board resolution of June 15, 2022, BSE-NSE listed Lloyds Metals and Energy (LMEL) allotted six crore zero interest optionally fully convertible debentures (OFCDs) to Sunflag Iron & Steel Co (Sunflag). The OFCDs got converted on March 16, 2023 with the allotment of six crore equity shares of Re 1 each of LMEL in the ratio of 1:1, representing an 11.89% equity stake in LMEL.

Since 2004, Sunflag has been entering into various understandings and contracts with LMEL to have joint control on the iron ore mine of the company in the ratio of 60% and 40% respectively. However, the said arrangements could not work. Sunflag had advanced funds to LMEL towards the operation and commencement of the mine. In 2016, LMEL started mining operations but could not share the iron ore with Sunflag in the agreed ratio for various reasons.

Sunflag then invoked the arbitration clause and won the arbitration award on April 22, 2022 wherein LMEL was made liable to pay Rs 900 crore — Rs 312 crore on account of refund of advance along with accrued interest, and the balance Rs 588 crore towards full settlement of all other claims.

The amount of Rs 900 crore being large, LMEL settled the liability by issuing 6 crore zero interest OFCDs to Sunflag, which got eventually converted into an equivalent number of shares on the basis of the agreed issue price of Rs 150 each (Re 1 face value). At the time of this announcement, LMEL’s last trading price on bourses was Rs 201.10, which is now fetching Rs 1,710 crore to Sunflag calculating LMEL’s current price of Rs 285.10, giving a hefty notional profit of Rs 810 crore.

Based in Nagpur, the Sunflag group ventured into the steel sector in 1989 with the setting up of an integrated steel plant at Bhandara, about 70 km from Nagpur. It today operates a 0.5 million tpa capacity plant manufacturing high-quality steel products, including a wide range of special alloy and stainless steels using liquid pig iron and sponge iron as basic inputs. The company has earned a good name as a reliable steel supplier to ball bearing and engine valves manufacturers.

In its quest for improved technology, the company has successfully embraced ‘Clean Steel Technology’ transferred by Daido Steel, Japan and has developed steel with high cleanliness, low gas and low inclusion content that are used in critical applications. It is worth mentioning here that Daido Steel also holds a 10% equity in the company.

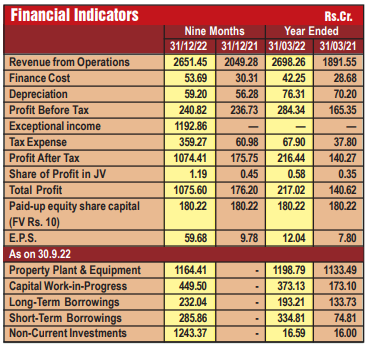

The company is in the process of expanding the capacity of its blooming mill. The capital workin-progress as at Sept 30, 2022 has been reported at Rs 449.50 crore against Rs 373.13 crore as of March 2022. It appears that the company is getting ready for cold trials.

With a vision for the future, Sunflag recently made an investment in ESR/VAR/VIM and ventured into the production of high-performance materials and super alloys for aviation, space, defence, the power sector and medical implants.

The company is actively pursuing the start of operations of its eight captive mines with respect to coal, iron ore and manganese ore. Due to procedural delays, the commencement of mining is taking a longer duration but once they become operative, with different time-frames, Sunflag will be benefited considerably in terms of an assured supply with good quality at minimal cost.

Sunflag has also been issued a letter of intent by the government of Madhya Pradesh in respect of the Bajna iron ore block for iron ore and manganese ore in Bajna village, Chhatarpur district spread over 96 hectares, for a lease period of 50 years.

Recently, Sunflag entered into long-term power delivery agreements with three solar power producer companies of Renew Green – MHH One, MHK Two and MPR Three. Further, the company has also executed share subscription and shareholders’ agreements with Renew Green Energy Solutions (the promoter) and the aforesaid three companies for developing and operating renewable energy projects and delivering the power generated from their 71.34 MW solar photovoltaic projects to Sunflag for a period of 15 years, extendable to 25 years. In this regard, Sunflag has taken a 31.2% stake in each of these three companies at a combined investment of Rs 36.16 crore.

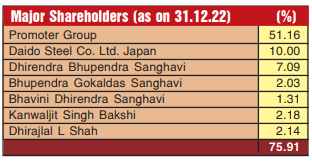

On a consolidated basis, Sunflag has achieved Rs 2,651 crore revenues from its operations during the first nine months ended December 2022 in FY23, against Rs 2,049 crore in the corresponding period of FY22. The PBT before exceptional items stood at Rs 240.82 crore vis-à-vis Rs 236.73 crore. The company has booked Rs 1,192.86 crore income as ‘exceptional items’ as of December 2022 but has not provided any details thereof. On an equity capital of Rs 180.22 crore (Rs 10 face value), the EPS for the nine months is Rs 59.68 (PY Rs 9.78), of which the major component is reflection of its one-time exceptional income.

The company enjoys a credit rating of ‘CARE A Plus stable’ for Rs 1,305.19 crore towards its long-term bank facilities and ‘CARE A Plus outlook stable’ for another Rs 500-crore long-term and short-term bank facilities, in addition to ‘CARE A Plus’ for Rs 100 crore for its proposed commercial paper. Putting everything together, the total facilities amount to Rs 1,905.19 crore, enhanced from Rs 1,205.19 crore it had earlier.

The slew of measures taken by the management and the big advantage of the arbitration award of Rs 900 crore, in addition to entering into the manufacturing of special-purpose high-grade steels, will improve its overall EBITDA margin. On the other hand, its own captive coal, iron ore and manganese ore mines coupled with long-term strategic arrangements for solar power will enable the company to control its cost of production. These developments certainly augur well for Sunflag.

Including Capital-WIP, the company has a productive fixed assets base of Rs 1,614 crore (30.9.22) and Rs 1,710 crore worth equity shares value of Lloyds Metals and Energy at its prevailing market price. Its total borrowing (LT + ST) is limited to Rs 518 crore as of September 2022. On the other hand, at its current market price of Rs 145.75, the company is being valued at Rs 2,626 crore. Hence, one can conclude that keeping a 12-18 months horizon, investors can expect decent returns on the scrip. However, when the company would monetise its LMEL holdings is equally important, as it could make it debtfree, though cash flow is also bound to improve especially upon the completion of its ongoing expansion project of Rs 450-500 crore.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives