Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Apr 30, 2023

Updated: Apr 30, 2023

Dhampur Bio Organics (DBOL), the demerged entity of Dhampur Sugar Mills with a legacy of 90 years, got separately listed on both NSE and BSE recently.

In its new avatar, DBOL has chalked out a concrete business plan to accelerate its pace of growth. It’s a leading, integrated sugarcane processing company manufacturing refined and raw sugar, bio-fuels, biomass-based renewable power and other related products.

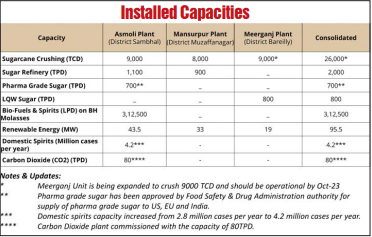

Currently, DBOL has a cumulative sugarcane crushing capacity of 22,000 TCD spread amongst its three manufacturing units, all based in Uttar Pradesh. The Meerganj unit is being expanded by 4,000 TCD to crush 9,000 TCD from the current 5000 TCD. It is expected to be operational by October 2023 and will make the company reach 26,000 TCD. The company is a leading player in pharma grade sugar with an installed capacity of 700 TPD at its Asmoli plant. It’s a well established player in this particular segment with an approval by the Food Safety & Drug Administration authority for supply of pharma grade sugar to the US, EU and India. Similarly, it has an 800 TPD capacity to manufacture LQW sugar at its Meerganj plant.

DBOL is also ahead in biofuels and spirits on BH molasses with a capacity of 3,12,500 LPD at a single location of its Asmoli plant. Interestingly, the company has created a power generating capacity of 95.5 MW put together at all three units through a renewable energy route.

In order to meet enhanced demand, DBOL has increased its domestic spirits manufacturing capacity from 2.8 million cases per year to 4.2 million cases at the Asmoli unit, where it has also recently commissioned an 80 TPD carbon dioxide plant.

During the recently concluded FY23, the company has produced 980.59 lakh BL ethanol vis-à-vis 456.03 lakh BL in the previous year and achieved sales of Rs 980.59 crore against Rs 456.03 crore of the same in the previous year. The average sales realization of ethanol has gone up by Rs 4.76/ltr to Rs 60.83 over Rs 56.07/ltr in FY22.

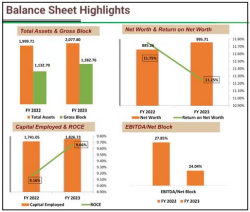

On a consolidated basis, the company has fared impressively and its total revenue has gone up to Rs 2,648.60 crore (PY Rs 1,564.09 crore) with EBIDTA of Rs 212.91 crore (PY: Rs 194.20 crore). The interest outgo has increased to Rs 40.74 crore (PY: Rs. 29.66 crore) and profit after tax to Rs 112.02 crore against Rs 104.05 crore, translating into EPS of Rs 16.87 for FY23 (PY: Rs 15.67). It is worth pointing out that despite being in a seasonal business, the Q4 EPS has remained quite high at Rs 12.08 vis-à-vis Rs 16.87 for the whole year. However, the profitability is not commensurate vis-à-vis the impressive growth registered in revenue. The company has declared a dividend of 35% on an equity capital of Rs 66.39 crore and Rs 10 face value. The book value per share comes to Rs 138.93.

The promoter group holds 50.22%, FIIs 5.34% and individual shareholders 37% as on March 2023. DBOL’s long-term borrowings have increased to Rs 246.32 crore against Rs 168.40 crore in the previous year. However, its working capital has been reduced to Rs 460 crore from Rs 645 crore in FY22 whereas the debt-equity ratio has witnessed a modest change from 0.18 times to 0.25 times. CARE Ratings has assigned an A+ rating (outook: stable) to the company for long-term and short-term facilities. DBOL repaid long-term loans of Rs 62.08 crore during FY23. As on year-end, the company has capital work-inprogress of Rs 36.17 crore.

The sugar production during the last season (Oct-Sept) has come down at home. The carried forward sugar stock was also less compared to the previous year. Moreover, in some of the largest sugar- producing countries like Cuba, production has been affected due to poor rains. Further, a diversion of sugarcane juice towards ethanol is on the increase in India.

Considering these developments, it certainly looks like the retail price of sugar, which has already started moving upwards, will continue its northward journey and in the process leading and well managed integrated sugar mills will be benefited. DBOL is one of them. The stock can be accumulated at every decline in small lots.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives