Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Apr 30, 2023

Updated: Apr 30, 2023

This fortnight, we have selected a fundamentally sound, financially strong, efficiently managed and growth-oriented company – one which has the ability to grow at a faster pace than its peers — as the Fortune Scrip. It is APL Apollo Tubes.

Formerly known as Bihar Tubes Ltd, APL Apollo Tubes is the largest producer of electric resistance welded (ERW) steel pipes and sections in India. It enjoys a 15 per cent market share in the country, which is expected to cross the 20 per cent mark within the next couple of years. The company’s products are well received in several global markets and are exported to over 20 countries. As by now it is globally recognized as one of the lowest cost producers in the world, its export prospects are all the more buoyant going ahead.

The New Delhi-NCR headquartered company has 11 plants spread across the country, with the highest number of SKUs in the range of 1,500+ and 75 registered trademarks with 16 registered product designs. Its product basket numbers over 400 as it believes that developing new and innovative products is a key driver to profitable growth.

The company thrives on innovation, which is its top priority. From products to processes to performance, innovation at APL Apollo is not a deliberate strategy but an intrinsic strength. When it entered the industry, it was about round circular pipes. As there were many large and established players, it was a herculean task for APL Apollo to compete with them. So the company thought of differentiating its position and decided to manufacture square and rectangular tubes which replaced conventional products like steel angles, channels, wooden structures and aluminium profiles. With this innovative approach, it gave a new dimension to the market. In due course, it emerged as the world’s first company to produce steel tubes from 10 mm to 1,000 mm with 0.23 mm to 40 mm thickness.

The company always strives to bring the latest technology to steel tube manufacturing in order to boost the industry as a whole in terms of efficiency and product innovation. It is a pioneer in electrical resistance welding (ERW), in-line galvanizing technology and high-speed rolling mills.

Today, steel tube manufacturing has emerged among the fastest-growing industries across the globe and APL Apollo has gone from strength to strength to lead this charge.

The company’s pillars are grounded in innovation, market creation and ESG, and its skills in these three areas are trusted by its customers and also by industry participants. As far as ESG is concerned, this strategy is embedded in its DNA in the last few years. The management believes that by imbibing these strategies, the company will remain in the forefront in achieving sustainable goals.

The company has a strong domestic distribution network, with more than 800 distributors who further sell the company’s products to 50,000 retailers and 2 million fabricators down the value chain. It has an extended distribution network of warehouses and branch offices in 39 cities across the country.

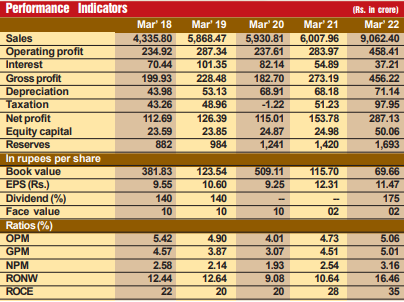

The rising demand for APL Apollos’s products at home as well as abroad has enabled it to make rapid strides on the financial front. During the last 12 years, the company’s sales turnover has shot up over 14 times – from Rs 899 crore in fiscal 2011 to Rs 13,063 crore in fiscal 2022. with operating profit surging over ten and a half times, from Rs 90 crore to Rs 946 crore, and the profit at net level to taking a high jump of over 14 times, from Rs 43 crore to Rs 619 crore. The company’s financial position is very strong, with reserves at the end of March 2022 standing at Rs 2,578 crore – over 51 times its equity capital of Rs 50 crore, that too after two bonus issues, one in 2007 in the ratio of 1:1. It is reducing its debt burden, with long-term borrowings declining from Rs 834 crore in fiscal 2020 to Rs 580 crore in fiscal 2022, which led to a reduction in interest burden from Rs 113 crore in fiscal 2019 to Rs 44 crore in fiscal 2022.

But I have not picked APL Apollo for the position of Fortune Scrip for its past laurels. Its prospects going ahead are all the more promising. Consider:

APL Apollo will rule the roost in the structural steel tube industry as it is wedded to pioneering changes to cater to an ever-evolving economy by infusing superior cutting-age technology and innovation, while applications for such tubes is on the increase. The company is all set to serve as a 'one stop shop' for a wide spectrum of steel products, catering to an array of industry plants, green houses and engineering.

Shares of the company are quoted around Rs 1,190. I will not be surprised if the price doubles in a year to Rs 2,000. This stock can emerge as a milch cow for investors with a long-term perspective.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives