Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: August 15, 2023

Updated: August 15, 2023

In a sudden — and seemingly inexplicable — turnaround, Indian IT stocks have started rising again from very recent troughs as investors ranging from FIIs to HNIs have rediscovered their yen for the infotech space. Among the prime targets of investors’ new-found infatuation with IT, Indian tech giant TCS, which was brought down from Rs 3,575 to Rs 2,926 just a few months back, has recovered to Rs 3,489 while the second biggest, Infosys, which fell from Rs 1,763 to Rs 1,185, is in happy territory again at Rs 1,426. Needless to say, market Cassandras believe the outlook for IT is still uncertain, what with continuing fears of a recession in the US and Europe.

However, taking an optimistic view, top brokerage house Kotak Institutional Equities maintains that “the situation is not as bad as it appears”, pointing out that revenues of IT companies came in above expectations in Q3 FY2023. On a philosophical note, it predicts that the worst that can happen would be a moderate downside in case of a full-blown recession in leading economies. Corporate India Research Bureau thinks that large cap stocks like TCS, Infosys, HCL Tech, Wipro and Tech Mahindra will yield excellent returns in the long run. Discerning investors should stay away from short term perspective.

Information technology stocks, which were hammered last year in the wake of widespread fears of a looming recession over the US and European economies and aggressive monetary policy measures to contain the inflationary price spiral, had dissipated the excitement around the IT space. A strong wave of pessimism had engulfed the erstwhile vibrant sector. Some companies had started laying off people. According to media reports, net hiring in leading Indian IT companies had declined to the lowest level in 12 quarters ending with the March 2023 quarter.

Needless to say, IT stocks turned friendless with their prices starting to seek lower levels. Tata Consultancy Services (TCS), the numero uno IT stock in the Indian market, nosedived from Rs 3,575 to Rs 2,926 and the number two, Infosys, moved down from Rs 1,763 to Rs 1,185, Wipro gave way from Rs 445 to Rs 352, Tech Mahindra declined from Rs 1,270 to Rs 980, LT Mindtree slipped from Rs 5,430 to Rs 3,846, HCL Technology moved down from Rs 1,203 to Rs 876 and Birla Software from Rs 380 to Rs 250.

However, suddenly the market sentiment in the IT space undewent a dramatic change. FIIs (foreign institutional investors), FPIs (foreign portfolio investors), DIIs (domestic institutional investors) and HNIs (high net worth investors) started chasing IT stocks. Needless to say, the pessimism disappeared and stock prices returned to the recovery path. TCS, which was brought down to Rs 2,926, recovered to Rs 3,489 and Infosys moved up from Rs 1,185 to Rs 1,426. Tech Mahindra moved back from Rs 980 to Rs 1,245 and Wipro from Rs 352 to Rs 416. HCL Technology staged a comeback from Rs 876 to Rs 1,151 and LT Mindtree from Rs 3,846 to Rs 5,093. Coforge, which was friendless around Rs 3,210, started attracting demand at Rs 4,926.

Now, the hot question making the rounds is whether the worst is over for the IT sector! Not surprising, since the market sentiment in the sector underwent a sudden and dramatic change! Of course, there are pessimists who believe that the outlook for the sector is still hazy. There are also strong concerns over a recession in the US and Europe. These analysts find it difficult to foresee a clear trend for the near future as, according to them, the fears of recession are not over as yet.

Insists a market expert and head of research of a brokerage house, “The immediate future for the Indian IT industry will remain rough due to the expected slowdown in its dominant clients’ segments such as BFSI and high-tech companies who are on cost-cutting drives.”

Says one analyst, “The Indian IT sector has faced the heat after the banking crisis in the US and Europe erupted.” Considering the macro-economic challenges like high inflation, rising interest rates and banking crises in the US and Europe, the situation is unlikely to improve until the end of March 2024, some analysts opine.

Points out another analyst, in the midst of such an uncertain environment, foreign portfolio investors sold their stakes in IT companies as they turned bearish on the IT and oil & gas sector in March 2023. Between these two sectors, they sold stocks worth Rs 13,734 crore.

According to pessimists, the biggest issue in the IT sector is growth slowdown and the possibility of a recession. According to them, as long as the slowdown persists and global growth remains uncertain, the market can expect a lower order flow, slower execution and pricing challenges. All these three factors will lead to IT companies’ woes and valuations may also not expand. “Investors will have to remain watchful for some time till there is some clarity on the global growth scenario,” maintains Deepak Jasani, head of retail research at HDFC Securities.

Little wonder, the IT majors’ performance during fiscal 2023, particularly in the last quarter, as well as well as the prospects for fiscal 2024, tell their own story about the industry’s ongoing struggles. For fiscal 2023, the country’s second largest IT company, Infosys, reported a growth of 15.4 per cent in constant currency terms – lower than the guidance of 16-16.5 per cent that it had given at the end of Q3 FY2023. What is more, it guided a 4-7 per cent revenue growth in fiscal 2024. This was the first time since FY2016 that Infosys had guided single-digit revenue growth in constant currency terms. The top IT company, TCS, reported an 11-quarter low constant currency revenue growth at $ 7.2 billion for Q4. The company was seeing stress in one of the largest markets – North America. Experts were not optimistic of any short-term change as the US and North America, which are among the biggest markets for the Indian IT sector, are not expected to improve in the near term.

Inspite of such a gloomy environment, the IT sector suddenly started recovering fast. Stock prices started moving up from their 2022-23 lows. Optimists were not that surprised. Maintains Kotak Institutional Equities, “We do not think the situation is as bad as it appears to be for the IT sector. Revenues of IT companies came in above expectations in Q3 FY2023, which was not expected. It was aided by an increase in pass-through revenues.”

The brokerage firm underscored the fact that IT stocks are at an interesting juncture – moderate upside if it is just a slowdown in developed economies, and moderate downside in case of a recession. The recession view for the developed markets, which was a consensus a few months ago, still holds but with reduced intensity. The brokerage house believes that a deeper recession can be offset by higher rupee depreciation and margin expansion, leading to largely unchanged EPS estimates. It expects a double-digit EPS increase for the Indian IT industry in rupee terms in fiscal year 2024, aided by 7 per cent revenue growth, margin expansion and rupee depreciation.

A research analyst opines that IT firms with a focus on niche verticals need not fear as they have a brighter outlook. Pureplay and vertically focused IT services companies in niche segments are seeing continued demand and they have an encouraging outlook going ahead. One company in the niche space is KPIT Technologies, which is a software integration partner to the automotive and mobility ecosystem. On the other hand, L&T Technology Services (LTTS) and Tata Elxsi are pureplay engineering research services companies.

During Q1FY2024, KPIT Technologies reported a 56.9 per cent year-on-year rise in profits at Rs 134.4 crore. Revenues too expanded 51 per cent. Maintains Kishor Patil, CEO and Managing Director of KPIT Technologies, with justifiable pride on his face, "Opportunities remain stronger as mobility players continue to invest in new technologies in the area of electrification, vehicle autonomy, connectivity and personalization."

Likewise, Tata Elxsi, which reported a marginal 2 per cent y-o-y increase in net profit at Rs 189 crore, remains largely optimistic on the outlook for a majority of its verticals. Maintains Manoj Raghavan, CEO of Tata Elxsi, "As we step into the second quarter (July to September 2023) of the current fiscal year, the strong deal pipeline, especially in automotive, healthcare and design businesses, provide us the confidence and foundation for accelerating our growth throughout the year."

Research analysts point out that demand for certain companies is strong because of the nature of the work. Maintains Sumit Pokharna, research analyst at Kotak Securities, "The projects undertaken by companies like KPIT technologies can't be stopped in between; hence the demand is strong."

Discussing what the future holds for the IT sector, an IT expert, Ajay Srivastava, says, "One clear thing that came out was the sectoral order book remains robust. The new acquisitions and large accounts have equally been robust, particularly for Infosys. I think they have a fair bit. What is also going to happen now is that they have got a huge benefit of the dollar-rupee depreciation - almost 12 per cent has come from that -- which might be missing next year. The growth rate for investors next year will not be 17 per cent or 14 per cent."

"I think in the next 20 to 24 months, one will have trouble making money out of it unless NASDAQ (National Association of Securities Dealers Automated Quotations) is for a different trajectory altogether, so I think it is worthwhile buying. However, I would advise to wait and watch right now for all this dust to settle. IT as a sector has been facing a crunch."

On which companies are better poised to grab those deals whenever they may emerge, Mr. Srivastava maintains that TCS ranks among the highest in terms of profitability because, when compared to all other companies, it does not have any large operating costs. Therefore, in terms of pure margins, it is matchless. It has a certain magic in that it manages its margins so well despite not having a large ESOP (employee stock ownership plan) payout like most startups and other companies.

Interestingly, hiring in India's IT sector is showing a slight revival. According to an expert report, overall IT hiring activity month-on-month for freshers reported a 6 per cent increase. Following months of slowdown in hiring activity during 2021 and 2022, the Indian IT industry is inching towards recovery, albeit slowly, as the industry saw an uptick of 3 per cent in job demand on a month-on-month basis, as per the latest report published by Talent Management Platform.

However compared to a year earlier when companies were aggressively hiring tech talent with wage hikes, bonuses and incentives amidst high attrition, IT hiring noted a dip of 14 per cent year-on-year, according to the staffing firm.

Does this indicate that the worst is over for the IT sector? ICICI Securities says 'no', adding that the Nifty IT index has lost over 20 per cent in 2021 and a further 27 per cent in 2022. According to the brokerage house, the deployment in the IT sector should be slow and gradual in nature as there would be unknown risks ahead that might further degrade valuations.

As per ICICI Securities, the macro-economic challenges have worsened of late as: (a) the International Monetary Fund trimmed the US GDP growth forecast and raised jobless estimates for the last two years; ie. 2022 and 2023, and (b) a record high energy price inflation and forex weakness persists in Europe, the UK and elsewhere.

It further notes that the impact of the macro weakness on the technology sector is visible as follows: (1) Saas players are experiencing elongation in deal cycles; (2) reduction in revenue guidance by some SaaS companies (3) weakness in verticals such as mortgage, capital markets and retail for IT services, and finally (4) slowing hiring in IT services.

However many experts feel that even if the worst is now over, it cannot be ignored that there is great growth potential in IT stocks - particularly in large cap stocks as well as companies with niche specialization. The global macro economic problems may last over a year or two. Hence, investors should buy such IT stocks with a long-term perspective.

No doubt, big tech companies in the US are facing severe challenges. But Indian companies will not be hit to that extent. In fact, analysts are highly positive about a lot of work moving to India as more organisations in the US go remote, realizing the cost efficiency of such models.

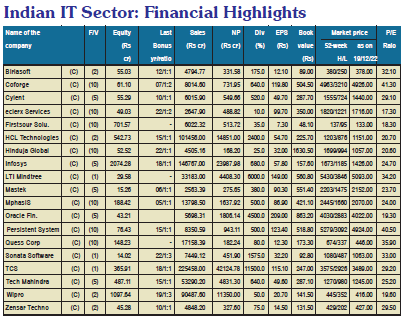

Corporate India Research Bureau suggests gradual investment in the following 10 IT stocks at every dip, of course with a long-term (say 4 to 5 years at the least) perspective.

| FACE VALUE | 01 |

| CMP | 3443.45 |

| 52 WEEK HIGH /LOW | 3575/2926 |

| FACE VALUE | 05 |

| CMP | 1389.15 |

| 52 WEEK HIGH /LOW | 1673/1215 |

| FACE VALUE | 02 |

| CMP | 418.35 |

| 52 WEEK HIGH /LOW | 445/351 |

| FACE VALUE | 02 |

| CMP | 1136.00 |

| 52 WEEK HIGH /LOW | 1203/875 |

| FACE VALUE | 05 |

| CMP | 1235.50 |

| 52 WEEK HIGH /LOW | 1271/982 |

| FACE VALUE | 10 |

| CMP | 1120.95 |

| 52 WEEK HIGH /LOW | 1185/521 |

| FACE VALUE | 10 |

| CMP | 7084.70 |

| 52 WEEK HIGH /LOW | 10760/5708 |

| FACE VALUE | 10 |

| CMP | 4826.20 |

| 52 WEEK HIGH /LOW | 5279/3091 |

| FACE VALUE | 02 |

| CMP | 4238.40 |

| 52 WEEK HIGH /LOW | 4370/3218 |

| FACE VALUE | 01 |

| CMP | 5103.30 |

| 52 WEEK HIGH /LOW | 5425/4120 |

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives