Fortune Scrip

Published: August 15, 2023

Updated: August 15, 2023

Gujarat Mineral Development Corporation

Mining success from minerals

Believe it or not, this fortnight we have selected a PSU as the Fortune Scrip. It is Ahmedabadheadquartered Gujarat Mineral Development Corporation (GMDC), one of the country’s leading mining and mineral processing companies. GMDC – India’s second largest lignite producing company — is also engaged in the exploration of bauxite, fluorspar, manganese, silica, sand, limestone, bentonite and ball clay.

Not just that, GMDC also has a sizeable presence in the energy sector. The company owns and runs a power plant, Akrimota Thermal Power Station, a 250 MW (2X125 MW) lignite-based thermal power plant located at village Nanichher in Lakhpat taluka of Kutch district.

Promoted in 1963, the company commenced its operations with a small silica sand quarry. It was followed by bauxite mines in Kutch and today it operates six bauxite mines.

In 1971, a beneficiation plant was commissioned to process 500 tonnes of fluorspar ore and to produce calcium fluoride which is used for the manufacture of hydrofluoric acid and as flux in metallurgical industries. A captive mine at Amubadungar was established to feed the plant. Lignite was discovered in Gujarat in 1976 and GMDC started its first lignite mines in Panadhro. This was followed by a captive refining plant with copper mines set up near Ambaji. In 1983, another lignite mine was discovered and started operations at Rajpardi near Bharuch. This was followed by setting up a calcination plant to add value to the bauxite mine at Gadhsisha in Kutch. In order to use the lignite mined by it, GMDC started a thermal power plant at Nani Chher in Kutch. In 2005 and 2009, more lignite mines were started at Adkeshwar near Surat and near Bhavnagar. Meanwhile, it developed a manganese ore mine at Shivrajpur in Panchmahals. It also set up an alumina plant with Raytheon Corporation of the US.

Today, the company has six lignite mines. Of these, three mines will soon reach the end of their life, but six new mines will be added and thus the company will have 9 operating lignite mines. For fiscal 2023, GMDC has produced 10 million tonnes of lignite against 8.5 million tonnes in fiscal 2022. In the case of bauxite, it is currently mining nine bauxite deposits, of which eight are in Kutch and one in Dwarika.

OUT OF THE RED

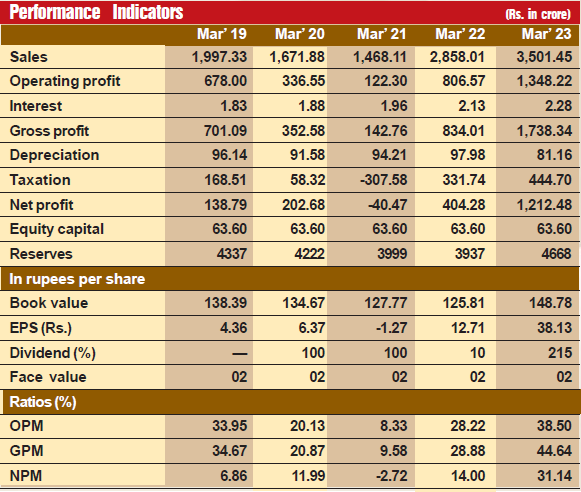

The company has made steady progress on the financial front. During the last 12 years, its sales turnover has more than doubled from Rs 1,627 crore in fiscal 2012 to Rs 3,501 crore in fiscal 2023, with operating profit advancing from Rs 760 crore to Rs 348 crore. In fiscal 2020-21, GMDC had plunged into the red but it soon come out of the trough. Now, the profit at net level has almost trebled from Rs 487 crore to Rs 1,216 crore after passing through a loss of Rs 36 crore in fiscal 2021.

GMDC’s sales CAGR during the last five years has been 11 per cent. The company’s financial position is very sound, with reserves at the end of March 2023 standing at Rs 5,735 crore – almost 90 times its equity capital of Rs 64 crore. It is totally debt-free and the interest it paid in fiscal 2023 was after issuing bonus shares in the ratio of 1:1. Since 2008, the company has been regularly paying dividends, the rate for the last year being a handsome 215 per cent.

But we have not selected this PSU for the Fortune Scrip of this fortnight on the strength of its past laurels. We are confident that future prospects for the company are all the more promising. Consider:

-

Shocked by the cash loss in fiscal 2020-21, the authorities started taking remedial steps. First, the management was changed - Gujarat Additional Chief Secretary Raj Kumar was appointed Chairman and Gujarat Commissioner of Geology and Mining Roopwant Singh was appointed Managing Director. The new top team investigated the reasons for the sudden loss - the first in the 58-year history of the company. Remedial measures were taken and the company returned to the profit path. What is more, it put up the best-ever show of its 60-year-old history in fiscal 2022-23 with record sales and earnings.

TOP CONSULTANTS

-

Having learnt a lesson from the slump of fiscal 2020-21, GMDC embarked on a major transformative exercise to place it on a robust growth path. It roped in four leading global management consulting firms - Boston Consulting Group (BCG), McKinsey, AT Kearney (AK) and Deloitte -- to suggest ways and means to achieve production diversity, increase profitability and meet its targeted objectives. BCG was asked to look into the company's transformation - from being known as a coal miner to its aspiration of becoming a diverse mineral resources player with an interest in niche as well as volume segments. McKinsey was given the task of helping it build a portfolio of Rare Earth Elements (REE). ATK was asked to help the company transform its thermal power projects and Deloitte was supposed to speed up its new lignite mining projects. The entire programme, given proper and effective implementation, is expected to change the shape and size of the company.

-

Accordingly, the management is busy planning to build on the company's capabilities in other minerals and metals, including REEs. In associated minerals, GMDC has resources in silica sand fluorspar, multi-metal and limestone which find applications across various industries like electronics, defence, laser and radar systems. At present, lignite accounts for around 90 per cent of the company's revenues. The objective is to achieve 50 per cent of its revenues from non-lignite segments.

NEW FOCUS

-

This objective is quite achievable as there are plenty of non-lignite prospects, given that Gujarat's northern district of Banaskantha has base metal deposits and GMDC holds a mining lease on about 184 hectares in the area. The company is in the process of starting a geological study of the area followed by geophysical mapping and drilling. The area is known to have base metal deposits of around 10 per cent, of which 1.5 per cent is copper, 3.5 per cent lead and the rest zinc. The management believes that this will drive the company's objective to venture into highvalue products.

-

GMDC's entry into rare earth oxide mining may prove a game-changer for the company. According to its estimates, rare earth oxide deposits in the Ambajidonger area of Chota Udaipur in Gujarat are around 3,46,000 tonnes. But in reply to a question in the Lok Sabha on February 2, 2022, the Union government state that as of January 31, 2022, rare earth oxide deposits in the Ambajidonger area are not less than 7,37,283 tonnes - almost double the earlier estimates. The government is pushing for self-reliance in rare earth production and has targeted a three-fold increase in rare earth mining capability by December 2032. The biggest advantage here is the fact that rare earth deposits are contiguous to fluorspar deposits that GMDC is currently mining. Hence, GMDC will have a major role to play in this endeavour. The Union government is reported to be thinking of allowing private sector companies to mine rare earth minerals, and GMDC may also follow suit. The company could be a beneficiary in this regard as it has a proven 11.6 million tonnes of fluorite and rare earth reserves that have a high concentration of cerium (a rare earth mineral) in the Ambajidonger area and is looking for a global partner for mining these minerals.

FLUORSPAR PUSH

-

Another area in which GMDC intends to foray is the mining of fluorspar. The company has some good fluorspar mines in Kadipani. It has already floated an RFP (request for proposal) for the PMC (project management contract) of the plant. Fluorspar finds applications in industries like steel, aluminium and welding electrodes.

-

Realising that thermal power projects have been its bane, the company management has decided to rope in Chicago-headquartered AT Kearney to transform its thermal power projects in order to achieve better efficiency and profitability. As per the consultant's advice, GMDC has devised some short-term and long-term plans. For the short term, the company has corrected its major equipment defect, like boilers and turbines as a trade auxiliary, and found improvements in PLF.

BAUXITE FOCUS

-

The company is also focusing on the marketing of bauxite. It has nine bauxite deposits - eight in Kutch and one in Dwarika. It is nursing an unsold stock of 1.1 million tonnes of bauxite and, in order to dispose of the same, has chalked out an aggressive selling policy. It has also engaged BCG to sharpen the edge of its marketing policy.

-

As far as the main product of the company, lignite, is concerned, demand for the mineral is on the rise. As GMDC is the only producer of lignite and coal prices are on the upswing, demand for lignite, especially from MSME units, is on a steady rise and the company has been striving to maintain production over the 10 million tonne level achieved in fiscal 2023. GMDC has six lignite mines with total reserves of 100 million tonnes. Of these, two mines - Umarsar and Rajpardi -- are expected to exhaust their reserves within the next 4-5 years (the average life of a lignite is 12 years). Fortunately, the company has developed six new mines with estimated reserves of 540 million tonnes. The company has appointed Deloitte for fast-tracking these new mining projects in order to maintain the annual production over 10 million tonnes. These six mines are expected to be developed within a couple of years.

Demand for lignite is expected to rise swiftly. On one side, coal prices have shot up globally in the wake of the energy crisis generated on account of the Ukraine-Russia war. On the other hand, the Indian government has reduced GST on lignite to just 5 per cent. This has made lignite highly competitive against coal. Naturally, MSME units have been switching over more and more to lignite.

WINNING BIDS

-

There is further good news for GMDC. On emerging as the highest bidder at the commercial coal block auction by the Union Ministry of Coal, the company has won two bids for Odisha's Burapahar block in Sundargarh district (reserves of 548 million tonnes) and Baitarani (west) block in Angul district (reserves of 1,152 million tonnes).

-

Elated at this development, Roopwant Singh, Managing Director, says, "This expansion helps GMDC to go beyond the geographical boundaries of Gujarat, and also helps with future planning opportunities for the development of the power sector and building the energy requirements of the country."

-

This year, on the retirement of Mr Raj Kumar, Hasmukh Adhia, former Union financial services secretary and current principal adviser to the Chief Minister of Gujarat, has been appointed as Chairman of GMDC. This is a highly positive development at a time when the company has embarked upon an ambitious diversification programme to reduce its dependence on one product - lignite.

STOCK SURGE

-

The company's drive to speed up the implementation of various projects, the rising demand for lignite in the wake of an upsurge in coal prices, and GMDC's foray into coal mining - at these augur well for the company's stock price. During the last three years the market price of GMDC has shot up by a good 317 per cent, with the share price having risen by 25 per cent in just 30 days. In view of the company's ambitious growth plan, the share price is slated to appreciate all the more in the coming days. Investors with a long-term perspective can certainly go for investing in this stock.

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access