Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: August 15, 2023

Updated: August 15, 2023

After rising for 6 quarters in a row, from 22.40 per cent as on September 30, 2021 to 25.73 per cent as on March 31, 2023, the share of domestic institutional investors (DIIs) along with retail and high net-worth individual (HNI) investors in companies listed on the NSE declined to 25.50 per cent as on June 30, 2023, as per primeinfobase.com, an initiative of the PRIME Database group.

According to Pranav Haldea, Managing Director, PRIME Database group, this was on account of profit booking by LIC and mutual funds as also retail and HNI investors with markets reaching all-time highs. Net inflows from DIIs stood at just Rs 3,368 crore during the quarter.

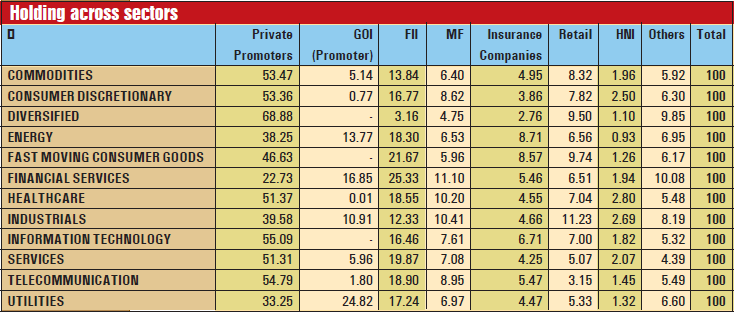

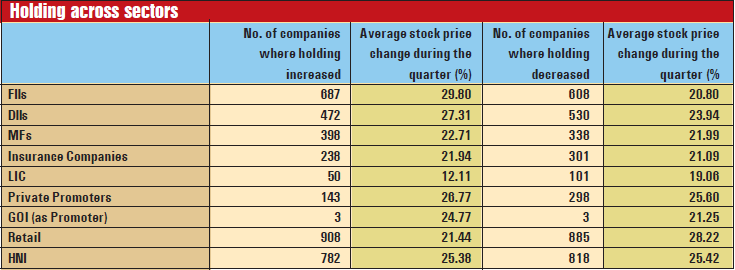

Meanwhile, net inflows from foreign institutional investors (FIIs)^ of a huge Rs 1,02,617 crore during the quarter resulted in the FIIs’ share increasing for the fourth quarter in a row to 18.94@ per cent as on June 30, 2023 (up by 7 bps from 18.87 per cent as on March 31, 2023). While FIIs pumped in a huge Rs 44,065 crore and Rs 16,818 crore in the financial services and auto sectors respectively, they pulled out Rs 9,376 crore from the Information Technology sector during the quarter.

Following from the above, the gap between FII and DII holdings widened in this quarter with the DII holding now being 15.19 per cent lower than the FII holding (on March 31, 2023, the DII holding was 13.29 per cent lower than the FII holding). The widest gap between FII and DII holdings was in the quarter ending March 31, 2015, when the DII holding was 49.82 per cent lower than the FII holding. The FII to DII ownership ratio also increased to 1.18 as on June 30, 2023, up from 1.15 as on March 31, 2023.

Meanwhile, the total share of institutional investors; viz. FIIs and DIIs combined, declined to 35.01 per cent in the quarter ending June 30, 2023, down from 35.24 in the quarter ending March 31, 2023.

The share of domestic mutual funds (MFs) declined to 8.64 per cent as on June 30, 2023, after increasing for 7 consecutive quarters, from 7.24 per cent as on June 30, 2021 to 8.74 per cent as on March 31, 2023. Net inflows by domestic MFs stood at just Rs 2,979 crore during the quarter. MFs increased their exposure to the financial services and industrial sectors while trimming down their exposure to diversified and FMCG.

The share of insurance companies as a whole also declined to 5.67 per cent as on June 30, 2023, down from 5.87 per cent as on March 31, 2023. LIC continues to command the lion’s share of investments in equities by insurance companies (at least a 68 per cent share or Rs 11.16 lakh crore). LIC’s share (across 273 companies where its holding is more than 1 per cent) also decreased to 3.85 per cent as on June 30, 2023 from 3.99 per cent as on March 31, 2023. Insurance companies increased their exposure to Energy and FMCG sectors, while trimming down their exposure to Diversified and Consumer Discretionary.

Following from the above, the share of DIIs as a whole also decreased to 16.07 per cent as on June 30, 2023 from 16.36 per cent as on March 31, 2023, after increasing for 6 quarters in a row. Among DIIs, insurance companies sold a net of Rs 15,500 crore and banks sold a net of Rs 644 crore during the quarter.

The share of retail investors (individuals with up to Rs 2 lakh shareholding in a company) remained the same at 7.49 per cent as on June 30, 2023 from one quarter back, while the share of High Net Worth Individuals (HNIs) (individuals with more than Rs 2 lakh shareholding in a company) increased to 1.94 per cent as on June 30, 2023 from 1.88 per cent on March 31, 2023, despite retail investors selling a net of Rs 25,497 crore during the quarter. As such, the combined retail and HNI share stood at 9.43 per cent as on June 30, 2023, up from 9.37 per cent as on March 31, 2023.

The share of the government (as promoter) in companies listed on the NSE increased marginally to 7.78 per cent as on June 30, 2023 from 7.75 per cent as on March 31, 2023. Over a 14-year period (since June 2009), the share of the government has been steadily declining, from 22.48 per cent as on June 30, 2009, due to the government’s divestment programme, not enough new listings and the lacklustre performance of many CPSEs relative to their private peers.

The share of private promoters in companies listed on the NSE increased to 42.17 per cent as on June 30, 2023 from 41.97 per cent on March 31, 2023. Over a 14-year period (since June 2009), the private promoter share has been steadily increasing, having increased from 33.60 per cent on June 30, 2009. While ‘Indian’ private promoters’ share has gone up from 26.44 per cent to 34.16 per cent over the last 14 years, ‘foreign’ promoters’ share has gone up from 7.16 per cent to just 8.01 per cent.

There were 12 companies in which the trinity of promoters, FIIs and DIIs all increased their stake during the quarter, these being (in descending order by market capitalisation) Relaxo Footwears, Godawari Power & Ispat, Mrs Bectors Food Specialities, HBL Power Systems, Welspun Enterprises, Jai Balaji Industries, Shakti Pumps, Mangalam Cement, Snowman Logistics, CSL Finance, Salzer Electronics and Dynemic Products.

November 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives