Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Feb 15, 2023

Updated: Feb 15, 2023

Several readers have requested us to select a small- priced stock which can emerge as the Fortune Scrip going ahead. Fundamentally strong and established companies can easily be selected as the Fortune Scrip but they are quoted at a very high price and hence the scope for a further rise is always limited, even though they are sound investment avenues. However, to select a Fortune Scrip right from the beginning is a hazardous exercise, as we found out.

After a detailed study of its present performance and future prospects, we selected IDFC First Bank. Then came the disastrous report on the budding bank in the form of the Morgan Stanley research report which describes IDFC First Bank as the most expensive overvalued bank and ridicules it for its low RoE. At the end of its analysis, the report suggests that the ideal price of the scrip will not be more than Rs 13. We were shocked and reassessed our analysis and calculations. However, we were convinced of the soundness of our analysis and went ahead with our decision to name it the Fortune Scrip for this fortnight, even as the Morgan Stanley report has become the talk of the town in investment and banking circles. The small banking company is just coming up and we strongly feel that within the next 10 years or so it will be a blue chip on the stock exchange and patient investors in the scrip will reap a rich harvest.

The bank came into existence on December 18, 2018, just four years ago. It was born out of the merger of IDFC Bank, a banking entity demerged from Infrastructure Development Finance Company, an infrastructure financing entity, and Capital First, a non-banking finance company.

IDFC was set up in 1997, while Capital First was set up in 2012 by veteran financial expert V Vaidyanathan to cater to small entrepreneurs, MSMEs and Indian consumers. The merger brought new zest to the Indian banking sector and within just 4 years IDFC First Bank got the label of an emerging Gen-X bank.

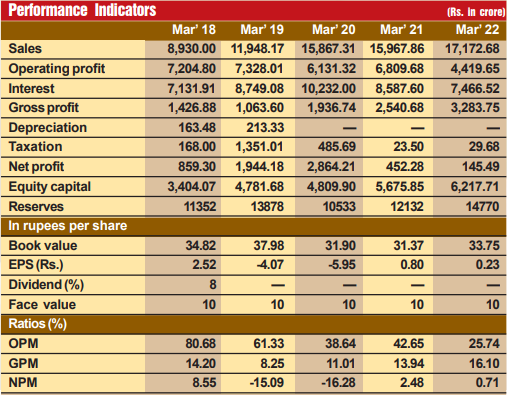

During the first four years, the banking entity exhibited its growth potential, with revenues doubling from Rs 8,930 crore in fiscal 2018 to Rs 17,153 crore in fiscal 2022 and gross profit more than doubling from Rs 1,427 crore to Rs 3,284 crore. The outbreak of the Covid-19 pandemic, however, played havoc with its net earnings, and the net profit which had shot up from Rs 859 crore in fiscal 2018 to Rs 2,864 crore in fiscal 2020 slumped to Rs 452 crore in fiscal 2021 and further to Rs 145 crore in fiscal 2022. However, the company’s financial position is steadily improving now and its reserves at the end of March 2022 stood at Rs 14,848 crore, more than double its equity of Rs 6,218 crore. Within the first four years, the company’s RoA has reached a positive 1 per cent in fiscal 2022 from the negative 4 per cent in the earlier 3 years.

This is the first universal bank in India to offer monthly interest credit on savings accounts and lifetime free credit cards with dynamic and low annual percentage rates.

Things have turned better for the bank once the impact of the pandemic started declining. In the first half of fiscal 2023, revenues amounted to Rs 10,392 crore as compared to Rs 7,632 crore grossed in the same half-year period in the previous year, with gross profit rising from Rs 1,234 crore in the first half of 2022 to Rs 2,113 crore and the profit at net level spurting from Rs 195 crore to Rs 1,030 crore. The rising trend continued in Q3 (October-December) of 2022 with revenues amounting to Rs 5,912 crore as compared to Rs 4,492 crore, gross profit moving up from Rs 770 crore to Rs 1,261 crore and net profit jumping from Rs 281 crore to Rs 605 crore.

We see remarkable growth prospects for the bank going ahead and that is why we have selected IDFC First as the Fortune Scrip for this fortnight. Consider:

Mr Vaidyanathan, the supremo of the bank, has worked a miracle of sorts with the dramatic transformation of a term-lending infrastructure financing institution into a vibrant retail bank, as had happened in the case of ICICI Bank. Within the first three years, the bank brought down its infrastructure book down from Rs 22,000 crore at the time of the merger (2018), and the management has planned to bring it down even further over the next two years or so.

At the same time, the bank has strived to boost its retail loan business by focusing on growth segments like home loans, SME loans, LAP, and rural and credit cards. Interestingly, by now the bank has succeeded in building a strong retail profile of 76 per cent. Prospects for growth in this segment are immense as the market is formalizing with more people entering the workforce. Hence, growth in this segment can be 25 per cent more as currently the book is small.

Though the share of corporate loans has come down as part of the bank’s strategy, the management endeavours to maintain this segment in proportion to its net worth. The bank has introduced facilities like cash management solutions, forex trade facilities and enhancing corporate tech since its inception. The bank has started building a loan book with a primary focus on retail assets, the share of which has almost doubled from 38 per cent (fiscal 2019) to 76 per cent by now. Research analysts at Motilal Oswal expect the total loans to clock 21 per cent CAGR during the next three years.

With a view to expanding its business, the bank is consistently increasing its footprint. By now, it has successfully served customers in 60,000 villages, cities and towns across the country by expanding its branches to 651, asset service centres to 235, ATMs to 807, and rural business correspondence centres to 602. The bank provides various facilities to customers, including quality technology-enabled corporate banking solutions, contemporary cash management solutions, fleet card and FASTag solutions and wealth management solutions. Little wonder that the company’s business is steadily growing with its consolidated revenues expanding from Rs 9,000 crore in 2018 to Rs 17,173 crore in fiscal 2022.

The bank has successfully moved towards digitisation, emerging as the first bank to introduce FASTag recharge via WhatsApp. Till December 2022, the bank has undertaken over 95 per cent digital transactions. The bank has also launched UPI123 PAY for non-interest based UPI transactions and feature phone users. It has successfully issued one million credit cards since January 2021. It has also launched UFILL for fuel prepayment through UPI. Maintains financial expert Manoj Dalmia, founderdirector of Proficient Equities, “IDFC First is one of those Indian banks that has remained focused on the online banking business. Its customized credit card idea has helped develop a loyal customer base across age groups, including millennials. What is more, its online retail lending has made a huge upside growth that signals that the bank is one of the most preferred banking stops for GenX.

As legacy issues with respect to asset quality have been dealt with, GNPA has been remarkably stable.

Reviewing the bank’s performance in Q3 of fiscal 2023, it can be said that the asset quality continued to improve as the GNPA/NNPA ratios contracted considerably. The PCR ratio was stable at 66 per cent while the corporate (non-infra) book is well provided for by PCR of 99 per cent. The trend in retail has reverted to the long-term mean of GNPA of 1.9 per cent.

Further the SMA book in retail is under control at 1.0 per cent in the last quarter and the restructuring book declined to 0.9 per cent of funded assets from 1 per cent in the Q2 FY2023. All in all, a great prognosis for the future of IDFC First.

The bank’s cost of credit is on the decline. IDFC being a development financial institution and Capital First being an NBFC, the borrowing rate for them was around 8.5 per cent. But the bank, after going retail, started offering a 5.5 per cent interest rate on saving deposits, which is certainly the best rate in the contemporary banking climate. Depositors were attracted to this rate and with tremendous public response, the bank’s CASA portfolio recorded a jump accounting for 50 per cent. The outcome? With a gradual run-down of its high-cost legacy borrowings over fiscal years 2023-2025 (Rs 22,400 crore borrowed at 8 to 9 per cent), the bank started replacing them with deposits (at 5.5 per cent). According to a banking expert, this will potentially add around Rs 800 crore to the net interest income in due course. Admits Mr Vaidyanathan, “With CASA deposits climbing up to 50 per cent, we feel very comfortable with liquidity in the bank amounting to over Rs 17,000 crore.” Going ahead, the bank is going to open 150 new branches every year. This expansion will augment the bank’s CASA deposits further.

Maintains a leading market research, “IDFC First is entering a phase of strong loan growth as the drag from the wholesale book moderates. We estimate a 27 per cent CAGR in loans during the next 3 years. The bank has scaled up retail deposits (77 per cent of loans) with a strong CASA ratio of 50 per cent. It has invested well in digital capabilities, branch and product expansion, and has a presence across retail products. We estimate a 40 per CAGR in PPOP during the next 3 years. Controlled credit costs will drive a 210 per cent CAGR in PAT over the similar period. We thus estimate RoA/RoE to reach near 15 per cent within the next 3 years or so.”

Thus, the bank is well positioned to benefit from the gradual run-down of its high cost legacy borrowings. Assuredly, IDFC First is all set to enter a phase of strong loan growth going ahead.

Little wonder that despite Morgan Stanley placing the ideal stock price for IDFC First at Rs 13, investors’ fancy has pushed up the stock price from Rs 38 to Rs 60. We feel that whatever may be the price movement in the stock in the coming few years, HDFC First will be quoted in triple figures after five years or so.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives