Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Feb 28, 2023

Updated: Feb 28, 2023

Like Humpty Dumpty in the children’s tale, Gautam Adani and his group’s fortunes have come tumbling down after a scathing report by American short seller Hindenburg Research went for the jugular, accusing the Gujarati mega tycoon’s group of brazen stock and accounting manipulation

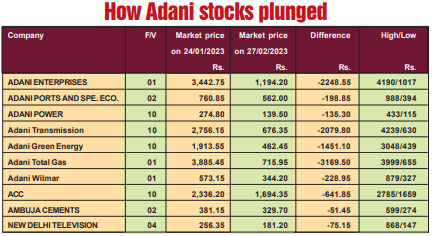

How are the mighty fallen! Till recently the world’s second richest person, Gautam Adani is now in the low double digits of the Richie Rich list after the report fired a bazooka. Even a 400-page Adani group rebuttal of the 100-page Hindenburg report could not stop the carnage as domestic and foreign investors scurried for selling cover, knocking $ 110 billion from the group’s market cap and dragging down the Indian stock market in the bargain.

Once the second wealthiest individual on the planet with a fortune of $ 147 billion, Gautam Adani had to swallow the bitter pill of seeing his personal wealth erode to ‘just’ $ 47.9 billion. What is more, Mr Adani was forced to abandon his shares sale programme designed to reduce his huge debt burden. The Adani Saga has raised five pertinent questions.....

Not only did the episode send the Indian stock market into a tailspin, Credit Suisse has stopped accepting bonds of Adani group companies as collateral for margin loans to its private banking clients. The Citigroup wealth unit too has halted margin loans on Adani securities while Dow Jones has removed Adani Enterprises from its sustainability index. The Dow Jones sustainability world index comprises the world’s top companies identified by S&P Global through a Corporate Sustainability Assessment (CSA). It includes 10 per cent of the largest companies in the S&P Global BMI based on long-term economic, environmental and social indices. Adani’s exit from the list follows negative media and stakeholder reactions triggered by the Hindenburg allegations.

Within the country, the BSE and the NSE too have placed Adani Enterprises under surveillance. The BSE-NSE step is part of an initiative to safeguard market integrity and protect investors’ interest.

In the Hindenburg aftermath, Adani group backers around the world are trying to gauge their exposure to the conglomerate. Financial institutions that have backed the group, including Citigroup, Credit Suisse and Barclays, are looking at ways to reduce their exposure to the group. Back home, the RBI is also looking into Indian banks’ exposure to the Adani group.

The Adani episode has not only rocked Parliament but also has serious political ramifications as Gautam Adani is being widely considered as close to Prime Minister Narendra Modi. In fact, well-known billionaire investor George Soros went to the extent of predicting that Mr Adani's troubles would significantly weaken Mr Modi's stranglehold on India's federal government and open the door to a "democratic revival" in the country.

Though the Indian government has slammed Mr Soros for his remarks, it is an unavoidable fact that Hindenburg Research's description of Gautam Adani as "the largest con in corporate history" has not only stunned India but its shock waves have spread throughout the globe. Ironically, while in India the reactions are muted, the analysis as well as criticism of the Adani empire is more open and detailed overseas. As wits are describing it, the erstwhile licence raj in the country has been converted into a 'Silence Raj' under the Modi-led BJP government, and the Indian media have preferred to stop being analytical and critical on the Adani episode in order to save them from the wrath of the powers-that-be. Whatever will be the conclusion of this episode is anybody's guess but it has raised five pertinent questions which need elaboration.

However, before we get to these questions, it will be useful to trace the history of the Adani empire. Gautam Adani is a first-generation entrepreneur. The Ahmedabad-based college drop-out began his career as a trader in diamonds and then in commodities, before he founded his first company to trade in commodities. He made remarkable progress but no one, including perhaps himself, would have imagined that a college drop-out turned commodity trader would one day emerge as the richest person in Asia and the third richest person in the world.

According to a knowledgeable analyst, it all started with the Gujarat communal violence which marked the most difficult period in Mr Modi's political career. There were calls for his ouster with even then Prime Minister Atal Behari Vajpayee raising questions about his conduct as Gujarat chief minister and stressing that a ruler must stick to 'raj dharma'. Even as stinging criticism came from apex industrial bodies like the Confederation of Indan Industry (CII), Mr Adani stepped in and created a rival body to effectively split CII. The splinter group spearheaded by Mr Adani sponsored the 'Vibrant Gujarat' summit and created an aura of fandom around Mr Modi and his so-called 'Gujarat model', which became the main plank for Mr Modi's 2014 Lok Sabha campaign.

Mr Adani invested with zeal in the aftermath of the communal violence and helped in transforming Mr Modi image at a time when the latter was being seen almost as a pariah. "Thus started a reciprocal and mutually convenient partnership," adds the analyst.

According to this observer, between 2002 and 2014 Mr Modi has backed Mr Adani to the hilt. The first sign was a land deal where 7,350 hectares was handed over to Mr Adani around Mundhra port at a throwaway price of one cent a square metre - far less than even the concessional rate offered to fellow-industrialists. Apart from the throwaway price, the Adani group was exempt from payment of all stamp duties for thousands of acres of land acquired for its SEZ. The group was also known to be in flagrant violation of environmental and tribal regulations. It is another matter that Mr Adani further let out the land for $ 11 per square metre -- a hundred times the acquisition price. The CAG also flagged the huge benefits given by Gujarat State Petroleum Corporation to the tune of Rs 70 crore with Mr Modi as CM controlling GSPL.

In 2012, the UPA government imposed a Rs 200 crore fine on the Adani group for destruction of the local ecology, mangroves and illegal reclamation of land for the Mundhra port and SEZ projects. The Gujarat government under Mr Modi opposed the fine, underlining that when it came to protect Mr Adani's interests, Mr Modi did not shy away from sacrificing environmental concerns. Even ahead of Mr Modi's assumption of office as Prime Minister in 2014, when he was officially declared as the BJP's PM candidate, the market price of shares of Adani Enterprises shot up by a whopping 65 per cent over a decade. The Adani group's turnover rose more than 24 times - from Rs 741 crore in 2001 to Rs 659 crore 2014.

"The widespread environmental violations were one of the first areas where pre-Modi strictures were removed. The fine levied on the Mundhra project was surreptiously withdrawn. Similarly, the Modi government removed the tribal affairs secretary to redefine forest land in order to clear the Adani coal mining project in Chhattisgarh. The arm-twisting of public sector financial institutions for securing the interests of the Adani group was evident in the MoU signed by State Bank of India for a loan of $ 1 billion for a controversial coal mining project in Australia's Queensland. The project was considered a major threat to the ecosystem of the Great Barrier Reef, and most of global banks had withdrawn support for the project, but SBI was there to support the project -- which was eventually shelved.

Following a DRI enquiry into allegations of over-valuation of capital equipment imports by the Adani group, its conclusive international report of December 2013 that an amount of Rs 2,322.75 crore had been siphoned off was given a quiet burial by the new government headed by Mr Modi.

"But perhaps the biggest complicity of the Adani group's irregularities," the analyst narrates, "were overlooked by the non-action of regulators SEBI and the Department of Company Affairs, who had looked the other way given the track record of the principal player of the Adani group. There is clear proof as to how Vinod Adani had been coordinating 38 Mauritius shell companies. Apart from this, there are other shell entities controlled by Vinod in Cyprus, the UAE, Singapore and several Carribean islands. It is clear that these entities do not have any sign of activity and have virtually no publicly stated specific service. These shells ensured stock parking/stock manipulation through Adani's private companies in order to maintain the appearance of activity, financial health and solvency."

With a runaway rise in growth, Mr Adani started believing that the sky was the limit for him and his growth. He expanded into a private infrastructure empire that operates ports, airports and coal mines across India and the world. He started buying available companies in any field and acquired two cement companies, ACC and Ambuja Cements, and logistic company Navkar Corporation's Vapi assets. He took over the erstwhile BSES - which distributes electricity in Mumbai -- from the Anil Ambani group. There was a joke in business circles that if any company in any field is on sale, the Adani group is in the list of top buyers.

Today, the Adani group has seven publicly listed companies and 578 subsidiaries, largely controlled and managed by Gautam Adani and his family. As on January 24, 2022, when the Hindenburg Research report exposed the Adani group by flagging concerns about the group's brazen stock price manipulation, blatant accounting frauds, the group's debt levels and use of tax havens, Adani group companies had a market cap of over $ 200 billion.

As regards price manipulation, Hindenburg Research said that "we found evidence that the group's 7 key listed companies have 85 per cent downside purely on a fundamental basis owing to sky-high valuations. At the same time, substantial debt puts the group on precarious financial footing." The Hindenburg report also claimed that Adani family members allegedly cooperated in the creation of offshore shell entities worth $ 4.5 billion through forged documents, primarily in tax-haven jurisdictions like Mauritius, the UAE and 14 Caribbean islands. Hindenburg noted that SEBI was still investigating a case in Mauritius in September 2022 but that no action has been taken against the group so far, while observers maintain that there is no possibility of any action in the future either.

The Adani group and the government still refuse to accept the Hindenburg findings, but not investors who have started dumping their shares with the group's market cap losing more than 50 per cent in value. Even after a month, there is no stability in the group's stocks. There are warnings that the stock prices may fall further. But no observers or even astrologers can predict what will happen to the group and its stocks, as the Prime Minister, whose name is associated with the Adani group, is totally silent over the episode.

However, let us come back to the five serious questions raised the Adani saga. They are:

(1) Hindenburg has exposed brazen stock price manipulation, maintaining that even listed companies of the group are overvalued to the extent of 85 per cent. Interestingly, in India almost all market observers have taken note of widespread kite-flying in the group stocks. However, how is that SEBI - the so-called market regulator that was established to protect the interests of investors -- is totally silent over the issue? Does SEBI protect the interests of the retail investors or the Adani group? Such disastrous episodes may adversely affect the spread of the equity cult in the country, which in due course will hit the Indian economy very hard. Why did no regulatory authority think it proper to take action against the group and curb the malpractices at the very root?

Are regulatory agencies like SEBI afraid of the powers that be? Have the agencies thought it better to save their positions instead of confronting the Adani group?

(2) As soon as the Hindenburg Research report was out, there were widespread discussIons, analyses and reactions in global newspapers. Many leading publications like The Economist and The New York Times came out with cover/lead stories on the issue. But Indian newspapers refrained from analyzing the research report and covered just the bare details. How is that Indian newspapers have not taken an alleged scam of such proportons seriously?

Are these publications just 'godi' publications and do not out to be in the bad books of the powers that be? Have they lost their independence and objectivity?

(3) All said and done, Hindenburg is a small American short seller with a total staff strength of just five. If by sitting miles away it can expose such a scam, how is that not a single research agency or market research body in India dared to investigate the unwarranted and unbelievable spurt in prices of Adani group stocks? Most research agencies have preferred not to comment on Adani stocks. Why? Are they afraid of 'punitive' action?

(4) How is that despite such a huge brouhaha in the country and abroad about the Hindenburg finding, the Government of India is keeping silent, that too at a time when the government should clearly spell out its verdict on the episode and take the necessary action. It has several regulatory institutions. For example, it can ask SEBI to investigate and examine all the allegations made in the research report. Why is SEBI not being asked to take up this job even if it has no courage to take up the investigation on its own?

The response of the Adani group to the Hindenburg Research report was overloaded with the politics of nationalism, dubbing the report an 'attack on India', arrogating to itself the description of some critics that 'Adani is India'. This reminds one of Dev Kant Barooah, a past president of the Congress during the period of the Emergency (1975-77), who had declared - "Indira is India and India is Indira". Does Mr Adani mean, when he says that Hindenburg Research's report is an attack on India, that "Adani is India", or does he equate Adani to Modi and Modi to India?

Many opposition politicians have criticized Mr Adani's recourse to nationalism. K Taraka Rama Rao, a Telangana minister, has objected to the use of nationalism and also took a shot at the close relationship between the company's billionaire founder and Prime Minister Modi. He tweeted: "Neither Pradhani (Prime Minister) nor Adani is India. Obfuscation and taking refuge under a nationalist narrative is nothing but bringing more shame to the people of this great nation."

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives