Fortune Scrip

Published: Feb 28, 2023

Updated: Feb 28, 2023

Polycab India

Aiming for bigger B2C pie - Ticking all growth boxes

At this juncture, stock markets are uncertain and volatile in nature, mainly on account of the prolonged Russia-Ukraine conflict and fears of recession in the US and European economies. This has in turn vitiated the outlook for the Indian information technology industry and adversely affected demand for dyes and chemicals from India. Domestically, there is an element of suspension over the forthcoming general elections in the wake of the bloodbath in Adani group stocks following the serious allegations of US short seller Hindenburg Research. In these circumstances, to select the Fortune Scrip for this fortnight becomes a somewhat delicate and difficult job. Hence, we have preferred a neutral space — wires and cables — and have picked Polycab India, which has tremendous growth potential.

Mumbai-headquartered Polycab is the largest manufacturer of wires and cables in India with a 20 per cent marketshare in the organized sector and an over 12 per cent share in the overall wires and cables market.

HOME APPLIANCES

Promoted by the Jaisinghani family almost four decades ago, the company in 2014 entered the FMEG – fast moving electrical goods – segment with the manufacture of switches and switchgears, fans, LED lights, water heaters, coolers and clothes irons, among others.

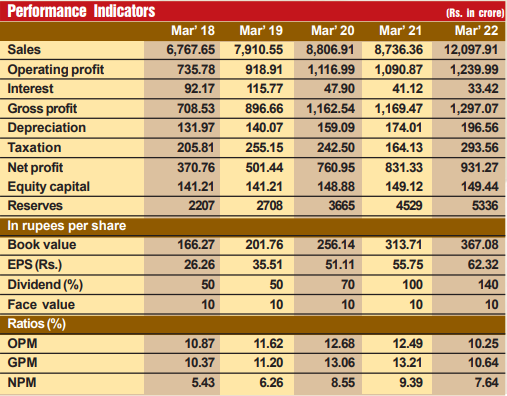

The company has been going from strength to strength on the financial front with its sales growth during the last five years being 17 per cent CAGR and the profit during this period growing at a CAGR of 31 per cent. What is more, its future prospects are all the more promising. Consider:

-

By now, the company has not only emerged as the largest manufacturer of wires and cables in the country, it has also established itself as the provider of one of the most extensive range of wires and cables in the country. The demand for the company’s wires and cables is on a steady rise.

-

Having strengthened its position in the B2B segment (cables and wires), Polycab is now focusing on enlarging its presence in the B2C (FMEG) segment. Having entered the FMEG segment in 2014, the management succeeded in growing it to 10 per cent of revenues in the last five years. During the last three years, the FMEG share has shot up to 30 per cent and then 40 per cent, and the management is confident of taking this share to 50 per cent within the next 4 years.

MOVING TO B2C

-

Thus, the company has evolved from a B2B player to a fast growing B2C brand in the consumer electrical market. Realising that in a competitive environment brand-building is a must, the company appointed actor Paresh Rawal to promote sales of house wires. As the results were highly encouraging, the company appointed another two actors – R Madhavan and Khurana — for two other products. Here too, the outcome was highly satisfactory. Needless to say, within the very first five years, the company achieved a strong brand recognition in the electrical industry. The management now expects the B2C mix to increase from the current level of 35-40 per cent to 50 per cent within a couple of years.

-

The management’s confidence is based on three drivers. The first is the strong growth potential in FMEG. This is on account of rising incomes and improved standards of living of people, especially the lower and higher middle-income groups. The rising urbanisation trend has aided this pace of growth.

-

Another growth driver is imaginative and calculated expansion of the manufacturing and distribution network. Today the company has as many as 24 manufacturing facilities (including two joint ventures) in strategic locations. These facilities are supported by 30 depots across the country. This imaginative logistics strategy has enabled the company to maintain a smooth supply position and at the same time ensure substantial cost reduction, ensuring better margins and higher realisation. Furthermore, the company has a retail outlet reach of 38,000 and 3,700 authorised dealers/distributors.

TRIPLING EFFECT

-

The rising demand for the company’s products and a steady improvement in margins are well reflected in its financial performance. During the last nine years, sales turnover has expanded from Rs 3,986 crore in fiscal 2014 to Rs 12,204 crore in fiscal 2022, with operating profit shooting up by more than four times – from Rs 299 crore to Rs 1,264 crore and the profit at net level spurting by more than 10 times – from Rs 89 crore to Rs 917 crore. The company’s financial position is very strong, with reserves at the end of March 2022 standing at Rs 5,684 crore – almost 38 times its equity capital of Rs 150 crore. The company is steadily lowering its debt burden, which has come down substantially from Rs 856 crore in fiscal 2017 to Rs 112 crore in the fiscal 2022. Taking into account cash in hand and investments (Rs 1,287 crore), Polycab is for all practical purposes a debt-free entity.

-

The company has by now emerged as the largest and most versatile manufacturer of wires and cables, enjoying a 12 per cent (overall market) to 18 per cent (organized market) marketshare. The pace of growth is expected to improve in view of the government’s emphasis on implementation of infrastructure schemes like ‘Smart Cities’, ‘Housing for All’ and ‘Electrification of All Villages’. This growth will also be propelled by Polycab’s entry into newer segments like EVs, defence and distributor-led exports. In view of the rapid strides made by the company so far and the better prospects ahead, the share price of the company has started scaling new high levels. During the last few months, the share price has more than trebled to Rs 2,330. In view of the bullish phase, the share price can move up further to even Rs 4,000/5,000. Accumulate this stock at every decline.

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access