Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Jan 15, 2023

Updated: Jan 15, 2023

Forty Indian corporates raised Rs 59,412 crore# through main board IPOs in calendar year 2022, half of the Rs 1,18,723 crore (all-time high) mobilized by 63 IPOs in 2021, according to primedatabase.com, India’s premier database on the primary capital market. According to Pranav Haldea, Managing Director, PRIME Database Group, Rs 20,557 crore, or a huge 35 per cent of the amount raised in 2022 ,was by LIC alone.

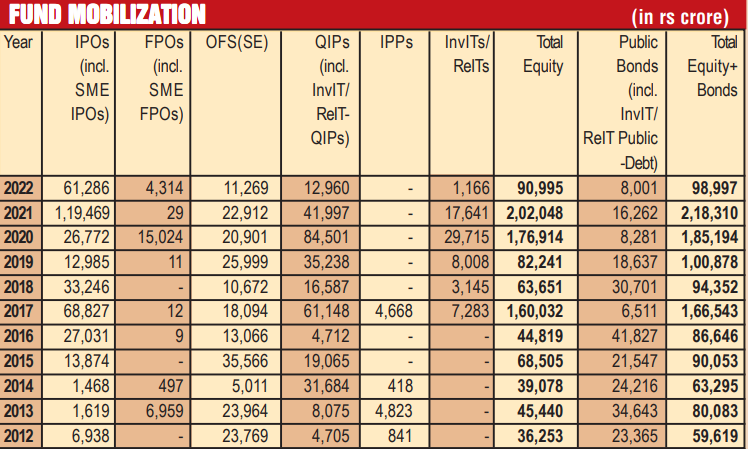

Overall public equity fundraising also dropped by 55 per cent to Rs 90,995 crore from Rs 2,02,048 crore in 2021

The largest IPO in 2022, which was also the largest Indian IPO ever, was from Life Insurance Corporation of India. This was followed by Delhivery (Rs 5,235 crore) and Adani Wilmar (Rs 3,600 crore). The average deal size was a high Rs 1,485 crore. According to Haldea, as many as 17 out of the 40 IPOs, or nearly half, came in the last 2 months of the year alone, which shows the volatile conditions prevalent through most of the year which are not conducive for IPO activity.

Only 1 out of the 40 IPOs (Delhivery) was from a new age technology company (NATC) (in comparison to 7 NATC IPOs raising in Rs 42,826 crore in 2021), pointing towards the slowdown in IPOs from this sector.

The overall response from the public, according to primedatabase.com, was moderate. Of the 38## IPOs for which data is available presently, 12 IPOs received a mega response of more than 10 times (of which 2 IPOs more than 50 times) while 7 IPOs were oversubscribed by more than 3 times. The balance 19 IPOs were oversubscribed between 1 and 3 times. The new HNI segment (Rs 2-10 lakh) saw an encouraging response with 11 IPOs receiving a response of more than 10 times from this segment.

In comparison to 2022, the response of retail investors also moderated. The average number of applications from retail dropped to just 5.92 lakh, in comparison to 14.25 lakh in 2021 and 12.77 lakh in 2020. The highest number of applications from retail were received by LIC (32.76 lakh), followed by Harsha Engineers (23.86 lakh) and Adani Wilmar (18.96 lakh).

The amount of shares applied for by retail by value (Rs 46,437 crore) was 22 per cent lower than the total IPO mobilisation (in comparison to being 42 per cent higher in 2021), showing the lower level of enthusiasm from retail during the period. The total allocation to retail, however, was Rs 16,837 crore, which was 28 per cent of the total IPO mobilisation (up from 20 per cent in 2021).

According to Haldea, the IPO response was further muted by a moderate listing performance. The average listing gain (based on the closing price on the listing date) fell to 10 per cent, in comparison to 32.19 per cent in 2021 and 43.82 per cent in 2020. Of the 38$ IPOs which have got listed thus far, 17 gave a return of over 10 per cent. DCX Systems gave a stupendous return of 49 per cent, followed Harsha Engineers and Hariom Pipe Industries (47 per cent each). 23 of the 38 IPOs are trading above the issue price (closing price of December 30, 2022).

Only 14 out of the 40 IPOs that hit the market had a prior PE/VC investor who sold shares in the IPO. Offers for sale by such PE/VC investors at Rs 7,821 crore accounted for 13 per cent of the total IPO amount. Offers for sale by private promoters at Rs 8,623 crore accounted for 15 per cent of the IPO amount while offers for sale by the government accounted for 35 per cent of the IPO amount. On the other hand, the amount of fresh capital raised in IPOs in 2022 was Rs 17,662 crore.

Anchor investors collectively subscribed to 32 per cent of the total public issue amount. Domestic Mutual Funds played a more dominant role than FPIs as anchor investors, with their subscription amounting to 15 per cent of the issue amount with FPIs at 12 per cent. Qualified Institutional Buyers (including anchor investors) as a whole subscribed to 57 per cent of the total public issue amount. FPIs, on an overall basis, as anchors and QIBs, subscribed to 21 per cent of the issue amount, again slightly lower than MFs at 22 per cent.

2022 saw 85 companies filing their offer document with SEBI for approval, in comparison to 128 last year. On the other hand, 27 companies looking to raise nearly Rs 37,000 crore let their approval lapse in 2022 and 7 companies looking to raise Rs 4,200 crore withdrew their offer document.

OUTLOOK FOR 2023 The pipeline continues to remain strong. 54 companies proposing to raise a huge Rs 84,000 crore are presently holding SEBI approval. Another 33 companies looking to raise about Rs 57,000 crore are awaiting SEBI approval (Out of these 87 companies, 8 are NATCs which are looking to raise roughly Rs 29,000 crore). According to Haldea, the momentum seen in the last 2 months of 2022 is likely to continue, at least for the smaller sized IPOs. However, it may be a while before we see larger sized deals, especially in light of lack of sustained interest from FPIs.

Activity in this segment saw a huge increase in calendar year 2022 with 109 SME IPOs collecting a total of Rs 1,874* crore in comparison to 59 IPOs in 2021 which collected Rs 746 crore. The largest SME IPO was of Rachana Infrastructure (Rs 72 crore). One company (DJ Mediaprint & Logistics) also mobilized Rs 14 crore through an SME FPO.

According to primedatabase.com, Offers for Sale through Stock Exchanges (OFS), which is for dilution of promoters’ holdings, also saw a huge decrease, from Rs 22,912 crore raised in calendar year 2021 to just Rs 11,269^ crore raised in 2022. Of this, the Government’s divestment accounted for Rs 9,646 crore or 86 per cent of the overall amount. The largest OFS was that of Axis Bank (Rs 3,876 crore). OFS accounted for 12 per cent of the year’s public equity markets mobilization.

FPOs made a comeback with Ruchi Soya Industries mobilizing Rs 4,300 crore. According to Haldea, this is just the second FPO in the last 8 years (since 2015) which shows how FPOs have fallen out of favour in comparison to other follow on fund raising routes.

14 companies mobilized Rs 11,743 crore through QIPs during calendar year 2022. This was 72 per cent lower than Rs 41,997 crore raised in 2021. The largest QIP of 2022 was from Macrotech Developers raising Rs 3,547 crore, accounting for 30 per cent of the total QIP amount. QIPs were dominated by real estate, hotels, resorts, restaurants & tourism, and financial services companies with them accounting for 88 per cent (Rs 10,289 crore) of the overall amount. In addition, there was one QIP of an Infrastructure Investment Trust (InvIT) of National Highways Infra Trust of Rs 1,216 crore.

The amount raised through InvITs and ReITs saw a huge decrease of 93 per cent to just Rs 1,166 crore from Rs 17,641 crore in 2021.

Of the total equity mobilisation of Rs 90,995 crore, fresh capital amount was Rs 34,259 crore (38 per cent), the remaining Rs 56,736 crore being offers for sale.

Divestment in calendar year 2022 was dominated by the mega IPO of LIC which contributed Rs 20,557 crore of the total divestment amount of Rs 31,606 crore (65 per cent) raised by the Government.

Public Offers (IPOs of LIC, Paradeep Phosphates and OFS of Axis Bank (SUUTI, IRCTC and ONGC) at Rs 30,675 crore (97 per cent) were the most used mode followed by Buyback (GAIL and MOIL) at Rs 931 crore (3 per cent).

Rights Issues: Mobilisation of resources through rights issues, according to primedatabase.com, stood at just Rs 4,053 crore in calendar year 2022, which was 85 per cent lower than Rs 27,771 crore that was raised in 2021. The largest rights Issue of 2022 was from Suzlon Energy raising Rs 1,200 crore, accounting for a huge 30 per cent of the total rights issues amount. By number, the year witnessed 10 companies using the rights route in comparison to 11 companies in 2021. In addition, there was one rights issue of an InvIT (Data Infrastructure Trust of Rs 317 crore).

Public Bonds: Public bonds market also saw a huge decrease of 58 per cent with 29 issues raising Rs 6,501 crore^^ in comparison to 27 issues raising Rs 15,262 crore last year. The largest issue was from Creditaccess Grameen raising Rs 500 crore. In addition, there was one Public Debt issue of an InvIT (National Highways Infra Trust of Rs 1,500 crore).

Debt Private Placements: The amount raised through debt private placement in calendar year 2022 stood at Rs 7,23,957 crore (as on December 26, 2022), up 11 per cent from Rs 6,50,358 crore in 2021. This was mobilised by 806 institutions and corporates. The highest mobilisation through debt private placements was by HDFC (Rs 62,415 crore) followed by SIDBI (Rs 38,555 crore) and NABARD (Rs 36,166 crore). In addition, there were 10 debt private placements from InvITs/ReITs raising Rs 4,900 crore.

Overseas Bonds: Indian companies also raised Rs 2,52,441 crore through overseas borrowing (including ECBs@), down 36 per cent from Rs 3,94,809 crore in 2021.

At an overall level, fund raising by Indian corporates, through equity and debt, in India and abroad, covering IPOs, FPOs, OFS (SE), Rights, QIP, InvITs/ReITs, preferential issues, Public Debt, Debt Private Placement, Overseas Bonds, ECB and FCCB, dropped by 15 per cent to Rs 11.55 lakh crore in calendar year 2022 from Rs 13.58 lakh crore in 2021.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives