Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: July 15, 2023

Updated: July 15, 2023

Among the companies belonging to the illustrious House of Tatas, there is one which has tremendous potential to emerge as a multi-bagger and is available in the market at a very attractive price. It is Tata Power — India’s largest integrated power company. This fortnight, we have selected it as our Fortune Scrip.

Over a century old, the company is a pioneer in technology and innovation, with many first to its credit. It has a total electricity generation capacity of 14110 MW, of which 37 per cent comes from clean energy sources. This integrated power company has the distinction of being among the top private sector ones with a presence in all segments of the power sector — fuel and logistics, generation (thermal, hydro, solar and wind) transmission, distribution and trading of power.

The company has spread its footprint overseas too. It has made strategic investments in Indonesia through a 30 per cent stake in coal trading company PT Kaltim Energy Resources, so as to secure coal supplies and the shipping of coal for its thermal power generation operations. Tata Power has invested in South Africa through a joint venture called ‘Cennergy’ to develop projects in South Africa, Botswana and Namibia. In Australia, it has made an investment in clean coal technologies, while in Bhutan it has invested through a hydro project in partnership with the government of Bhutan.

Tata Power is seen as an energy pioneer in terms of technology, process and platform. The company’s latest business integrated solutions, focusing on mobility and lifestyle, are poised for multi-fold growth. Since its inception in 1915, it has under its belt over a century of expertise in technology, leadership, project execution excellence, world-class safety processes and customer care, and driving green initiatives. In fact, the company is committed to lighting up lives for generations to come.

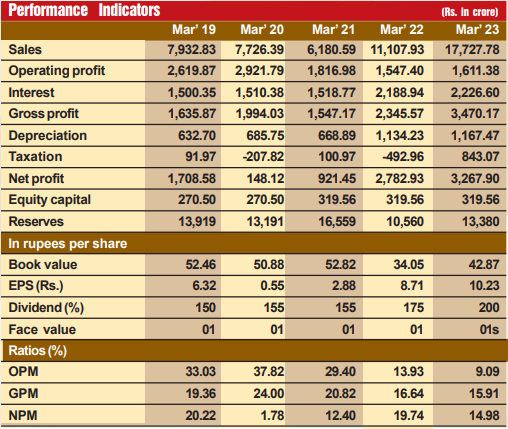

The company has made rapid strides on the financial front too. During the last 12 years, its sales turnover has more than doubled from Rs 26,069 crore in fiscal 2012 to Rs 55,109 crore in fiscal 2023, with operating profit inching up from Rs 4,884 crore to Rs 7,728 crore. Better still, its net profit was Rs 3,810 crore in FY2022, in striking contrast to a net loss of Rs 898 crore. The company’s financial position is also very strong, with reserves at the end of March 2023 standing at Rs 28,468 crore – over 88 times its equity capital of Rs 320 crore, that too after a 1:5 bonus issue in 1975.

But we have not selected Tata Power for its past laurels. We strongly feel that future prospects for the company are highly promising and the stock, which is available at Rs 220 a piece, will emerge as a multi-bagger within a period of 5 to 10 years. Consider:

At the same time, the company has decided to divest its non-core assets. It has already sold its 30 per cent stake in the Indonesian coal company. Now, it aims to sell its assets in Zambia and Georgia. Again, as the company's performance is steadily improving, it has a better cash flow and this will enable it to address its debt from its profits. All these exercises will make Tata Power's balance sheet healthy.

The company's shares are available at an attractive price level of Rs 221. Discerning investors should accumulate the stock with a long-term perspective. The stock is bound to emerge as a multibagger in due course.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives