Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: June 15, 2023

Updated: June 15, 2023

No more a subject of scientific speculation, Artificial Intelligence is new, well and truly in our midst as a technology with a mind-boggling variety of functions and uses, with serious implications that are positive or negative for humankind.

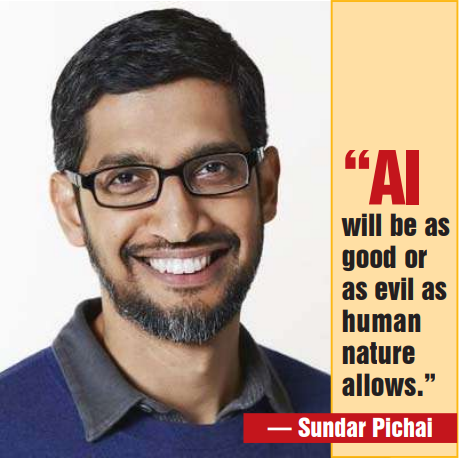

As observers, among them Google’s Sunder Pichai, see it, AI has the potential to revolutionise the way we work, as in developing medical breakthroughs, automating repetitive tasks and making motor vehicles much more efficient.

But the corresponding disadvantages are that it can result in job losses, particularly in manufacturing and service industries. Its potential for surveillance can also impinge on people’s privacy and civil liberties, and its use in weapons systems can give a fillip to a renewed global arms race.

What is more, the costs incurred in using and maintaining AI-based equipment could be huge. Not least, the resultant dependency on machines could humankind’s penchant for deep thinking and creativity.

Artificial Intelligence, a truly revolutionary feat of computer science, has emerged as one of the fastest growing technologies with a wide range of possibilities, from playing our favourite music to assisting in complex surgeries. However, some experts have started raising red flags against the new technology, fearing a major threat to humankind. The question being discussed today is whether artificial intelligence is a boon or a bane.

Of course, this new technology has made the lives of humans easier by offering solutions for various problems. What is more, it is all set to become a core component of all modern software over the coming years and decades. AI will be deployed to augment both defensive and offensive cyber operations. Additionally, new means of cyber attack will be invented to take advantage of the particular weaknesses of AI technology. Again, the importance of data will be amplified, redefining how we must think about data protection.

Hitherto, human civilization was transformed by fire, agriculture and electricity. Now, in 2023, we learn that a machine can teach itself to speak to humans like a peer, which is to say, with creativity, truth, errors and lies. The technology, known as a chat bot, is only one of the recent breakthroughs in AI — machines that can teach themselves superhuman skills.

The approach of Google, a leader in this new world, is interesting. While many experts warn that AI is a threat to humans, Sunder Pichai, Google CEO, says, “AI will be as good or as evil as human nature allows.”

The revolution is coming faster than one can presume. Says one expert, “Artificial Intelligence has been one of the most talked-about and debated topics of the 21st century. It has been hailed as a revolutionary technology that could change the way we live, work and play. But at the same time, it has also been criticized for its potential to displace workers, created a surveillance state and even lead to the extinction of humanity. The question posed is: Is AI a boon or a bane?”

Maintains Ms Rashmi Karan, a research analyst, “On the one hand, AI has the potential to revolutionise industries and provide solutions to some of the world’s most pressing problems. For example, AI can be used to develop medical breakthroughs, automate mundane tasks, even make cars and other vehicles safer and more efficient. AI can also help us understand the world better so we can take more informed decisions.”

On the other hand, AI also has its downsides. For example, it can be used to automate processes that could result in job losses, particularly in manufacturing and service industries. AI can also be used for surveillance, which could lead to a loss of privacy and civil liberties. Finally, AI could be used to create autonomous weapons systems which could lead to a dangerous arms race.

Again, AI is a very costly technology. Huge costs are incurred in the process and the machines are very complex and complicated in their training. What is more, these machines require regular maintenance at a particular point of time, thus resulting in bigger costs. Besides replacing human jobs and creating unemployment (which would be a highly dangerous phenomenon in a populous country like India), AI will make us more dependent on machines, leading to a major loss in the ability to think, and a danger to creativity and ideas.

Pointing out that AI raises a lot of questions and has its danger too in the legal world. Apoorva Mehta, an expert on AI, raises the issue of civil or criminal liability for wrongdoing. On the flip side, he notes, “However, what we are forgetting is that AI can be of greater help and will ease our various processes. AI can turn over the tiring process of reading bulky documents, and logistics can be taken care off — like preparing case files or summarizing judgements. AI’s way of functioning provides a unique opportunity to explore new fields of law. Every time a new system replaces the old one, it brings a new set of jobs and opportunities with itself. Inclusion of AI will bring in new theories of jurisprudence to work with. It will open a scope for new fields of law. Considering the legal ramifications of AI, it is little wonder that the Indian judiciary has already taken steps to include AI software and digitalize the system. Moreover, its inclusion can help getting insights into the legal profession within seconds, reducing significant man hours and leading to greater profitability of firms and companies. Natural language processing-based applications can be a great boon to the legal fraternity.”

In short, AI is good at detail-oriented jobs. It reduces the time needed for data-heavy tasks, saves labour and increases productivity. It also delivers consistent results.

Following up on his view that 'AI will be as good or as evil as human nature allows', Mr Pichai notes that it can spread a lot of disinformation. It will be possible with AI to create a video easily, where it could be 'A' saying something or 'B' saying something, while in reality 'A' or 'B' had never said that. Worse, it could look accurate and hence on a societal scale can cause a lot of harm. But the most serious AI issue is called 'emergent properties'. Some AI systems are teaching themselves skills they were not expected to have. How this happens is not well understood. For example, one Google AI programme adapted on its own after it was prompted in the language of Bangladesh, which it was not trained to translate.

Despite its limitations, AI is an extraordinary revolutionary feat of computer science. One IT expert considers it the most important invention that humanity will ever make. Maintains Mr Pichai, "If we take a 10-year outlook, it is so clear to me that we will have some form of very capable intelligence that can do amazing things. And we need to adapt as a society for it. Society must quickly adapt to it with certain regulations for AI in the economy, laws to punish abuse, and treaties among nations regarding AI."

According to Mr Pichai, we should develop AI systems that are aligned to human values, including morality. "I think the development of AI needs to include not just engineers but also social scientists, atheists, philosophers and so on. And I think we have to be very thoughtful and think these are all things that society needs to figure out as we move along," he notes.

Little wonder that Europe has drafted a law to regulate Artificial Intelligence (see box with this story) and even India is drafting the Digital India Act (read editorial).

Though having woken up late, India has made rapid strides in the space of Artificial Intelligence. In response to the enormous demand for digital goods, several Indian businesses have developed the most cutting-edge AI solutions across numerous industries, including health, finance and education. India brings pure expert knowledge and expandability of solutions to AI's execution as a nation that swiftly transitioned from paper-based to digital modes during the three-year Covid-19 pandemic. In India, data is as plentiful as people. AI initiatives have seen increasing penetration due to this as well as digital readiness, whether for modular UPI transactions or centralized data storage in the DigiLocker. The horizontal application of technology all over industries for intelligent automation, quicker turnaround, conflict resolution and more is another aspect of AI's Indian 'secret sauce'.

There are several companies operating in this space but we have selected here 10 companies among the top players. Many of them are listed on stock exchanges and some of them are excellent buys worth including in the portfolio of every discerning investor. Here goes the list:

| FACE VALUE | 10 |

| CMP | 7780.00 |

| 52 WEEK HIGH /LOW | 10760/5708 |

Tata Elxsi, belonging to the illustrious business house of the Tatas, is a company that offers design and technology assistance for system integration and support, and software development. These services are the two divisions in which the company operates.

The company's system integration and support segment is involved in the implementation and integration of broadcast, virtual reality, storage and disaster recovery as well as professional services for maintenance and support of infrastructure technology infrastructure in India and abroad.

The company's software development and services segment provides technology consulting, new product design, development and testing services, consumer insights and strategy, visual design and branding, product and packaging design, user experience design, service experience design, transportation design, high-end content and three-dimensional animation services.

In short, the over three decade-old Elxsi operates in two core segments - software, which contributes 88 per cent of revenues -- and systems integration -- which accounts for the balance 12 per cent. In the software vertical, 77 per cent of the revenues are derived from embedded revenues and the balance is derived from Visual Computing Labs (VCL). The company employs 10,000 people and derives approximately equal revenues from the US, Europe and Asia.

Tata Elxsi has made rapid strides on the financial front. During the last 12 years, its sales turnover has skyrocketed fro Rs 514 crore in fiscal 2012 to Rs 23,962 crore in fiscal 2023.

Prospects for the company going ahead are all the more promising as it is driving into an exciting future. The automotive and broadcast segments are set for exponential growth and Tata Elxsi is a top AI company in these fields. Global R&D spends by auto components stand at $ 120 billion annually, of which the outsourcing in India is just 0.4 per cent, indicating immense growth potential. Again, software, which comprised 2 per cent of the total value of a vehicle in 2000, now comprises 20 per cent of the total value and is expected to go up further.

Similarly, strong growth is also expected in the broadcast segment, led by investments by operators in developing newer services and features. Automotive and broadcast together account for 75 per cent of Tata Elxsi's EPD revenues and have been growth drivers. The company's financial position is very strong, with reserves at the end of March 2023 standing at Rs 2,028 crore - over 14 times its equity capital of Rs 62 crore, that too after a 1:1 bonus issue which is quoted at Rs 7,777.

| FACE VALUE | 10 |

| CMP | 19131.05 |

| 52 WEEK HIGH /LOW | 19855/13166 |

Bosch Ltd offers goods and services in the fields of consumer goods, industrial technology, mobility solutions, energy, and building technology.

Segments in which the company operates include automobiles, consumer goods, diesel systems, gasoline systems, and automotive aftermarket goods and services. In addition, some of the main offerings of the company include power tools, building technology, and fuel injection equipment and components. The company creates hardware, software and service-based smart mobility solutions. Cooking and baking units, washers and dryers, dishwashers, refrigerators and freezers are all included in its product category for home appliances.

The company also provides goods and services for businesses and trades such as drive and control technology, energy and building solutions, engineering and business solutions, professional power tools, security solutions and software solutions.

Bosch is steadily growing on the financial front. During the last 13 years, its sales turnover has expanded from Rs 8,166 crore in fiscal 2011 to Rs 14,929 crore in fiscal 2023, with operating profit inching up from Rs 1,342 crore to Rs 1,807 crore and the net profit improving from Rs 1,123 crore to Rs 1,424 crore. The company's financial position is very sound, with reserves at the end of March 2023 standing at Rs 10,983 crore - almost 367 times its equity capital of Rs 30 crore, that too after as many as four bonus issues in the ratio of 1:1 in 1973 as well as in 1986, and in the ratio of 1:2 in 1976 as well as in 1982. The company pays handsome dividends, the rate for the last year being as high as 2,800 per cent. Shares of the face value of Rs 10 are quoted at Rs 19,077. Despite the high price, the stock is worth buying.

| FACE VALUE | 02 |

| CMP | 916.20 |

| 52 WEEK HIGH /LOW | 1137/763 |

Happiest Minds Technologies , the Bangalore-headquartered company with operations in the UK, the USA, Canada, Australia and the Middle East is a 'mindful' IT company which enables digital transformation for enterprises and technology providers by delivering seamless customer experiences, business efficiency and actionable insights. This is being done by leveraging a spectrum of disruptive technologies such as artificial intelligence, blockchain, cloud, digital process automation, internet of things, robotics/ drones, security and virtual/augmented reality. Positioned as 'Born Digital, Born Agile', the company has capabilities which span digital solutions, infrastructure, product engineering and security. It delivers these services across industry sectors including automotive, BFSI, consumer packaged goods, e-commerce, edutech, engineering R&D, hi-tech, manufacturing, retail and travel/transportation/hospitality.

The company's segments include Infrastructure Management & Security Services (IMSS), Digital Business Solutions (DBS), and Product Engineering Services.

IMSS offers managed security services and ongoing support for technology firms and mid-sized businesses. It also provides solutions for a wide range of digital technologies, including security, cloud computing, business process management (BPM), big data and advanced analytics, robotic process automation (RPA) and software-defined networking/network function virtualization (SN/NFV).

Happiest Minds has gone from strength to strength on in its financial performance. During the last 12 years, its sales turnover has shot up from Rs 8 crore in fiscal 2012 to Rs 1,333 crore in fiscal 2023, with operating profit shooting up from a negative Rs 29 crore (loss) to a bumper profit of Rs 321 crore and the profit at net level surging to Rs 216 crore in 2023 in striking contrast to a loss of Rs 29 crore. The company's financial position is improving, with reserves at the end of March 2023 standing at Rs 797 crore against its equity capital of Rs 29 crore. The company pays hefty dividends, the rate for the last year being 170 per cent.

Shares of the face value of Rs 2 are quoted around Rs 915. There are very good chances for further appreciation in the long run.

| FACE VALUE | 02 |

| CMP | 389.75 |

| 52 WEEK HIGH /LOW | 412/202 |

Pune-headquartered Zensar Technologies is a leading technology solutions company with a strong engineering pedigree. The company, part of the $ 4.8 billion RPG Enterprises group, after establishing its 'go to market' strategy in 2016-17, has now placed its bets on artificial intelligence as the company is moving from being a 'living digital' to a living AI organization.

The company's AI strategy is focused on three pillars -- experience, research and decision-making. The latest strategy is an evolution of the firm's 'return on digital NeXT' strategy that was adopted about a year ago, focusing on new and exponential technologies (NeXT) within AI, natural language processing, block chain, internet of things and human experience.

The push for AI comes from a belief that this technology is at a point where digital technologies were a few years ago. No one expected digital to disrupt business as fast as it did, and this is what Zensar management expects will happen with AI.

Custom application management services, which span a variety of technical and commercial verticals, are included in the DAS segment. These services include application development, maintenance, support, modernization, and testing.

The company is doing very well in its financial performance. During the last 12 years, its sales turnover has expanded more than two and a half times - from Rs 1,794 crore in fiscal 2012 to Rs 4,848 crore in fiscal 2023, with operating profit going up from Rs 249 crore to Rs 552 crore and the net profit more than doubling from Rs 159 crore to Rs 328 crore. The company's financial position is very strong, with reserves at the end of March 2023 standing at Rs 2,931 crore - over 55 times its equity capital of Rs 45 crore - that too after a 1:1 bonus issue in 2010. The company is paying handsome dividends, the rate for the last year being 175 per cent.

Shares of the face value of Rs 2 are quoted around Rs 390. There is good chance for further appreciation going ahead.

| FACE VALUE | 10 |

| CMP | 4924.15 |

| 52 WEEK HIGH /LOW | 5279/3091 |

Pune-headquartered Persistent Systems is a trusted digital engineering and enterprise modernization partner which operates in the software and technology services industries. The company offers various services, including data and analytics, intelligent automation, cloud and infrastructure, client experiences (CX) transformation, and data and product engineering.

The company provides services to several sectors, including banking, financial services, insurance, healthcare, life sciences, industrial, software, high-tech, telecom and media. Aepona Group Limited (AGL), Aepona Imported, Youperience GmbH (YGmbH), and Youperience Limited are some of the company's subsidiaries.

With one billion dollars in annual revenue, Persistent continuously expand relationships with AWS to adopt Amazon Code Whisperer. It unleashes the power of generative artificial intelligence to securely harness enterprise data for growth and transformation.

Persistent is going great guns in its financial performance. During the last 12 years, its sales turnover has expanded more than eight times - from Rs 1,000 crore in fiscal 2012 to Rs 8,351 crore in fiscal 2023, with operating profit spurting by around seven times from Rs 224 crore to Rs 1,519 crore and the profit at net level shooting up almost five times from Rs 142 crore to Rs 690 crore. The company's financial position is very strong, with reserves at the end of March 2023 standing at Rs 2,889 crore - over 38 times its equity capital of Rs 76 crore, that too after a 1:1 bonus issue made in 2015.

The company's shares (face value Rs 10) are quoted around Rs 4,920. The stock is worth including in the portfolio of discerning investors.

| FACE VALUE | 05 |

| CMP | 62.94 |

| 52 WEEK HIGH /LOW | 80/40 |

Incorporated in 1993 as VMF Soft Tech, Hyderabad headquartered Keltron Tech Solutions is a CMMI level 5 and ISO 9001:2015 certified global leader in digital transformation, propelling businesses into their future by transforming the way they operate. The company is known for providing cutting-edge digital transformation solutions and services in strategy, consulting, digital and technology, with its service vision of 'infinite possibilities with technology' and its specialized digital transformational skills across all business and technology services, delivering sustainable business values to its clients. The company has a global workforce of 1,800+ employees that work together with business to drive innovation and deliver on its promises to stakeholders.

The company's capabilities to offer solutions across a broad spectrum of DIGINEXT technologies like Blockchain, Internet of Things, Artificial Intelligence and Data Engineering have made it a formidable player in the digital engineering space. Keltron's unique industry-specific solutions such as KLGAME and Optima have helped it deliver value-driven outcomes for both new-age as well as asset-heavy enterprise clients. This, along with the company's strong partnership ecosystem, has helped the firm establish itself as a leader amongst small and medium-sized providers in Zinnovi's 2022 FR&D Zones ratings.

Keltron's global footprint is strengthened by offices in the US and Europe. It employs over 1,800 people catering to over 350 clients ranging from start-ups to Fortune 500 companies, spread across verticals such as BFSI, travel, ecommerce, manufacturing, logistics and healthcare. It powers 30 per cent of the $ 25 billion e-commerce market in India through its clients. It ranks 23rd among the fastestgrowing companies in the Deloitte Technology Fast 50-India 2017. It has been listed among the 56 most highly recommended companies in the world by Clatch.

The company has made rapid strides on the financial front. During the last 12 years, its sales turnover has expanded rapidly from just Rs 1 crore in fiscal 2011 to Rs 883 crore in fiscal 2022, with operating profit shooting up from a negative Rs 3 crore (loss) to Rs 105 crore. Besides, it has earned a net profit of Rs 70 crore in striking contrast to a net loss of Rs 4 crore in 2011. The company's financial position has also improved considerably, with reserves at the end of March 2023 standing at Rs 430 crore - almost nine times its equity capital of Rs 48 crore, that too after a 1:1 bonus issue in 2017.

The company's shares are available around Rs 60, which is quite an attractive entry point for new shareholders to enter.

| FACE VALUE | 01 |

| CMP | 316.70 |

| 52 WEEK HIGH /LOW | 317/75 |

Chennai-based small cap information technology company Saksoft provides software, testing and business intelligence solutions for a range of sectors including fintech logistics and transportation, health tech and utilities.

Businesses can access real-time information thanks to the company's custom-developed cloud-enabled enterprise applications and omnichannel solutions. The company's verticals include telecommunications, healthcare, retail ecommerce, logistics and transportation, fintech, and the public sector.

Some of the digital solutions of the company include enterprise applications, intelligent automation, augmented analytics, and enterprise cloud. In addition, the company offers application services, managed services, testing and quality assurance (QA) and core data services. The company primarily conducts business in Europe, the US, Asia Pacific and Others.

Saksoft is steadily growing in size and stature. During the last 12 years, its sales turnover has expanded more than five times from Rs 123 crore in fiscal 2012 to Rs 666 crore in fiscal 2023, with operating profit shooting up over 8 times from Rs 13 crore to Rs 108 crore and the net profit surging ahead over 11 times from Rs. 7 crore to Rs 82 crore. The company's financial position has also improved noticeably, with reserves at the end of 2023 skyrocketing almost 40 times to Rs 396 crore against its equity capital of Rs 10 crore.

Shares of the company are quoted around Rs 315 (face value Re 1). Future prospects for the company are quite encouraging.

| FACE VALUE | 05 |

| CMP | 3849.85 |

| 52 WEEK HIGH /LOW | 3888/2883 |

Oracle Financial Services Software Ltd is a company that offers business processing services and information technology solutions to the financial services sector. Its segments include business processing outsourcing services, IT solutions and related services, product licenses, and associated business activities (products and BPO). Products are the various banking software products covered in this segment.

Enhancement, implementation, and maintenance activities are included in its related activities. Its Services segment provides services spanning the lifecycle of applications used by financial service institutions. Technology, application, support and consulting services are part of this segment's service offerings.

The company is on the growth path in its financial performance. During the last 12 years, its sales turnover has expanded from Rs 3,317 crore in fiscal 2012 to Rs 5,698 crore in 2023, with operating profit inching up from Rs 1,111 crore to Rs 2,471 crore and the net profit rising from Rs 1,009 crore to Rs 1,806 crore. The company's financial position has strengthened remarkably, with reserves at the end of March 2023 at Rs 7,416 crore against a capital of Rs 43 crore.

Shares of the company (FV Rs. 5) are around Rs 3,850. This is an excellent buy at every decline.

| FACE VALUE | 05 |

| CMP | 1000.20 |

| 52 WEEK HIGH /LOW | 1370/875 |

Global technology company Affle (India) Ltd provides a consumer intelligence platform that generates consumer recommendations and conversions through relevant mobile advertising for brands and business-to-consumer companies worldwide.

The Consumer platform and Enterprise platform are two of the company's segments. Appnext, Jampp, Mass, Faas, Mediasmart, Traction Enterprise, Rex and Vizury are some of its platform options. Its consumer platform mainly offers services like converting new customers and retargeting current customers to move them closer to transactions.

Additionally, it provides complete solutions for businesses to improve their interaction with mobile users, including the creation of apps, the ability for offline companies with e-commerce ambitions to conduct business online, and the provision of enterprise-grade data analytics for both online and offline corporations.

Affle has made rapid strides on the financial front. During the last 12 years, revenues have expanded from Rs 167 crore in fiscal 2012 to Rs 1,434 crore in fiscal 2023, with operating profit moving up from Rs 269 crore to Rs 1,003 crore and the net profit inching up from Rs 161 crore to Rs 514 crore. The company's financial position has become stronger, with reserves at the end of March 2023 standing at Rs 3,411 crore against its equity capital of Rs 55.

The company's shares with a face value of Rs 5 are quoted around Rs 1000. There is good scope for further appreciation.

| FACE VALUE | 05 |

| CMP | 1493.90 |

| 52 WEEK HIGH /LOW | 1526/724 |

Cyient Ltd is an India-based technology and engineering solutions providing company. It specializes in network, operations, analytics and geospatial solutions. In addition, transportation, communication and utilities, a portfolio of industries, and digital services and solutions comprise its Services segment.

Electronic manufacturing solutions across various industries, business units, and sectors, including transportation, communication and utilities, is the focus of its designled manufacturing segment.

The company is faring well on the financial front. During the last 12 years, its sales turnover has expanded around four times from Rs 1,553 crore in fiscal 2012 to Rs 6,016 crore in fiscal 2023, with operating profit inching up to cross Rs 1,000 crore from Rs 269 crore and the profit at net level advancing from Rs 161 crore to Rs 514 crore.

The five-rupee share of the company is quoted around Rs 1,490. Discerning investors can accumulate these stocks at every decline.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives