Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: June 15, 2023

Updated: June 15, 2023

For this fortnight, we have selected a unique information technology company which is a leading player in cloud communications. It is Tanla Platforms, formerly known as Tanla Solutions. The Hyderabad-headquartered company is promoted by Dasari Uday Kumar Reddy, who is its Chairman and CEO. Tanla was originally started in 1999 as a bulk SMS provider mainly catering to SMEs. Subsequently, it evolved into a cloud communications provider with services and products with aggregators and telcos across the globe.

Tanla has entered into various partnerships with leading companies to enter newer areas and this has upgraded its size and stature. This mid-cap technology company has offices in ten locations, including London, Singapore, the US, Colombo and Dubai. Tanla is engaged in providing integrated telecom products like SMSC, optimal housing solution, SS7voice, mail server, welcome roamer, high density media servers, multiple MSISDN, CRBT, missed call alert, SMS, direct broadcast and prepaid roaming gateway, automatic vehicle location (which provides instantaneous location information of a vehicle) and a power AMR 101 – an automated power reading service which provides instantaneous data of customer usage. The company also provides offshore services, including project management, application development and integration, technical support and technical consulting.

A wholly-owned subsidiary of Tanla, Mobizar has direct connections to all UK network operators and offers a range of SMS, MMS, WAP and 3G services. Tanla Mobile, another subsidiary, provides an extensive portfolio of mobile solutions for content and brand owners, marketing and digital agencies, media channels, retailers and corporate businesses to entertain and communicate with customers. It has entered the UK, Ireland, the US and Singapore markets with revenue sharing agreements with O2, 3, Meteor and Vodafone, and an exclusive agreement with Breathe in the UK for powering internet SMS to UK customers.

The ISO 9001-2000 and ISO 27001-certified Tanla is now working towards getting CMMI level 3 certification in software design, delivery, product and system integration. The company has partnerships with Intel, Brooktrout Technology, Wavecom, Novell, Texas Insruments and Telesoft Technologies. Its client list includes Reliance, BPL, Hexa-com, Airtel and Essar.

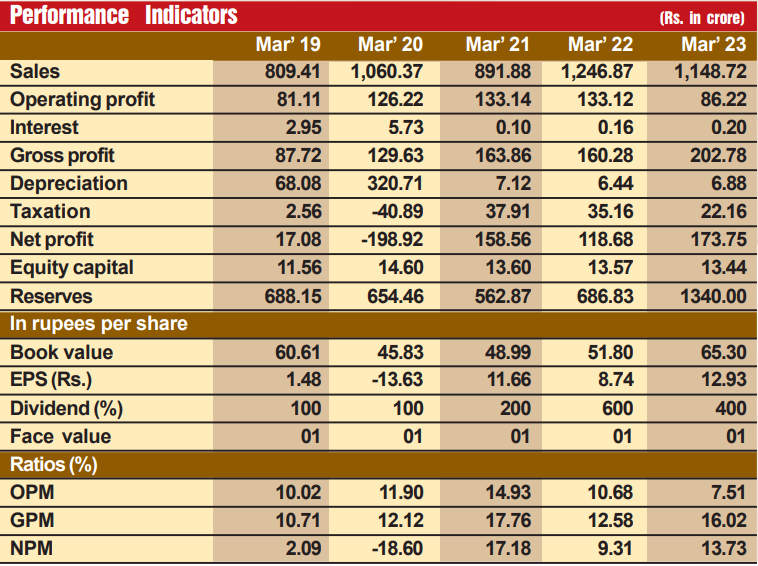

The company has made rapid strides on the financial front, with compounded sales growth during the last 10 years at 40 per cent and profit CAGR at 18 per cent. During the last 11 years, its sales turnover has expanded over 28 times from Rs 117 crore in fiscal 2013 to Rs 3,355 crore in fiscal 2023, with operating profit spurting by over 53 times from Rs 11 crore to Rs 588 crore and the profit at net level spurting to Rs 448 crore in striking contrast to a loss of Rs 147 crore in fiscal 2013. The company’s financial position is very strong, with reserves at the end of March 2023 standing at Rs 1,504 crore – over 115 times its equity capital of Rs 13 crore.

However, we have not picked Tanla as the Fortune Scrip for its past laurels. Its prospects going ahead are all the more fascinating. Consider:

The prevailing situation in the information technology industry will not adversely affect Tanla as in the case with other companies, particularly those over-dependent on the US. Tanla is doing extremely well in the domestic market and its growth prospects are highly encouraging. Little wonder, most research analysts are strongly in favour of Tanla. Says

Geojit, “We expect improved revenue visibility in fiscal year 2024 due to growth in UPI, ecommerce transactions, an increase in realization of revenue from new and existing customers, and price hikes. We reiterate a BUY rating with a target price of Rs 850.” Maintain analysts at HDFC Securities, “We are building in improved margins for fiscal 2024 and revised our EPS estimate upward by 2.61/3.3 per cent for fiscal 2024. We maintain our BUY rating with a target price of Rs 1,050.”

Discerning investors will do well to accumulate these stocks at every decline.

April 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives