Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: June 30, 2023

Updated: June 30, 2023

For this fortnight, we have selected Jindal Steel and Power as the Fortune Scrip. An industrial power house with a dominant position in steel, power, mining and infrastructure, the New Delhiheadquartered JSP is a part of the OP Jindal group. In terms of tonnage, it is the third largest private steel producer in India and the only private producer in the country to produce rails. The company manufactures sponge iron, mild steel slabs, rails, structural, hot rolled plates, iron ore pellets and coils. It has set up the world’s first coal gassification-based DRI plant at Angul (Odisha) that uses the locally available high-ash coal and turns it into synthesis gas for steel making, reducing the dependence on imported coke-rich coal.

The company’s coal gas-based steel technology became a case study at Harvard University! Led by Naveen Jindal, its unique and enviable success story has been scripted by its resolve to innovate, set new standards, enhance capabilities and enrich lives. This young, agile and responsive company is constantly expanding its capabilities to fuel its fairy tale journey that has seen it grow to a $ 3.3 billion business conglomerate. The company has committed $ 3 0 billion in the future and has several business initiatives running simultaneously across continents.

JSP produces economical and efficient steel and power through backward and forward integration. From the widest flat products to a whole range of long products, JSP today sports a product portfolio that caters to markets across the steel value chain. The company produces the world’s longest (121- metre) rails and it is the first in the country to manufacture large-size parallel flange beams.

JSP operates the largest coal-based sponge iron plant in the world and has an installed capacity of 3 million mtpa of steel at Raigarh in Chhatisgarh. Also, it has set up a 0.6 mtpa wire rod mill and a 1 mtpa capacity bar mill at Patratu in Jharkhand, a medium and light structural mill at Raigarh and a 2.5 mtpa steel melting shop and a plate mill to produce up to 5 meter-wide plates at Angul.

Jindal Steel and Power, headed by Naveen Jindal which has been ranked 4th by Dun and Bradstreat in its list of companies that generated the highest total income in the iron and steel sector, has embarked on an ambitious growth plan envisaging capex of Rs. 24,000 crore – which has been revised to Rs. 27,000 crore will totally transform the company which will lead to its rerating. The stock price has already started inching up shooting up from Rs. 329 to Rs. 563 during the last one year is all set to cross Rs. 1000-mark within the next 3 years or so.

Needless to say, JSP has been rated as the second highest value creator in the world by Boston Consulting Group. Dun and Bradstreet has ranked it 4th in its list of companies that generated the highest total income in the iron and steel sector.

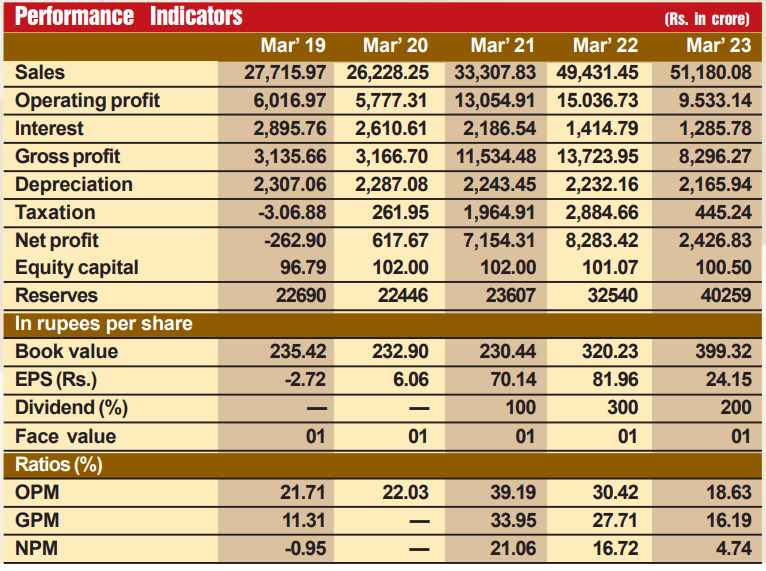

The company has gone from strength to strength on the financial front. During the last 12 years, its sales turnover has expanded from Rs 18,209 crore in fiscal 2012 to Rs 52,711 crore in fiscal 2023, with operating profit surging from Rs 6,799 crore to Rs 9,933 crore and net profit inching up from Rs 1,022 crore in FY2012 to Rs 6,766 crore in fiscal 2022 before declining to Rs 974 crore in FY2023. The company’s financial position is very strong, with reserves at the end of March 2023 standing at Rs 38,606 crore – over 386 times its equity capital of Rs 100 crore. It is steadily reducing its debt and during the last eight years has brought down its borrowings from Rs 46,797 crore in fiscal 2016 to Rs 13,046 crore in fiscal 2023, slashing in the process its interest burden from Rs 4,068 crore (FY2016) to Rs 2,691 crore (FY2023).

But we have not picked this stock as the Fortune Scrip just on the basis of its past laurels. We strongly believe that its future prospects are more promising. Consider:

The company’s highly ambitious expansion programme, announced in 2021, falls into three categories — brownfield capacity expansion, backward integration and forward integration. The brownfield expansion will add 3.3 mtpa by Q4 FY2024 and another 3 mtpa by Q2 FY2026. Totally, this expansion will raise the company’s capacity from the current level of 9.6 mtpa to 15.9 mtpa. Under its backward integration initiatives, the company will commission a 12 mtpa pellet plant – a slurry pipeline and four coal mines will commence from Q2 FY2024. This will strengthen the integrated product chain and support future cost efficiencies. In the case of forward integration, the hot strip mill, thin slab caster and rail mill are all set to begin commissioning to downstream volumes and upgrading the product mix.

We strongly feel that on completion of a substantial part of the expansion programme, the share price of JSP will cross the Rs 1,000 mark. Discerning investors should accumulate these stocks at every decline.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives