Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Mar 31, 2023

Updated: Mar 31, 2023

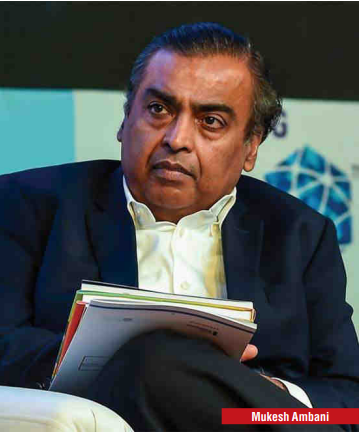

Far-sighted and enlightened industrialist Mukesh Ambani, Chairman and MD of Reliance Industries, realised quite early about the perils of high debt. In 2020, even when the Covid pandemic was raging in India, the company sold stakes in both its telecom and retail firms to the world’s top private equity firms.

The proceeds were used by RIL to become a net debt-free company. If its proposal to sell a stake in the oil business to Saudi Aramco had been successful, it could have been sitting on a pile of cash of at least $15 billion. But the deal did not take off. Nevertheless, the lesson for corporate India is: Repay the debt as soon as the project is commissioned.

Ambani learnt from the mistakes of the Videocon, Jaypee and Zee promoters and paid off his loans in advance.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives