Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Mar 31, 2023

Updated: Mar 31, 2023

A part of the 60-year-old and renowned Coimbatore-based Lakshmi group, LECS began its journey in 1981 by setting up a manufacturing unit spread over five acres in collaboration with Sprecher & Schuh of Switzerland to manufacture control gear — its first product. After three years, it widened its product basket by adding control panels, engineering plastic components and commercial toolroom moulds. Later, it added smart meters as well.

After a thorough market survey and looking at future prospects, the company decided to manufacture electric vehicle chargers for two-three wheelers, cars, buses and trucks. LECS developed a complete range of electric vehicle chargers (EVCs) in a technology tie-up with a leading manufacturer from China to become a leading player in the field. It has introduced different variants for AC, DC and on-board chargers as per Indian and international standards in a fully integrated manufacturing facility.

The module is designed with resonance voltage type dual-loop control switching power technology, featuring high efficiency, high reliability, small size and light weight. LECS has taken special care to make its electric vehicle charging equipment (EVCE) user-friendly, supported with professional installation and comprehensive services. It has incorporated state-of-the-art safety features and high efficiency level of more than 96% with speed.

In addition, the company assembles Li-Ion battery packs for electric vehicles with customisation and with an arrangement with an internationally reputed battery cell supplier. It has developed in-house plastic moulding. These factors are contributing to its success in becoming a leading player in the field in a relatively short span of time.

The company is stepping up its manufacturing capacities. Recently, it announced establishment of a second factory unit on leased premises near its existing factory at Arasur, Coimbatore. The new unit will consist of a 15,000 sq ft area and the capital expenditure will be met from internal accruals. Though the company has not shared the product details of the new unit, it is presumed that it will mostly enhance the manufacturing capacity of electric vehicle charging equipment.

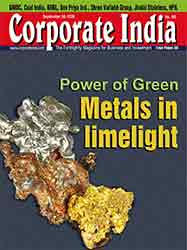

FY22 witnessed a stellar performance as the company’s revenues went up almost twice, from Rs 132.25 crore (FY21) to Rs 256.12 crore. Likewise, the profit after tax also saw an increase of over five fold from Rs 3.06 crore to Rs 15.49 crore. However, it is worth mentioning that FY21 had a big and long shadow of the Covid-19 pandemic. In the first three quarters (9 months) of the current fiscal year 2023, it has already crossed the 12-month revenue and profit figures. It has reported Rs 265.04 crore revenue and PAT of Rs 15.87 crore, translating into an EPS of Rs 64.58 vis-à-vis Rs 41.63 in the corresponding period in the previous year and Rs 63.01 for the full year.

As a result of parking surplus funds judiciously, LECS’s other income reflects good numbers. In FY21 and FY22, the figures were Rs 3.49 crore and Rs 3 crore respectively and during the nine months ended December 2022, it has reached Rs 2.20 crore. This symbolises prudent financial management because every year, other income itself is capable of generating earnings of above Rs 10 per share.

The company’s finance cost is very negligible. In FY22 (12 months) it was Rs 42.77 lakh and in the nine months ended December 2022 (FY23), it has been Rs 38.28 lakh. It has no outstanding term loan. Only working capital requirement is being arranged with the banker and as of September 2022, the outstanding amount was Rs 9.01 crore. However, considering its long-term investments of Rs 149.76 crore supported with a strong bank balance of nearly Rs 17 crore, the company is debt-free with a net worth of Rs 212.97 crore as of March 2022, resulting in a hefty book value of Rs 866.45 on its Rs 10 face value share.

LECS holds 88,800 equity shares of Lakshmi Machines Works (LMW), the promoter group’s listed flagship company. At its current market price of Rs 10,796 each, the investment is valued at Rs 95.87 crore. Though the company management is not going to monetise this particular holding, it adds a weight to its financial muscle. Another investment is in 6,289 equity shares of Indian Bank, a PSU. At the current price of Rs 292 each, that fetches Rs 18.36 lakh to LECS. The company has also parked surplus funds of Rs 40.63 crore in different mutual fund schemes as on Marchend, 2022.

One might feel that despite belonging to the Lakshmi group, the company has not grown to the expected size as it is still below Rs 300 crore in revenue even after 40 years of existence. But one needs to focus on its newly developed electric vehicle charging equipment segment which has enormous potential for a higher and sustainable level of revenue and profits, coupled with its already established and successful product portfolio. More importantly, LECS has sound fundamentals and a strong balance sheet with a debt-free status. Another plus point is the proven track record and higher level of credibility of its promoter group.

LECS, listed on BSE, enjoys the advantage of its tiny equity capital of Rs 2.46 crore wherein 36.13% is held by the promoter group and the balance 63.87% rests with the 9,110 public shareholders. The EPS of the trailing twelve months works out to Rs 85.96, translating into a PE of 9.07 times its current market of price of Rs 780 — which looks attractive for investment.

FY24 (next year) is going to be important for the company as its new manufacturing facility will go on stream (maybe in the second half) and contribute in generating incremental revenue and a spurt in profits. Any favourable news with regard to getting big orders for EVCE could evince the interest of investors and act as a trigger to the counter, with the potential to rerate the stock.

September 30, 2025 - Combined Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives