Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Mar 31, 2023

Updated: Mar 31, 2023

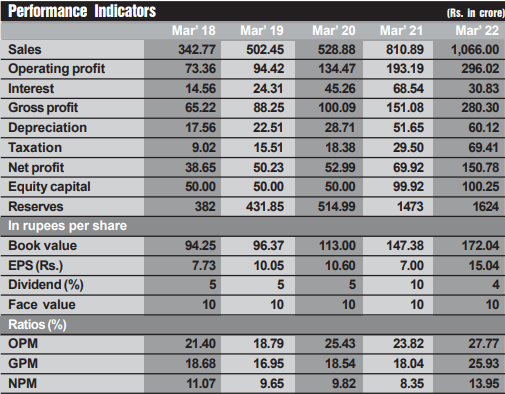

Gujarat-based Anupam Rasayan, a leading manufacturer of multi-synthesis molecules such as speciality chemicals related to agrochemicals, personal care and pharmaceuticals which has cross the milestone of Rs. 1000-crore turnover last year is growing from strength to strength.

The company manufactures multi-synthesis molecules such as: (a) Life science-related speciality chemicals comprising products related to agrochemicals, personal care and pharmaceuticals; and (b) Other speciality chemicals comprising speciality pigments and dyes as well as polymer additives on an exclusive basis for its customers. The company has six manufacturing facilities — four in Sachin near Surat and two in Zagadia. Some of these facilities are ISO 9001:2015 and ISO 14000:2015 certified. The company is known for its sound technology, environmental consciousness, rich history of innovation through research, and total commitment to excellence in quality and sustainability. The company is doing well, but its prospects going ahead are all the more exciting.

The company’s financial position is also very sound with reserves at the end of March 2022 standing at Rs. 1693 crore as against its equity capital of Rs. 100 crore.

These products were conceptualised within 3 months and it took under 18 months from conceptualisation to commercialisation of these products. The company is able to deliver these products in such short period on urgent request of our customer.

Moreover, both of these products were being manufactured in Europe. Now the customer has decided to source these products exclusively from Anupam. The management is starting to see this trend of India being chosen as preferred manufacturing base for strategical products presently being manufactured in Europe. The company is working with few more MNC clients and expect 20 to 25 niche products to be added in Anupam’s product portfolio in near term as of part of Europe plus one strategy.

During the current bearish environment, the share price of Anupam Rasayan has tumbled from a 52- week high of around Rs 1,107 to Rs around Rs 631 but has soon recovered to Rs. 748 by now. The current price level is highly attractive for discerning investors to invest in such a growthoriented company. Once the current phase of market depression is over, the Anupam stock price is most likely to cross the Rs 1,000-mark once again.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives