Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: May 15, 2023

Updated: May 15, 2023

Poison of one economy is another economy’s meat! Shrinking global supplies of fertilisers due mainly to the Russia-Ukraine conflict have meant that Indian fertilizer manufacturers have had to step up to the plate and meet the increasing demands of Indian farmers.

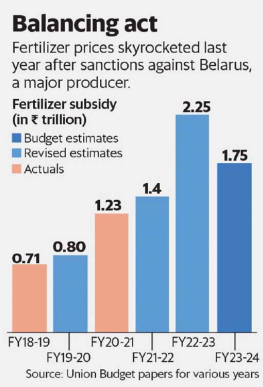

With prices going northward, the government for its part has eased the pain of farmers by increasing the annual fertiliser purchase subsidy by a massive Rs 1.08 lakh crore. This augurs well for the financial health of both the Indian farmers and domestic fertiliser manufacturers, as well as the overall foodgrains sufficiency of the country.

The government’s ‘Atmanirbhar’ push too has given a fillip to the growth of the domestic fertiliser industry, with the market size projected at Rs 1,188.3 billion by 2028. In the current scenario where the domestic fertiliser market is highly competitive, Corporate India Corporate India has Corporate India culled nine leading company stocks for the consideration of its reader-investors.

The Rs 90,000-crore Indian fertiliser market is in fine fettle, thanks ironically to the RussiaUkraine war shrinking supply chains and sanctions against Belarus (which supports Russia against Ukraine) restricting that country’s exports of fertilisers. With fertiliser prices consequently rising, it was feared that Indian farmers would have to reduce the use of fertilisers, but Union Fertiliser Minister Mansukh Mandaviya assuaged farmers’ fears by announcing that the Union cabinet had approved an additional subsidy of Rs 1.08 lakh crore for the ongoing kharif (monsoon) season.

Of this amount, Rs 38,000 crore will subsidise phosphatic and potassic (P&K) fertilisers while Rs 70,000 will go towards the urea subsidy. Last year, the total fertiliser subsidy was about Rs 2.56 lakh crore.

Mr Mandaviya has stated that the government will ensure that prices of urea and diammonium phosphate (DAP) will remain unchanged during the kharif season. At present, the subsided rate of urea is Rs 276 per bag while that of DAP is Rs 350 per bag. “The government’s decision will benefit about 12 crore farmers,” he has said.

According to the minister, the total consumption of urea in the country is 325-350 lakh tonnes. Apart from this, 100-125 lakh tonnes of DAP, 100-125 lakh tonnes of NPK and 50-60 lakh tonnes of muriate of potash (MOP) are also sold. “Farmers should get fertilisers on time. They should not be burdened at a time when international prices are on the upswing,” he has noted.

Pointing out that the fertiliser subsidy usually ranges between Rs 1 lakh crore and Rs 1.25 lakh crore, the minister has added, “However, last year it had shot up to Rs 2.56 lakh crore. As cultivation takes place on 1,400 lakh hectares of land across the country, the fertiliser subsidy for one hectare is about Rs 8,999. We have 12 crore farmers, and each farmer gets a subsidy of Rs 1,350 per bag. In the case of NPK, the subsidy is Rs 1,639 per bag while the MOP subsidy amounts to Rs 734 per bag. The Centre spends Rs 2,196 per bag of urea. In order to ensure that farmers do not face any difficulty in getting fertilisers at the right time, we have to maintain stocks of 150 lakh tonnes for the kharif season.”

For the current year, the government had budgeted a fertiliser subsidy amount of Rs 1.75 lakh tonnes, but in view of the inflationary price spiral in global fertiliser markets, the subsidy bill is going to overshoot the budgeted amount. In order to ensure that farmers do not face any difficulty on account of the high price and reduce their purchase of fertilisers, the government has sanctioned an additional subsidy of Rs 1.08 lakh crore for this kharif season.

This is indeed good news for the Rs 900-billion Indian fertiliser industry. After all, the agriculture sector in India is one of the largest in the world. It accounts for about 15 per cent of the country’s GDP and over 70 per cent of the output comes from small-scale farmers. The sector employs around 1.97 million people, accounting for 6 per cent of total employment in India.

In supporting the fertiliser industry, the government has announced plans to increase its focus on industrialisation through initiatives such as increasing the import duty on fertilisers, increasing subsidies on hybrid seeds and organic fertilisers, and providing incentives to farmers who adopt new technologies like biogas digesters or solar-powered irrigation pumps.

Today, India is the third largest producer and second largest consumer of fertilisers in the world. It has been widely acknowledged that fertilisers have played a key role in the success of the country’s Green Revolution and its subsequent self-reliance in foodgrain production. The increase in fertiliser consumption has contributed significantly to sustainable production of foodgrains in the country. As a result, the demand of fertilisers has witnessed double-digit growth over the past several years.

However, despite strong growth in recent years, the average intensity of fertiliser use in India remains much lower than in most of the developed and emerging countries around the world. The usage of fertilisers is also highly skewed, with wide inter-regional inter-state and inter-district variations. Thus, there are tremendous growth prospects for the fertiliser industry in India.

There are at least half a dozen drivers of fertiliser growth. These are:

In its latest report on the Indian fertiliser industry, the well-known Imark group says the Indian fertiliser market size has reached Rs 998.6 billion in 2022. Going forward, the group expects the market to reach Rs 1,188.3 billion by 2028, exhibiting a compounded growth rate (CAGR) of 4.85 per cent during 2023-2028.

Taking advantage of the bright prospects for the fertiliser industry in the country, fertiliser companies have been able to expand their marketshare by offering innovative products such as plant growth hormones, that offer improved performance over traditional alternatives. Little wonder then that fertiliser stocks have been gaining popularity among investors going ahead.

Prospects for the fertiliser industry are quite promising, which is a good sign for fertiliser stocks and their investors. In recent years, fertiliser companies have been able to increase their marketshare by offering innovative products that offer improved performance over traditional alternatives. The industry has benefited from normal monsoons and improved reservoir levels, higher coverage under assured irrigation, remunerative crop prices, export focus, favourable government policies including sizeable fertiliser subsidies, and procurements under MSP (Minimum Support Price).

Today, India has become a prominent market for fertilisers with an annual consumption of 55 million tonnes. The country not only imports certain fertilisers but also raw materials to produce complex fertilisers like urea, di ammonium phosphate and tri super phosphate. Overall, the industry is expected to grow at a CAGR of 4.8 per cent for the next five years.

With a view to transforming the country through 'Atmanirbhar' (self-reliance), the government is pursuing an initiative to reduce reliance on imports and expand production capabilities at home. Additionally, increasing rural inclusion coupled with relatively easier credit availability will likely produce a positive impact. All in all, the key market outlook for the industry remains positive, indicating that prospects for fertiliser stocks are quite promising.

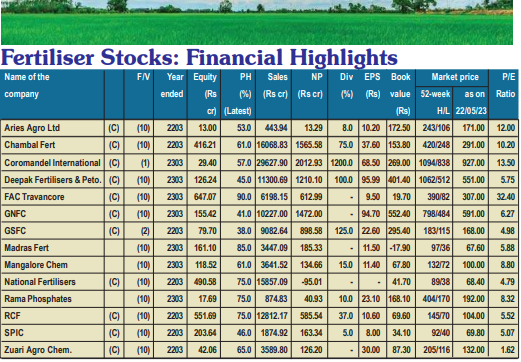

Though there are more than two dozen fertiliser companies divided into three segments -- public sector, private sector and co-operative sector -- the market is highly competitive. Out of 10 investing fertiliser stocks worth investing in, we have selected five top stocks to recommend to our readers. These stocks are:

| FACE VALUE | 01 |

| CMP | 932.65 |

| 52 WEEK HIGH /LOW | 1095/838 |

Hyderabad-headuqartered Coromandel International, a part of the illustrious industrial house of south India, the Murugappa group, is a pioneer player in agri-solutions, offering diverse products and services across the farming value chain. It is the country's largest manufacturer of fertilisers in terms of market capitalisation and net revenue. It manufactures fertilisers, speciality nutrients, crop protection solutions, organic fertilisers and bio-pesticides.

Promoted by EID Parry and IMC as well as Chevron of the US as Coromandel Fertiliser, the company subsequently changed its name to Coromandel International and is today engaged in the businesses of fertilisers, pesticides and speciality nutrients. It is also in the rural retail business in the states of Andhra Pradesh, Telangana, Karnataka and Maharashtra through its 'Maha Gromer' centres.

A subsidiary of EID Parry (which holds a 62.82 per cent equity stake), Coromandel has 17 manufacturing facilities spread across the states of Andhra Pradesh, Rajasthan, Uttar Pradesh, and Jammu and Kashmir. Its brands include Gromar, Godavari, Paramtos, Parry Gold and Parry Super.

The company has been evolving for over a century by offering customised farm solutions and advisory services. The company's 'Farmer First' approach, quality focus and consumer connect initiatives have helped in gaining farmers' trust and has resulted in Gromor being among the most trusted brands in the country. The trust built over decades has catapulted the company to the position of India's largest private sector phosphatic fertilisers company. It has also emerged as the world's largest neem-based fertiliser makers and the company has become the country's largest agriretail chain with over 751 stores.

The company's enlightened management has taken various strategic initiatives such as strengthening its backend supply chain, significant backward integration and strategic procurement, improving its R&D capabilities with the help of advanced tools such as 'ARM' and 'Minitab' to conduct trials and analyse research data, and digitizing its processes by adopting a dashboard for materials management and ascertaining the status of batches to improve its operating efficiency.

The company is aligning itself with key trends in the industry by expanding its product portfolio to performance agri-input solutions. It is venturing into drone-spraying services to address the need for highly efficient delivery mechanisms.

With steadily rising demand for the company's products and services, it is going from strength to strength on the financial performance front. During the last 12 years, its consolidated revenues have expanded from Rs 7,639 crore in fiscal 2011 to Rs 19,111 crore in fiscal 2022, with operating profit more than doubling from Rs 1,093 crore to Rs 2,156 crore and the profit at net level also more than doubling from Rs 694 crore to Rs 1,528 crore during this period. The company's financial position is robust, with reserves at the end of March 2022 standing at Rs 6,329 crore - over 218 times its equity capital, that too after two bonus issues of 3:5 in 1978 and 1:2 in 1986.

As far as short-term debt is concerned, the company has repaid its remaining debt of Rs 16 million and has become a debt-free entity. As far as long-term borrowings are concerned, it has brought down the debt from Rs 2,946 crore in fiscal 2012 to Rs 395 crore. Little wonder that the interest burden has been slashed from Rs 251 crore in fiscal 2019 to Rs 141 crore in fiscal 2022. The company has been paying handsome dividends, the rate for the last three years being 1,200 per cent.

Prospects for the company going ahead are all the more promising. A good development for the company is the declining prices of raw materials. For example, phosphatic acid prices have contracted from $ 1,715/tonne for Q2 FY2023 to $ 1,175/tonne for Q4 FY2023. The declining trend in raw material prices will give a big boost to its bottomline.

Besides the declining trend in raw material prices, the company's various initiatives have pushed up production and capacity utilisation. For example, the capacity utilisation for complex fertilisers was at 107 per cent in Q2 FY2023. As a result, the company's EBITDA/tonne should increase and its profit margin should improve. Little wonder that the management had revised its fiscal 2023 margin to Rs 5,500/tonne as compared to its original guidance of Rs 4,000-4,500/tonne.

Needless to say, the company's share price is on the rise on good demand. It is has moved up from the recent low of Rs 709 to Rs 927 an is expected to cross Rs 1,000. Almost all research houses are bullish about the stock. Motilal Oswal has set the target at Rs 1,150, Sharekhan has placed it at Rs 1,155 and Prabhudas Lilladhar has set a target of Rs 1,200.

| FACE VALUE | 10 |

| CMP | 292.25 |

| 52 WEEK HIGH /LOW | 420/248 |

Kota (Rajasthan)-based Chambal Fertilisers and Chemicals, a KK Birla group company, is the largest manufacturer of urea in the private sector, accounting for 13 per cent of the total urea production in the country. It also manufactures other fertilisers like DAP, MOP and NPK. The company offers crop protection solutions as well.

The company operates three plants and markets its products through 19 regional offices, 2,800 dealers and 50,000 retailers.

The company has faced headwinds of late. These include a huge outstanding subsidy amounting to Rs 240 crore, a 242 per cent spurt in interest costs due to stretched working capital, and the delay in the TAN project by over a year.

However, the adverse impact of these headwinds will be short-lived and after a couple of years it will be back on the growth path.

The TAN project is now expected to come up by October 2026. Meanwhile, the cost of the project is expected to go up from Rs 1,470 crore to Rs 1,645 crore but the capacity of the project will be increased from 0.22 million metres to 0.24 million metres.

The company's ROCE of 18 per cent is slightly better than the 17 per cent generated by the chemicals industry. Though its annual earnings for fiscal 2023 were not cheerful, the earnings going ahead are forecast to grow faster than the Indian market.

Despite headwinds, the company has made rapid strides on the financial front. During the last 12 years, its sales turnover has expanded from Rs 5,684 crore in fiscal 2011 to Rs 16,069 crore in fiscal 2022, with operating profit more than trebling from Rs 703 crore to Rs 2,265 crore and the net profit spurting more than seven times from Rs 216 crore to Rs 1,566 crore. The company's financial position is very sound, with reserves at Rs 637 crore - over fifteen times its equity capital of Rs 416 crore. Once the outstanding subsidy amount is received, the company's debt burden will be negligible.

Maintains a leading research analyst, "It is important to know that Chambal Fertilisers and Chemicals has a current liabilities-to-total assets ratio of 49 per cent, which we would consider very high. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we would like to see this reduce as that would mean fewer obligationbearing risks. In short, Chambal Fertilisers has proven its ability to adequately reinvest capital at good rates of return. And since the stock has risen strongly over the last five years, it appears the market might expect this trend to continue. So while the positive underlying trends may be accounted for by investors, we still think this stock is worth looking into further."

| FACE VALUE | 10 |

| CMP | 547.95 |

| 52 WEEK HIGH /LOW | 1062/512 |

Pune-based Deepak Fertilisers and Petrochemicals Corporation is one of the leading manufacturers of fertilisers and industrial chemicals. Set up I 1979 by a far-sighted businessman Mr. Chimanbhai Mehta to manufacture ammonia, Deepak Fertilisers is today a leading producer of high quality NPK, speciality and water soluble fertilisers and nutrients. Besides it is the sole manufacturer of 24:24:0 nitro phosphate in India with market leadership of speciality products, solubles and bentonite sulphur.

The company has been growing from strength to strength on the financial front. During the last 12 years, its sales turnover has expanded from Rs. 2410 crore in the fiscal 2012 to cross Rs. 10,000-crore mark and reah at Rs. 11,301 crore with operating profit shooting up over five times from Rs. 412 crore to Rs. 2165 crore and the profit at net level surging by almost six times - from Rs. 212 crore to Rs. 1221 crore. The company's financial position is extremely strong with reserves at the end of March 2023 standing at Rs. 4941 crore - over 39 times its equity capital of Rs. 126 crore.

The company is setting up an ambitious ammonia plant with a capacity of 5,00,000 million tonnes per annum at Taloja in Maharashtra at a capital expenditure of Rs. 4350 crore. The plant is fast coming up and is expected to go on stream by June/July 2023. This is said to be a world-scale ammonia plant with the world's best technology (KBR and TOYO). As ammonia is a critical raw material for fertilisers, industrial chemicals and TAN (technical ammonium nitrate), the demand for it will grow substantially going ahead. The company management insists that this ammonia plant will meet the total requirements of ammonia in the country and there will be no need for imports.

The new project will substantially pushup the topline as well as bottomline of the company as during the fiscal year 2023, ammonia prices have shot up by 63 per cent. The topline is expected to shoot up by around Rs. 2000 to Rs. 2500 crore. Besides this plant would save forex of Rs. 20,000 crore over the next 20 years through import substitution.

Now the company has taken up a corporate restructuring plan under which the TAN business (mining chemicals) will be demerged from Smartchem Technologies (a subsidiary of Deepak Fertilisers) to DMSPL, another wholly owned subsidiary of Deepak and Mahadhan Farm Technologies a wholly-owned subsidiary of Smartchem will be merged with Smartchem. According the management, this restructuring will considerably help create strong independence business platforms within the larger DFPCL brand umbrella, hence enhancing stakeholders' value over a period.

Shares of Deepak are quoted around Rs. 547. Discerning investors with a long-term perspective can expect the price to cross Rs. 1000-mark within the next 4 to 5 years.

| FACE VALUE | 02 |

| CMP | 166.85 |

| 52 WEEK HIGH /LOW | 184/114 |

Gujarat State Fertilisers & Chemicals (GSFC) is a Gujarat government PSU engaged in the manufacture of various ammonium fertilisers as well as industrial chemicals products. The company is also a well-established producer of polyamide-6 which is using in the production of fiem grades and engineering plastics. Of course, it is predominantly a fertilizer company fertilizer segment accounting for over 77 per cent of the company's total revenue.

The company has recorded steady growth on the corporate front. During the last 12 years its sales turnover has more than doubled from Rs. 5295 crore in the fiscal 2012 to Rs. 11,298 crore in the fiscal 2023 with operating profit rising from Rs. 1135 crore to Rs. 1617 crore and the net profit inching up from Rs. 758 crore to Rs. 1293 crore. The company's financial position is extremely sound with reserves at the end of March 2023 standing at Rs. 11,884 crore - over 148 times its equity capital of Rs. 80 crore. The company has substantially reduced its debt from Rs. 1559 crore in the fiscal 2020 to just Rs. 2 crore in the fiscal 2023 and by now it is almost a zero-debt corporate entity.

GSFC is a good investment bet as the demand for fertilisers is likely to go up with a hike in the government subsidy. Again the company has delivered good profit growth of 22.1 per cent CAGR over the last 5 years. At the same time the company has been maintaining a healthy dividend payout of 21 per cent. What is more, the Gujarat Government has directed its PSUs including GSFC to pay liberal dividend and make bonus issues. Again the company has significant investment in Gujarat Narmada Valley Fertiliser Company and Gujarat Gas - both of which are also good investment avenues. Interestingly, the stocks are available around Rs. 165 - around Rs. 0.53 times its book value. Hence this is quite an attractive entry level for new investors for the scrip.

| FACE VALUE | 10 |

| CMP | 599.85 |

| 52 WEEK HIGH /LOW | 799/484 |

| FACE VALUE | 10 |

| CMP | 185.35 |

| 52 WEEK HIGH /LOW | 380/170 |

| FACE VALUE | 10 |

| CMP | 303.75 |

| 52 WEEK HIGH /LOW | 390/82 |

| FACE VALUE | 10 |

| CMP | 102.05 |

| 52 WEEK HIGH /LOW | 145/80 |

| FACE VALUE | 01 |

| CMP | 192.30 |

| 52 WEEK HIGH /LOW | 271/182 |

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives