Fortune Scrip

Published: May 15, 2023

Updated: May 15, 2023

Solar Industries

'Explosive' growth in explosives

For this fortnight we have selected a company as the Fortune Scrip which is not only doing very well but has tremendous growth prospects going ahead. It is Nagpur-headquartered multinational Solar Industries which is engaged in the manufacture of industrial explosives and explosive initiating systems with a capacity of 330,000 metric tonnes per year (mtpa). It is the largest company of its kind in India, enjoying a hefty marketshare of 30 per cent.

The company has a pan-India presence with as many as 34 manufacturing facilities across the country. At the global level, it has a presence in 65 countries with manufacturing facilities in six -- Zambia, Nigeria, Turkey, South Africa, Australia and Ghana.

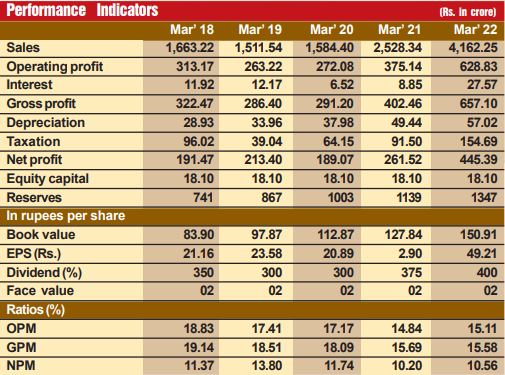

Solar has made rapid strides on the financial front. During the last 12 years, sales turnover has expanded more than five times from Rs 910 crore in fiscal 2012 to Rs 6,923 crore in fiscal 2023, with operating profit shooting up over seven times from Rs 171 crore to Rs 1,289 crore, and net profit surging over eight times from Rs 101 crore to Rs 811 crore. The company's financial position is extremely sound, with reserves at the end of March 2023 standing at Rs 2,392 crore - over 147 times its tiny capital of Rs 18 crore.

POLE PLAYER

However, we have not picked Solar as the Fortune Scrip for its past laurels. We strongly feel that its prospects going ahead are all the more promising. Consider:

-

SIIL, the largest manufacturer of industrial explosives and explosive initiating systems in the country, is the dominant player in its field with a 30 per cent marketshare. Almost all leading coal mine companies and infrastructure firms are its customers. As coal prices have turned distinctly firmer on account of a coal shortage, the demand for explosives is on the rise and Solar is the biggest beneficiary of this rising demand. It was in 2017 that Solar Industries bagged a running contract to supply bulk explosives to the subsidiaries of Coal India amounting to Rs 1,143.63 crore. Last year (fiscal 2023), sales to Coal India grew to around 500 crore. At present the supply of explosives to coal companies continues regularly. The next contract with Coal India is expected to be finalized in October 2023 and with Singareni Coal by April 2024.

-

Besides rising demand for its products at home and prices on the upswing, the company has also emerged as the largest exporter of explosives and explosive initiating systems from India, accounting for a 70 per cent marketshare. The company exports to as many as 65 countries in the world and has extended its manufacturing base to several countries, including a few African countries. Last year (fiscal 2023), exports contributed around 40 per cent of the total revenues, exhibiting a growth of around 95 per cent to around Rs 900 crore. Export prospects are more promising going ahead.

DEFENCE FORAY

-

Having strengthened its dominance in the explosives and explosive initiating systems segments, the company has diversified of late into the sunrise sector of defence. Last year the company participated in various RFPs (request for proposals), which include an RFP for one of the Pinaka variants and an RFP for drone-based loitering munitions. The company has set up a modern manufacturing facility for HMX and propellants, 3-layer stock tubes and electronic detonators. The company received a major contract from the Ministry of Defence for the supply of multimode hand grenades valued at over Rs 409 crore. Again, the company has signed a contract with the Indian army for supplying over 400 fully indigenous Kamikaze drones that can strike enemy targets from over 15 km. The deal, which is worth up to Rs 300 crore to supply 400 drones, will have to be completed within one year. Till now, the country used to acquire such drones from foreign vendors, including companies from Israel and Poland. Over a month ago, the company has bagged an order to supply unmanned aerial vehicles (Nagastra-I) to the Indian army. By now, government orders have crossed the Rs 1,000-crore mark.

By now, the company produces everything from explosives and propellants to grenades, drones and warheads as part of the 'Make in India' mission. With rising government orders for defence, the market value of the company shot up by 700 per cent in a decade from Rs 1,765 crore in fiscal 2012 to more than Rs 15,000 crore by December 2022. With a 73 per cent ownership position in Solar Industries, the promoter Satyanarayan Nuwal has amassed a fortune of $ 3 billion, and according to the Forbes India Rich List he is now the 72nd richest Indian.

CAPEX RISE

-

The company is on the growth path. For fiscal 2023 it spent a capex of Rs 450-500 crore. For fiscal 2024 and fiscal 2025 it has planned a capital expenditure of Rs 500 crore each year - mainly for expanding the defence portfolio and increasing its geographical presence. The company has already set up a manufacturing facility in Australia, while a new plant in Indonesia has started partial production and is expected to start full production by June 2024.

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access