Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: November 15, 2023

Updated: November 15, 2023

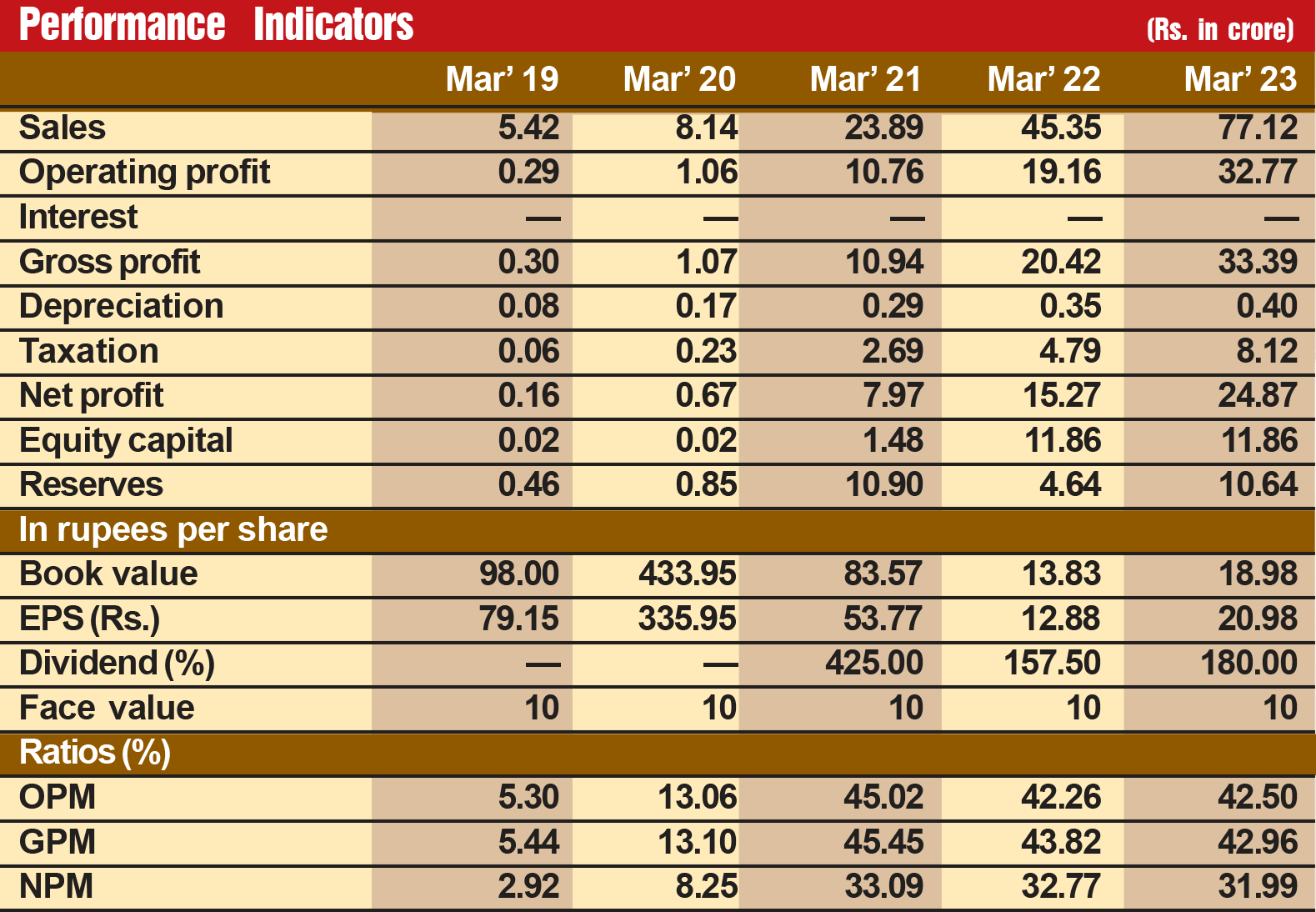

This fortnight we have decided to change track in picking the Fortune Scrip. Instead of a wellestablished company, we have selected a very small and rather new company with a market capitalisation of around Rs 1,200 crore, sales turnover of less than Rs 100 crore and depreciation of Rs 25 crore (in fiscal 2023). In fiscal 2021, it earned a net profit of just Rs 1 crore on a sales turnover of Rs 8 crore. But thereafter, the company has made rapid strides with sales turnover advancing to Rs 77 crore for the year ended March 2023, on which it earned a net profit of Rs 25 crore.

The company floated its issue in June 2020 at a price of Rs 100 – today, the current market price is around Rs 1,098. The stock has becoming extremely popular, what with the board of directors declaring bumper dividends. In fact, it spends most of its earnings on dividend payments, and – hold your breath – the payout rate for fiscal 2023 was 74 per cent! For FY23, it paid a dividend of Rs 15.50 per share of a face value of Rs 10. And for the current year, it has already announced the first interim dividend of Rs 7 per share. No other small company on the Indian exchanges pays such bumper dividends.

Headquartered in Noida, Ksolves is a small cap infotech company that specialises in providing a range of software development and IT consulting services to various industries, including ecommerce, healthcare and finance. It refers to itself as a ‘true software development partner’ to its customers. It curates and develops the best possible software solutions while keeping the customer’s original brief and business needs in mind. It comes with a proven track record of servicing clients across several countries, and has 40+ in-house technology experts.

While it is a 360-degree software development provider, it is known in the industry for its expertise in Big Data, (Apache Kafka), Apache Nifi, Apache Spark, Apache Cassandra, Data Science (Artificial Intelligence and machine learning), Sales Force, Devops, Java and Micro Services, Open Shift Penetration, testing etc. The company also has a strong presence in developing and distributing apps on the Adoos and Magento platforms.

Though the company was incorporated 10 years ago, its operations in the real sense started from fiscal 2020. During the last four years, it has put up an extra-ordinary performance with sales turnover advancing from Rs 8 crore in fiscal 2020 to Rs 77 crore in fiscal 2023, operating profit shooting up from Rs 1 crore to Rs 33 crore, and the profit at net level surging from Rs 1 crore to Rs 25 crore. But we have not picked this small cap company as the Fortune Scrip on account of its past laurels. We strongly feel that its future prospects are all the more promising. Consider:

But there may be two disturbing possibilities. The huge dividend payouts will not leave funds for reinvestment in growth projects. Secondly, if the profit growth slows down or drops, bumper dividends may not be possible. Discerning investors should be watchful about the company’s performance in the coming years.

November 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives