Fortune Scrip

Published: November 30, 2023

Updated: November 30, 2023

Coal India

CIL’s fortunes undergo change: Making hay while coal shines

Our readers will find it intriguing that the stock which we had recommended for disinvesting two years ago is being picked now as the Fortune Scrip for this fortnight. Let us clarify our 360-degree turn in evaluating this stock. Two years ago, when we recommended disinvestment in Coal India, the wind was blowing strongly against the growing menace of pollution and climate change. The worldwide mood was against fossil fuels like coal and for the replacement of coal-based power with renewable energy.

The Indian government too chalked out highly ambitious plans for solar energy.

In these circumstances, the importance of coal was expected to go down considerably; hence, our

suggestion at that time to disinvest in Coal India.

But two years down the line, it is now being realized that the importance of coal has not

diminished as on would have expected. Considering that the growth in solar energy is not in line

with the growing demand for power in the country, we cannot afford to neglect coal as the major

feedstock for power. Realising this, the government has asked the coal industry to ramp up coal

production. In fact, demand for coal is rising so fast that the country has to depend on imports.

As the government is keen to reduce these imports, Coal India is gearing up to augment its coal

production. At the same time, on account of the growing demand for power and in turn for coal,

coal prices have started firming up. Little wonder that in these circumstances, the prospects for Coal

India have brightened and we have – naturally — picked this stock as the Fortune Scrip for this

fortnight.

COAL GIANT

Kolkata-headquartered Coal India is a central public sector undertaking owned by the Union

Ministry of Coal, and is the largest government-owned coal producer in the world. It is also the 9th

largest employer in India with over 272,000 employees. The company contributes around 82 per

cent to the total coal production in the country, having produced around 554.14 million tonnes of

new coal in 2016-17. In the current fiscal year (2024) the production of the company will reach 680

million tonnes. Last year, it earned revenues of a whopping Rs 144,802 crore in 2023.

CIL, the PSU enjoying Maha ratna – a privileged status functions through its direct and indirect

subsidiaries in 84 mining areas spread over 8 states of India. The company has 352 mines of which

158 are underground (UG), 174 opencast (OC) and 20 mixed mines. The company’s major consumers are power plants which account for 78 per cent of its offtake. Its other consumers include

industries like steel, fertilisers, cement, brick kilns and a host of other industries.

The company has started doing well on the financial front. During the last 12 years, its sales

turnover has expanded from Rs 72,424 crore in fiscal 2012 to Rs 38,252 crore in fiscal 2023,

with operating profit more than doubling from Rs 15,293 crore to Rs 36,810 crore and the

profit at net level almost doubling from Rs 14,788 crore to Rs 28,125 crore.

But we have not picked this stock as the Fortune Scrip for this fortnight on account of its past

laurels. We strongly believe that the future prospects of the company are all the more promising

going ahead. Consider:

RENEWABLES LAG

-

Demand for power in the country is on the rise. Domestic power generation is expected

to grow at a rate of 7.2 per cent to 1,750 bu in the current fiscal year ending March 2024,

consequently driving up demand for coal. The country’s efforts to boost production of cleaner

sources of power since 2015 have not brought the desired results as yet. Despite widespread

efforts to boost renewal energy, these have been hindered on account of increased capital costs,

the time required for land acquisition, inadequate transmission infrastructure, lack of funding

and the Covid-19 pandemic. No doubt solar, wind, hydro and natural gas have supplemented

coal in meeting the energy needs of the country, but these sources cannot substitute coal wholly

at present.

For the last two years, India has accounted for around 11 per cent of global coal consumption.

Little wonder that today, India remains the second largest coal consumer in the world. Now, experts

have realized that it will take much longer for renewable energy to have a larger share of energy

consumption and will have to co-exist with coal for at least a couple of decades before renewables

can significantly contribute to a larger share of India’s energy market. In short, coal is irreplaceable for

the time being.

Dispatches to coal-fired power plants till November 2023 stood at over 350 million tonnes

and are expected to touch 610 million tonnes in fiscal 2024. No doubt, FSA (fuel supply

agreement) prices are relatively low as compared to market prices, but there is a strong possibility of FSA prices going up after the general elections in April-May 2024. This will boost the

financials of CIL.

E-AUCTION HIKE

-

CIL has started offering coal through e-auctions, which fetches higher prices. Till the

first half of the current fiscal, the company was selling around 10 per cent of its production

through the e-auction route. For the current fiscal ending March 2024, it plans to dispatch 15 per

cent of its total volumes through this route. As the current e-auction premium is around 90 per

cent, the company’s sales and profits are bound to go up. What is more, the e-auction process

will be completely shifted to an e-auction house platform from fiscal 2025. The company is

expected to dispatch 610 million tonnes to the power sector under FSA in fiscal 2024 and the

volumes are expected to grow by 15 to 20 per cent in fiscal 2025. As an FSA price hike is

expected after the general elections, the company’s topline as well as bottomline are bound to

go up.

- CIL has planned to take up a Rs. 65,000 crore capital expenditure plan of five years. These

funds will be utilized towards railway capacity expansion, first-mile connectivity projects (FMCP) and

acquisitions, as well as infrastructure development. According to the company management, once

the FMCP projects are commissioned, it would reduce the loading time from the current level of three

hours to around 45 minutes. A portion of the capex fund will also be utilized to enhance the

company’s excavation capacities and drive cost synergies.

- Interestingly, the company is diversifying its product portfolio to enter the renewable energy

sector by setting up a 3 GW solar energy capacity at a capex of Rs 15,000 crore by fiscal 2026. Of this, 250

MW of solar RE capacity is expected to be commissioned within the next 6 months; i.e., by May 2024.

- CIL has a portfolio of 138 UG mines which employ 40 per cent of the total workforce but

yield less than 4 per cent of the total production. The company has undertaken steps to shut down

unviable mines in phases, which will eventually drive down the manpower costs going forward,

which in turn will boost the bottomline.

HIKE IN FMCPs

-

The company is also undertaking FMCPs which will upgrade the mechanised coal transportation and loading system. Nine such projects have already been commissioned and many more

are under implementation. At the same time, the company is undertaking more such initiatives to

enhance the mechanized evacuation capacity to 915 million tonnes. This expansion will lead to cost

efficiencies and enhanced productivity.

Fortune Scrip Part II (edited)

-

Coal India has taken a major initiative to build a matching logistics infrastructure to ensure

evacuation of the planned quantity of production. In order to augment the availability of rakes for

evacuating the increased quantity of coal in the South East Central Railway circuit, feeding to 15

Power Box N-S railway wagons will come at a capital cost of Rs 675 crore. This will facilitate adequate

indigenous supplies and will also help reduce imports.

- With a view to meeting the increasing requirements of coal and to bring down imports of

non-coking coal, as per the government's plan, the company is ramping up production. Today, it

supplies around 90 per cent of its production to the power sector -- and it is worth noting that thermal

power accounts for around 83-85 per cent of the total power generation. In order to meet the

increased power requirements -- which reached a peak of 243 GW by October 31, 2023, the

company has set a target of 1 billion tonnes of coal produciton by fiscal 2027. It has also been

undertaking strategic expansion by investing in machinery and acquisitions which will support it in

achieving the 1 billion-tonne target.

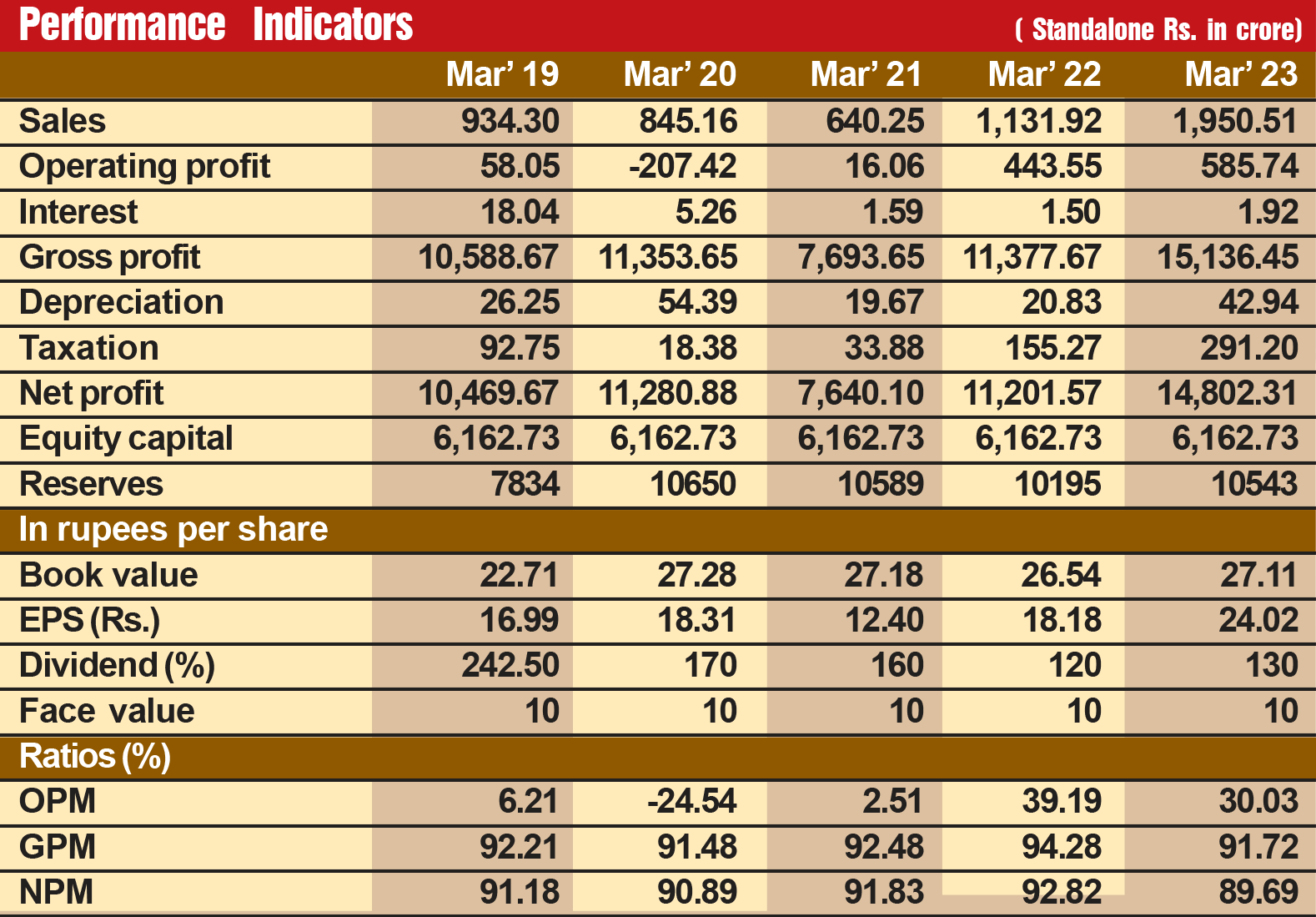

FINANCIAL CLOVER

-

Coal India's financial position is very sound, with reserves at the end of March 31, 2023

standing at Rs 51,082 crore - over eight times its equity capital of Rs 6,163 crore. It pays handsome

dividends, the rate for the last fiscal being 243 per cent. For the current fiscal it has paid an interim

dividend of @ 15 per cent. It has been maintaining a very healthy dividend payout of 63.7 per cent.

The company's fundamentals are very strong, with EPS of Rs 45.70 per share of the face value of Rs

10, ROCE being 91.31 per cent and RONW being 56.07 per cent.

During calendar year 2023 so far, the share price has shot up by 48 per cent, soaring from the

52-week low of Rs 207.70 (March 27, 2023) to Rs 346.55 most recently. Leading brokerage houses,

including Motilal Oswal, ICICI Securities and Nuwarna Wealth, have started giving a 'BUY' rating. We

strongly feel that discerning investors should add this stock to their portfolio.

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access