Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: November 30, 2023

Updated: November 30, 2023

Cocking a snook at doomsday talk of a recession in the US and Europe, Indian IT scrips are once again the flavour of the season among the entire spectrum of investors, from FIIs and DIIs to HNIs and even the ‘aam aadmi’. The who’s who of the sector, including TCS, Infosys,Wipro, HCL and Tech Mahindra, have seen a quick and large bounceback on the market. And even after some banking failures in the West and consequent cuts in BFSI spends, the outlook for Indian IT remains bright, especially for pureplay and niche players.

While leading brokerage house Kotak Institutional Equities opines that a worst-case Western recession scenario would be no more than a moderate downside for Indian IT, umbrella body NASSCOM makes a gung-ho prediction of an industry CAGR of 10.3 per cent and revenues of $ 350 billion by fiscal 2025.

In a sudden — and seemingly inexplicable — turnaround, the $ 250 billion Indian Information Technology sector has shed its fears and apprehensions about the adverse impact of a slowdown in the US and European economies. With investors — ranging from FIIs and DIIs to HNIs and even retailers — rediscovering their yen for the infotech space, IT stocks have started rising from the troughs seen in recent times.

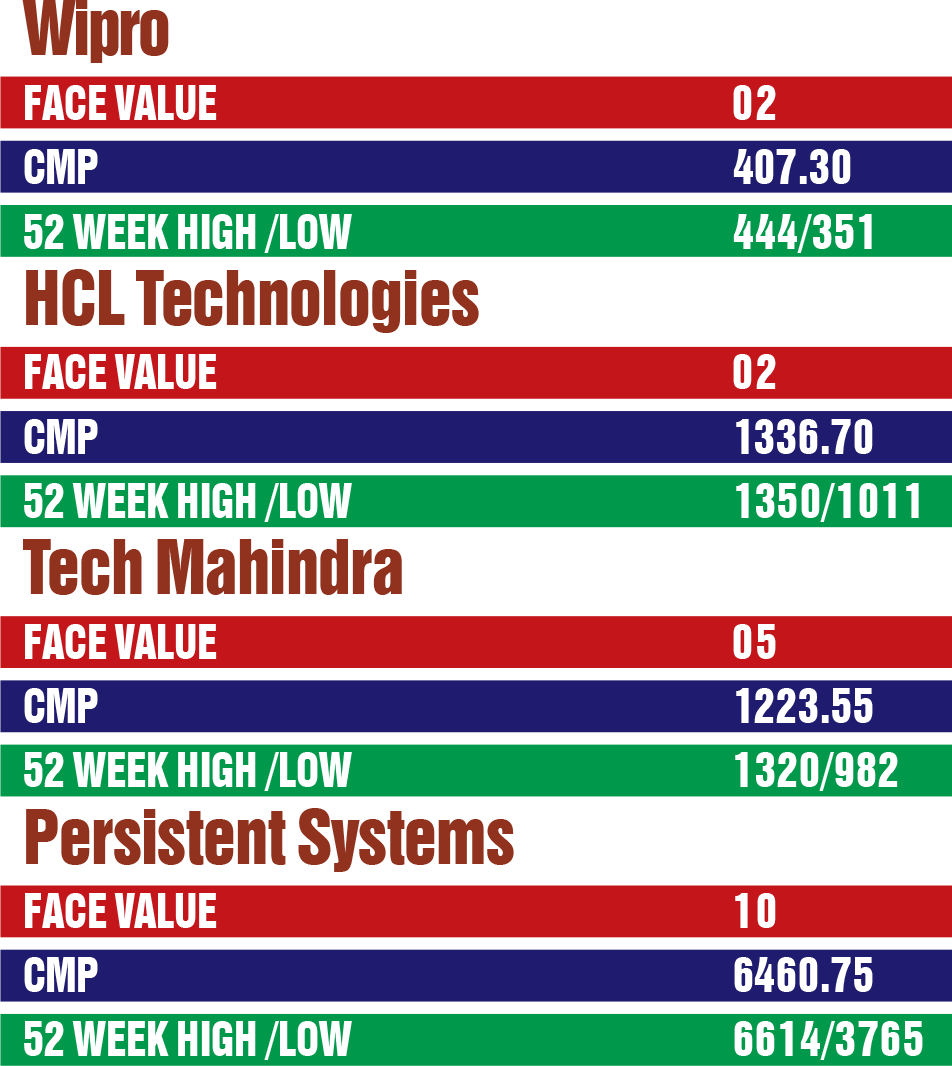

The ‘objects’ of investors’ ‘re-infatuation’ include the who’s who of the Indian IT sector. Tech giant TCS, which was hammered down from Rs 3,675 to Rs 2,926 just a few months ago, has recovered speedily to Rs 3,680 before settling at around Rs 3,510, while the second biggest Indian vendor, Infosys, which had fallen from Rs 1,763 to Rs 1,185, has bounced back to Rs 1,561 before settling at 1,464. Wipro, which was brought down from Rs 445 to Rs 321, has recovered fast to Rs 444 before settling at Rs 408, while HCL Technologies, which had slumped from Rs 1,203 to Rs 876, has bounced back to Rs 1,350 before closing around Rs 1,337 in the beginning of December. Tech Mahindra, which went south under selling pressure from Rs 1,270 to Rs 950, has shot up to Rs 1,320 before closing around Rs 1,225, and Persistent Systems, which was pressed down from Rs 5,297 to Rs 3092, has surged to a new high of Rs 6,614 before settling around Rs 6,450.

Needless to say, market Cassandras still believe the outlook for the Indian IT sector is uncertain, what with continuing fears of a recession in the US and Europe, repercussions of the failure of some banks in the Western world, and continuing geopolitical tensions.

There was, of course, the boom time in IT stocks during the Covid-19 pandemic phase, with the world coming to grips with the WFH (‘work from home’) phenomenon – one that benefited the IT sector through increasing digital consumption and strong order flows for IT vendors. At the same time, an abundance of liquidity in the Indian economy led to higher investments in digitization and cloud computing.

However, last year the industry faced considerable headwinds. The North American and European economies started slowing down, creating the scare of an impending recession. At the same time, other global economies faced inflationary concerns, leading to a rise in lending rates by banks which squeezed out the liquidity from financial markets

As higher interest rates slow down corporate cash flows, many American and European clients had to willy-nilly cut their budget for IT spending. This, in turn, hit the business of Indian IT companies which depend to a large extent on US and European clients.

As if this was not enough, in February and March there was an ‘earthquake’ in the US banking scene when Silicon Valley Bank went insolvent. This catastrophe was followed by the failure of several other national and regional banks in the US and Europe. As the BFSI (banking, financial services and insurance) sector is a major revenue earner for Indian IT companies, the latter faced further headwinds as BFSI clients started cutting their discretionary spending, further affecting the revenues of Indian IT companies.

Maintains one knowledgeable observer of the IT sector, “Notwithstanding the problems in Western economies, the outlook for the Indian IT industry is highly promising. Demand is still strong and is likely to remain buoyant in the long run as well. The order books of companies are looking really strong. The companies have witnessed broad-based growth across segments like banking and financial services, communication, retail, and manufacturing. Prospects for the industry as a whole are positive. Even though some global investment/brokerage houses have cut their outlook on the sector by claiming that the peak has passed, we believe the industry will eventually overcome supply side issues in the medium- to long-term period, if not in the short term.”

Leading Indian brokerage house Kotak Institutional Equities maintains, “The situation in the Indian IT sector is not as bad as it appears.” It points out that revenues of IT companies came in above expectations in the second half of fiscal 2023 and the first half of 2024. On a philosophical note, it predicts that the worst that can happen would be a moderate downside in case of a fullblown recession in leading economies.

Fears of an impending recession in the US and European economies that started early in 2022 have not materialized as yet, and there is a class of observers who believe that the feared recession may not take place. After a slowdown for some time, the situation will be normal and the outlook for the sector will start improving in the medium term. Little wonder that FIIs (foreign institutional investors), DIIs (domestic institutional investors) and HNIs (high net worth investors) have once again started chasing IT stocks. The renewed spurt in the prices of these stocks clearly indicates the changed mindset of IT-focused investors.

Maintains one expert, “The Indian IT sector has not faced such a crisis for the first time. Earlier also, a banking crisis in the US and Europe had erupted. I think the fears will die down after March 2024. Last year, FPIs (foreign portfolio investors) had sold their stakes in the IT and oil & gas sectors worth Rs 14,000 crore by March 2023. In the current fiscal, FIIs are turning buyers in IT stocks.”

A research analyst opines that IT firms with a focus on niche verticals need not fear as they have a brighter outlook. Pureplay and vertically focused IT services companies in niche segments are seeing continued demand and they have an encouraging outlook going ahead. One company in the niche space is KPIT Technologies, which is a software integration partner to the automotive and mobility ecosystem. On the other hand, L&T Technology Services (LTTS) and Tata Elxsi are pureplay engineering research services companies.

During Q1FY2024, KPIT Technologies reported a 56.9 per cent year-on-year rise in profits at Rs 134.4 crore. Revenues too expanded 51 per cent. Maintains Kishor Patil, CEO and Managing Director of KPIT Technologies, with justifiable confidence, “Opportunities remain stronger as mobility players continue to invest in new technologies in the area of electrification, vehicle autonomy, connectivity and personalization.”

Likewise, Tata Elxsi, which reported a marginal 2 per cent yoy increase in net profit at Rs 189 crore, remains largely optimistic on the outlook for a majority of its verticals. Maintains Manoj Raghavan, CEO of Tata Elxsi, “As we step into the second quarter (July to September 2023) of the current fiscal year, the strong deal pipeline, especially in the automotive, healthcare

and design businesses, provides us the confidence and foundation for accelerating our growth throughout the year.” Research analysts point out that demand for certain companies is strong because of the nature of the work. Maintains Sumit Pokharna, research analyst at Kotak Securities, “The projects undertaken by companies like KPIT technologies can’t be stopped in between; hence the demand is strong.”

Regarding the future prospects of the IT sector, Ajay Srivastava, an IT expert, says, “One thing that came out clearly in the current uncertain environment in the Indian IT sector was that the sectoral order book remains robust. New acquisitions and large accounts have equally been robust, particularly for companies like Infosys. Again, they have got a huge benefit from the dollar-rupee depreciation.”

On the issue of which companies will emerge the biggest beneficiaries from the revival of the IT sector, Ajay Srivastava insists that TCS ranks among the best in terms of profitability, considering that compared to other companies it does not have any large operating costs. Therefore, in terms of pure margins, it is ‘matchless’.

NASSCOM (National Association of Software and Service Companies), the umbrella association of Indian IT and BPO companies, sees a bright future for the Indian IT sector going ahead. It says the industry is expected to grow at a compounded annual growth rate (CAGR) of 10.3 per cent for five years to fiscal 2025, reaching $ 350 billion by fiscal 2025. The NASSCOM report identifies key drivers for this growth, including digital transformation, an innovation ecosystem, talent development, global market access and policy support. Additionally, it outlines strategic themes such as building digital capabilities, strengthening global leadership, enhancing competitiveness through innovation and partnerships, creating social impact, and enabling a conducive environment for growth.

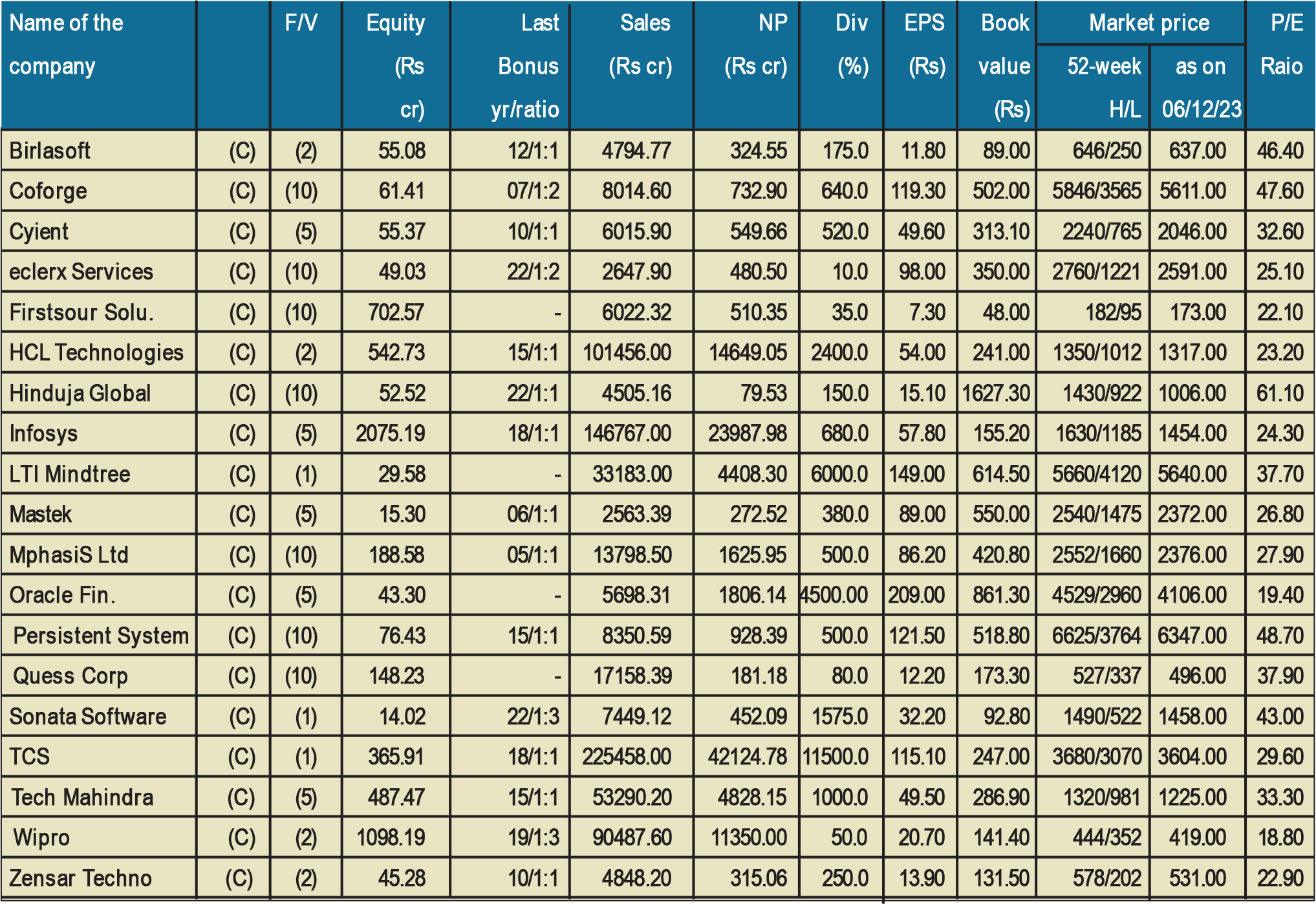

There are at least 30 IT stocks which deserve 'BUY' rating. Here we have selected 12 scrips for our readers to consider for adding to their portfolios. Here goes the list:

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives