Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: October 31, 2023

Updated: October 31, 2023

With a second tranche of Rs 34.20 crore recently, DGML has availed a Rs 50-crore loan from Ardent Steel Pvt Ltd, which is a Hira group company. This further borrowing will be primarily utilized for making an equity investment in Geomysore Services (India) Pvt Ltd (Geomysore). Geomysore is implementing a 1,500 tpd processing plant for its Jonnagiri gold project at Jonnagiri, Andhra Pradesh, where the other partner is Thriveni Earth Movers Pvt Ltd (Thriveni).

Both partners have agreed to infuse Rs 60 crore towards the equity capital of Geomysore. Proceeds of this investment would be utilized for land acquisition, ordering of equipment and commencement of civil work for the processing plant and water pipeline work. The construction of the processing plant is likely to be completed by end-2024, while the company has already placed an order for crushing, milling and elusion machinery. A water pipeline would also be operational simultaneously

After the recently completed fresh allotment process, DGML holds a 40.07% equity stake in Geomysore and has made a total investment of Rs 28.50 crore in this regard. Thriveni has also invested Rs 40 crore in the joint venture. Geomysore has already acquired 120 acres of key land in Jonnagiri. Efforts are on to acquire another 130 acres in due course, making a total of 250 acres primarily required to build the processing plant, water reservoir and tailing dam. The management also plans to acquire an additional 100 acres in the next two quarters.

A 20 tpd gravity circuit-based pilot plant is currently operating and the process flow is being fine tuned. The capacity will be enhanced to 40 tpd which could potentially produce 1 kg of gold per month. This particular plant will be operational till the fullscale plant is commissioned

Open pit mining in the East Block of the Jonnagiri mining lease area is in progress and currently about 800 tpd of gold ore is being extracted. The company has planned to enhance this to 1,200-1,500 tpd in the coming months. The extracted ore will be used once the processing plant is commissioned. However, a small quantity of the ore is fed into the existing pilot plant as well.

While sharing details, Managing Director of DGML Hanuma Prasad said full-scale production of the country’s first large private gold mine in Andhra Pradesh will begin by the end of next year at the Jonnagiri gold project, which will produce 750 kg of gold per annum once it begins full-scale production. DGML holds a 40.07% equity stake in the venture called Geomysore

DGML has formed a subsidiary — Deccan Gold (Tanzania) Pvt Ltd — for carrying out an exploration programme in five prospecting licence blocks that the subsidiary has been granted in Tanzania. DGML has also recently entered into a strategic alliance agreement with AK Corporation-FZCO (AKC), a company existing under the laws of the United Arab Emirates. Under this agreement, the company and AKC will work as strategic partners in the setting up of and construction of a processing plant focused on the gold mining industry.

AKC has extensive experience in the field in Africa, and in Mauritania in particular. In order to strengthen and consolidate the mineral exploration consultancy vertical, the company has incorporated a wholly-owned subsidiary, Deccan Gold-FZCO, in Dubai. This particular vertical is aimed at working mainly on gold, nickel, lithium and rare earth and battery metals.

DGML has completed the allotment of 17,70,028 equity warrants to non-promoters @ Rs 53.47 issue price per warrant, which are convertible into an equivalent number of equity shares of Re 1 each at a premium of Rs 52.47. The current equity capital is Rs 14,72,66,500 with the equal number of shares of Re 1 each. However, after the conversion of compulsorily convertible debentures and equity warrants, the paid-up capital of the company will be increased to Rs 15,68,94,544.

DGML’s wholly owned subsidiary — Deccan Exploration Services Pvt Ltd (DESPL) — has filed two writ petitions for its Ganajur mining lease and North Hutti Block prospecting licence applications. They are pending before the Karnataka High Court.

It’s worth mentioning that DGML has never performed well ever since its listing on BSE 38 years ago in 1985. Even its financials are also not worth writing about. Currently, its market price is Rs 118 (Re one face value) with a yearly high-low of Rs 137 and Rs 28 respectively, and a market capitalisation of Rs 1,744 crore. Nevertheless, one can conclude on a positive note upon reviewing important developments that have taken place, especially in the last 15 months, which indicate that investors with patience for twothree years can accumulate the stock in small lots at every decline for handsome returns.

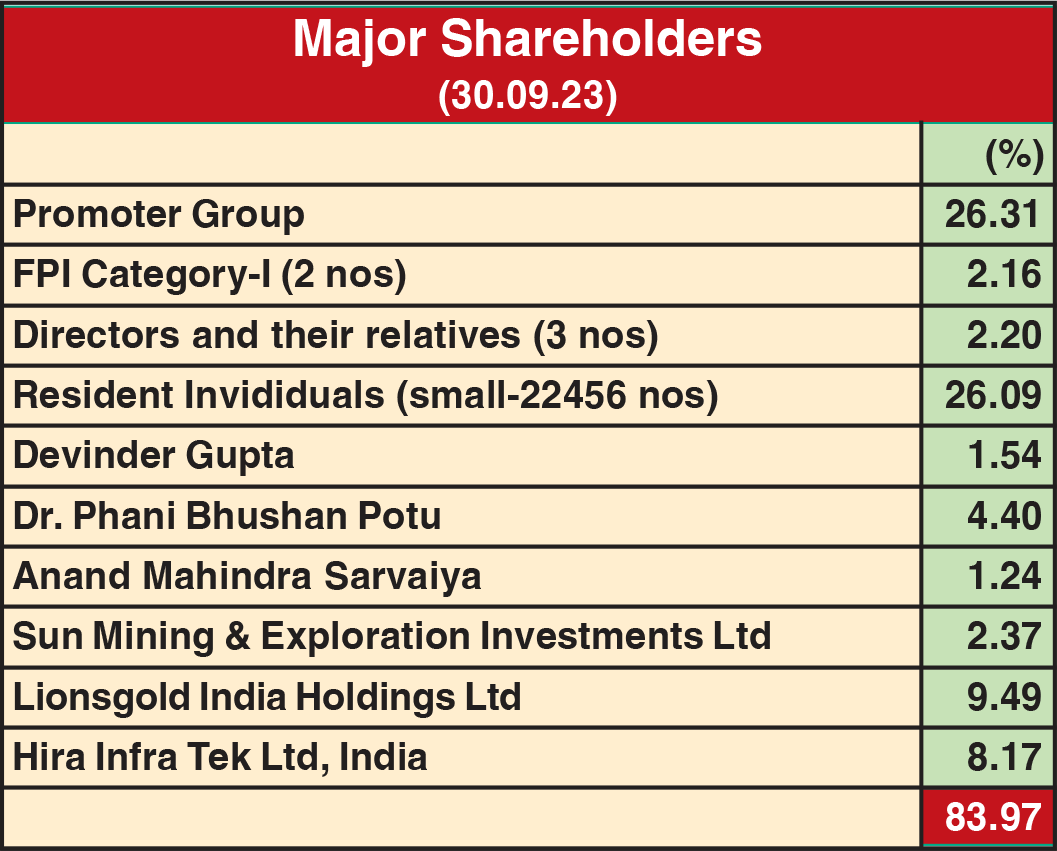

The long-pending legal cases have tremendous intrinsic potential to turn the fortunes of DGML and make the company a multi-bagger stock, provided the court verdicts finally go in its favour. Interestingly, both the foreign promoters jointly holding 26.31% currently are Rama Mines (Mauritius) Ltd with a 16.41% stake and Australian Indian Resources Ltd with a 9.90% stake.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives