Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: September 15, 2023

Updated: September 15, 2023

Coal India, a Maharatna coal mining corporate, today is the single largest government-owned coal producer in the world. It’s functioning through subsidiaries in 83 mining areas spread over eight states of India. The company has 322 mines of which 138 are underground, 171 open cast and 13 mixed mines. It contributes 85% of total domestic coal production, 75% of total coal based generation, 55% of total power generation and meets 40% of the primary commercial energy requirements of the country.

In a push towards eco-friendly coal transportation, Coal India Limited (CIL) has planned a capital investment of around Rs 24,750 crore in the next few years on 61 ‘First Mile Connectivity’ (FMC) projects. To come up in three phases, these projects will have a combined capacity of 763.5 million tonnes per annum (mtpa) when completed. FMC projects involve transportation of coal in mechanized piped conveyors from production point to coal handling plants/silos with a rapid loading system where coal is loaded directly into rail wagons.

CIL has realised that it is essential that coal transportation is environment-friendly to improve the quality of life of people living in the proximity of coalfield areas. FMC projects offer benefits like suppression of dust pollution and carbon emissions.

Other benefits include precise quantity and quality of coal being loaded for consumers with minimal manual intervention.

Thirty-five FMC projects under the first phase, having a 414.5 mtpa capacity, account for Rs 10,750 crore. Eight projects of 112 mtpa capacity are already operational. CIL is gearing up to commission 17 more projects of 178 mtpa by FY 2024-end. The remaining 10, comprising 124.5 mtpa capacity, are expected to be operational by FY 2025.

The second and third phase projects account for 9 and 17 respectively. While their respective evacuation capacities are 57 mtpa and 292 mtpa, the investments sequentially would be about Rs 2,500 crore and Rs 11,500 crore.

Under the second phase, 5 projects of 21.5 mtpa capacity under construction are expected to be commissioned by FY 2025. For the third phase, tenders have been floated for 3 projects of 65 mtpa capacity. Nine projects are to be executed through mine developers and operators. The phase three projects are anticipated to be commissioned by FY 2029. The remaining projects are in different stages of progress, with tenders issued and bid documents under preparation.

Initially, CIL targeted coal mines having a production capacity of 4 mtpa and above under the first phase. After a pilot study conducted through NEERI on the potential advantages of FMC projects in two major OC projects reflected a sizable reduction in CO2 emissions, air pollutants and ambient noise levels, and significant savings in diesel costs, CIL expanded the ambit by including mines producing 2 mtpa and above in the subsequent two phases. The total eco-friendly coal evacuation will go up to 914.5 mtpa when all 61 projects become operational by FY 2029, including the earlier capacity of 151 mtpa.

In another important and innovative development, the coal ministry is rationalizing coal linkages to reduce the distance between mines and thermal power plants (TPPs). In the first phase of such experiments comprising four rounds, 73 TPPs were covered of which 58 belong to state/central Gencos and 15 independent power producers, and resulted in rationalization of 92.16 million tonnes of the commodity with annual potential savings of around Rs 6,420 crore. This does not only help in reducing transportation costs but also simultaneously reduces the load on transport infrastructure, in addition to increasing the efficiency of coal-based power generation.

Sustaining its production pace and staying on course with the annual asking growth of 10.9% till August 2023, the stat- owned coal miner produced 281.5 mts, posting 11.1% yoy growth. The volume expansion in production was 28.2 mts during the first five months of FY24 compared to 253.3 mts during the same period in FY23.

During April-August 2023, the total coal offtake rose to 305.5 mts with around 8% growth with a 22.4 mt gain over the same period last year, when the offtake was 283.1 mts. Interestingly, the progressive supplies to the non-power sector (NPS) till August of FY24 has grown by 43.4% to 56.8 mts and represents an increase of 17.2 mts compared to 39.6 mts during the same period in the previous FY23. With the ease of supplies to the power sector, CIL has entered the comfort zone — as there is no pressure of criticality at the plants, the company can meet the NPS demand quite well.

The company has an ambitious target of 780 mts coal production in FY24 against 703 mts produced in FY23. All its subsidiaries have registered growth over the previous year, with SECL coming back strongly. BCCL, NCL and WCL have also attained their respective targets.

CIL has started taking an initiative to increase its capacity to beneficiate coking coal, a scarce resource used for production of coke, a major raw material for manufacture of crude steel through blast furnace to match up to the burgeoning demand of the metal till 2030.

Currently, CIL is operating 13 coal washeries with a total operable washing capacity of 24.94 MTY. Out of these, 11 are for coking coal washeries and balance 2 are non-coking washeries. However, the company’s total washed coal production from coking coal washeries during the FY23 was about 2.152 MT, though higher by 33.7% with compared to FY22.

As CIL’s production is poised to increase substantially in the ensuing years, the management feels it’s vital to align it with seamless coal transportation. The company is therefore continuing to invest heavily in evacuation infrastructure, and land and mining machinery. Its capex for FY24 is pegged at Rs 16,600 crore. The major account heads comprise Rs 2,907 crore for land acquisition, Rs 2,174 crore for construction of CHPs/silos and Rs 1,965 crore towards procurement of HEMM, while Rs 4,169 crore that has been budgeted for construction of rail sidings and corridors is the highest amongst all capex heads for FY24. The rest has been earmarked towards plant & machinery, solar projects, JVs and coal washeries, etc. It’s worth mentioning that in the last three years itself, CIL has stepped up its capex three-fold, or 197%, from Rs 6,270 crore in FY20 to Rs 18,619 crore in FY23.

There are 117 ongoing mining projects with CIL having an annual capacity of 928.7 MTY which have contributed 501 MT in the year 2022-23. It has approved 24 mining projects during the FY23 with incremental capacity of 58.98 MTY. These projects are expected to contribute additional production to augment CIL’s coal production to one billion tonnes by FY26. The company is also diversifying into aluminium production, chemical & fertilisers, thermal power generation in addition to increasing its renewable energy portfolio in order to decarbonize its operations.

It appears that the demand for coal, both from the power and non-power sectors, are likely to remain firm, and so would probably be the coal price. Moreover, of late, it is observed that Coal India has become more positive, aggressive and ambitious in its operational efficiency and capex business plans. Importantly, the coal ministry has also become very proactive and seems quite serious in accelerating the pace of CIL’s next level of growth with a view to smoothening coal availability locally and simultaneously reducing coal imports to the extent possible.

Recently, Union Power Minister RK Singh said that the Central Electricity Authority (CEA) has suggested that rather than retiring old thermal plants, it is advisable to implement renovation and modernization to extend their life. In line with the CEA’s advice, the government has identified 148 coal-fired plants having a combined generation capacity of 38,150 MW belonging to the Central, state and private sectors. This development certainly augurs well for CIL.

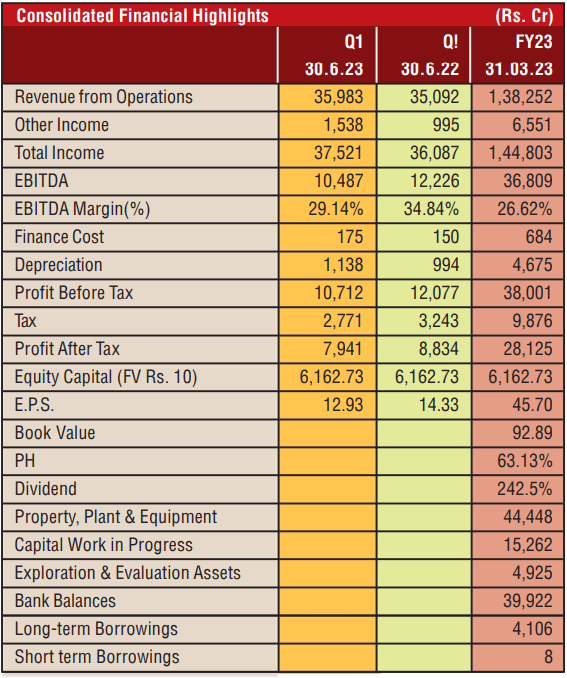

It’s worth pointing out that CIL is a net debt free and cash surplus company. Though its has long-term consolidated debt of Rs. 4106 crore at the year ended March 23, the bank balance of Rs. 39,922 and capital workin-progress of Rs. 15,262 crore speaks very high of its strong and comfortable financials. The finance cost for the FY23 has been at Rs. 684 crore and Rs. 175 crore during the Q1 of FY24.

CIL has accumulated input tax credit for GST paid on input materials/services available for utilization against the GST on output i.e. on sale of coal. This to a large extent includes GST on royalty against mining operations paid under reverse charge mechanism (RCM) at a rate of 18% against which the recovery is limited to 5% being the rate of GST payable on coal. The amount is getting accumulated due to inverted tax structure even though not refundable as per notification issued in the matter by the concerned authorities.

The company’s auditors have qualified this point in their report in the financial results of Q1 (30.6.23). However, the management has clarified that as there is no time limit for utilizing this input tax credit, they are carrying forward it as current assets. This does indicate that CIL’s net cash outgo to this particular effect will get reduced quite for a longer period.

Currently, the CIL share is priced at Rs 279 with an yearly high-low price of Rs 285 and Rs 208 respectively and a market capitalisation of Rs 1,72,156 crore. The stock is trading at a PE of 6.10 to its FY23 earnings and has started moving upside steadily since August this year.

Reviewing CIL from different perspectives, it is appropriate to conclude that the stock has good potential for appreciation because its overall performance is poised to improve substantially and as such it has not yet participated in the PSU rally in the market. Investors with a 12-15 month horizon could accumulate the stock in small lots at every opportunity.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives