Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: September 15, 2023

Updated: September 15, 2023

Of late, defence has emerged as a sunrise sector on the Indian stock exchanges, particularly in the wake of the ‘Make in India’ policy stance of the Indian government and the opening of the defence space for the private sector. Little wonder that defence stocks belonging to both the public sector and private sector have started attracting growing investment demand. To move with the times, we have selected Data Patterns (India) Ltd, a defence company, as the Fortune Scrip for the current fortnight.

The Chennai-headquartered Data Patterns is among the few vertically integrated defence and aerospace electronics solutions providers catering to the indigenously developed defence products industry. The company has proven in-house design and development capabilities, and an experience of more than three decades in the defence and aerospace electronics space. Its offerings cater to the entire spectrum of defence and aerospace platforms – space, air, land and sea. The company’s portfolio includes COTS Boards, ATE and Test systems, space systems, and radio frequency and microwave. It designs COTS module products that are used in rugged applications and automatic test equipment platforms.

Data Patterns can boast of +modern certified manufacturing facility of international standards: Its in-house design and development capabilities are complemented by its 1,00,000 square feet manufacturing facility located on 5.75 acres of land at the SIPCOT Information Technology Park, Siruseri, Chennai, which has facilities for design, manufacturing, qualification and life cycle support of high reliability electronic systems used in defense and aerospace applications. The company’s facility allows them to be self-sufficient in its requirement of high quality and high complexity production while ensuring functional testing for all its products using internally developed automatic testing equipment.The company is certified for or follows various standards across product life cycles, including for aerospace systems under AS9100D by TUV-SUD, IPC Standards for PCB design, DO 178B for software for airborne systems, software life cycle processes, etc.

The company has grown gradually and steadily, literally from scratch. Initially, it started with developing products for laboratory instrument automation and branded these products for large companies building instruments in India. These products were sold in competition against products of world-renowned companies like Hewlett Packard and Perkin Elmer in the gas chromatography market. Since its inception, the company concentrated on developing competencies and building products. This trait — ability and competence – has led to its emerging as a leading player in defence and aerospace electronics systems. Today, its customers include Defence and Research Organisation (DRO), Bharat Electronics Ltd (BHEL), BDL, the Air Force, Navy and Army, and overseas clients.

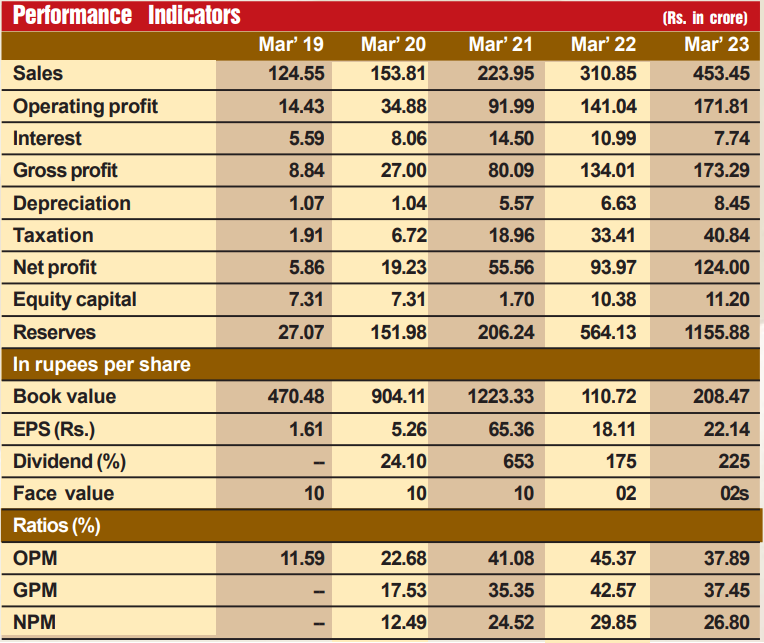

Needless to say, with a steady growth in manufacturing and marketing, the company has made rapid strides in financial performance. During the last nine years, its sales turnover has expanded almost seven times from Rs 63 crore in fiscal 2014 to Rs 453 crore in fiscal year 2023, with operating profit shooting up more than ten times from Rs 17 crore to Rs 172 crore and the profit at net level surging almost 18 times from Rs 7 crore to Rs 124 crore. As the company is being flooded with orders, it goes without saying that its future prospects are extremely promising. Consider:

The company came out with an IPO in 2021, with an issue price of Rs 585, and got listed on December 24, 2021 at Rs 864 (BSE). This shot up to Rs 2,484 in 2023 before settling around Rs 2,252. Prabhudas Lilladher,a well-known brokerage, has set a target of Rs 2,480/2,500. JM Financial has set a target of Rs 2,720.

Discerning investors will do well to accumulate these stocks at every decline, as the stock is fundamentally very strong and its future prospects are highly promising.

February 15, 2025 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives